A Short Outlook on Refining

Oct. 23, 2020

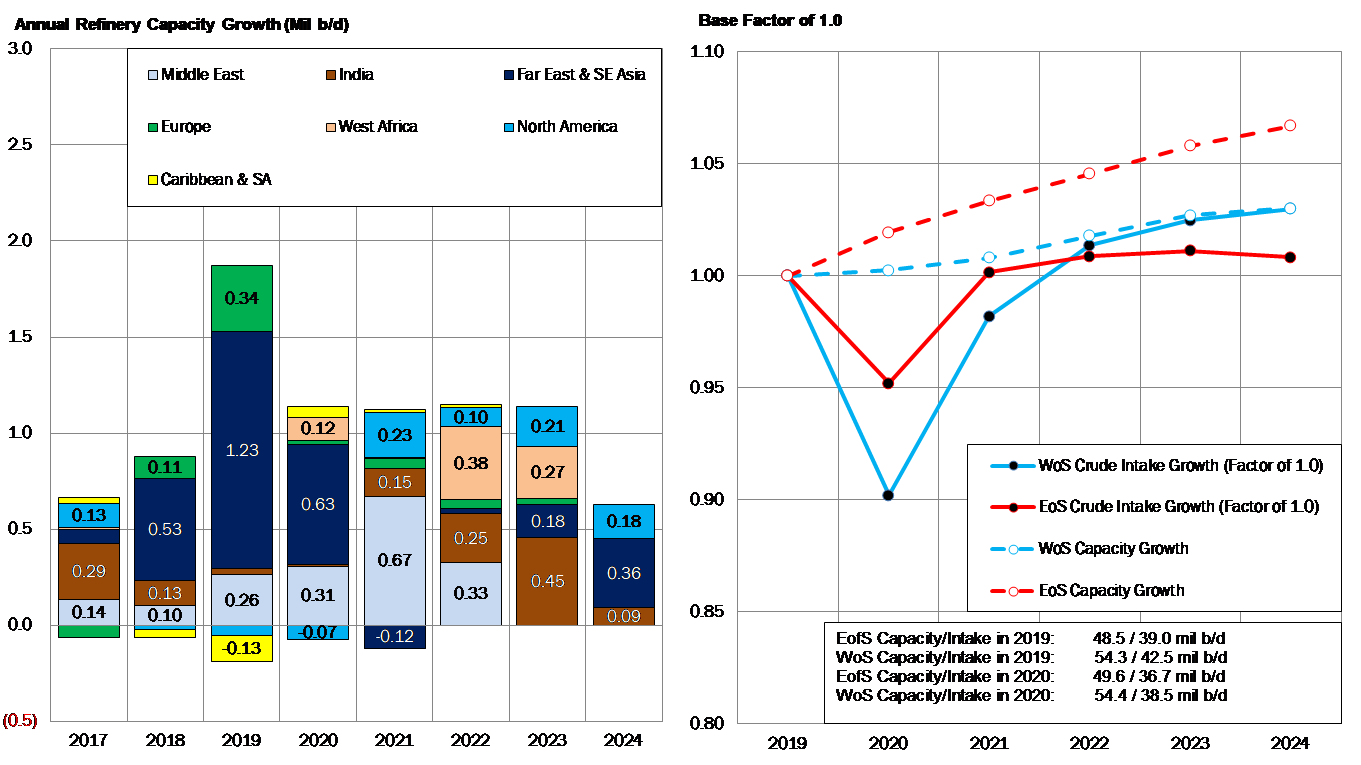

The story of the interaction between oil supply and demand is, of course, closely related to the future of the refining sector. In 2019 and 2020, we saw the most significant refinery capacity expansion in the Far East and Southeast Asia regions (Figure 1). It is worth noting that contrary to the production side, refining additions are usually projects that have begun some time ago, so their completion time was not likely to be affected much by the global pandemic.

Back to the Far East and SE Asia, we have already seen the additional capacity playing its role in supporting buying activity in the region, even during the difficult times we are facing. However, we need to make clear that additional refining capacity does not always mean an increase in utilization, especially when it does not make economic sense as was the case with refiners in the West in 2020.

Looking ahead, we expect the Middle East to add close to 0.7 million b/d of refining capacity in 2021, something that could potentially alter the crude balance in the region, leaving less available for exports. At the same time, this will increase the availability of products which, given the generally low demand in the region will likely be available for a diverse panel of regional trade partners in both the West and East.

The main story, however, with refining is that the increase in refining capacity is expected to outpace the projected increase in global demand for petroleum products (Figure 1). Faced with a scenario like this, refiners will likely choose to maintain low utilization levels in order to support margins, although this is likely to be unsuccessful in preventing closures of older refineries in both the West, but also to some degree in Asia. Furthermore, the combination of low margins persisting over the medium term and incentives to convert facilities toward environmentally friendly solutions, will continue to showcase more conversions of older refineries, predominantly on the US West Coast and European refining centers.

Figure 1 – Annual Refinery Capacity Growth & Capacity/Intake Comparison

2018 – 2024F

Source: JBC Energy, IEA, McQuilling Services