Bunkers and Freight; Fact or Fiction?

April 9, 2021

The question of if and how bunker prices affect freight rates, admittedly, is one that gets repeated quite frequently. After multiple years of forecasting and market modelling, our answer to it is that, under “normal” market conditions, bunker prices do not play a significant role in how tanker rates develop. For example, when HSFO price dropped to nearly a half in 2015 from a year ago, VLCC benchmark TD3 freight rates trended significantly higher; when HSFO bunker gained US $100/mt in 2017 from 2016, TD3 reversely lost almost 23% year-over-year.

However, with the bunker price surge in the last couple of months, we have constantly noticed tanker owners’ reluctancy to continue fixing at below OPEX level. It suggests that in a low-earning environment, high bunker prices may act like a “buffer” to tanker freight and prevent freight rates from falling more precipitously.

To test the correlation between bunker prices and tanker freight rates, we have calculated the monthly averages of TD3/TD3C freight rate assessments as well as HSFO/VLSFO bunker prices. Based on the then-current earning levels, we further split the historical data into three categories: low-market (TCE less than US $20k/day), mid-market (TCE between US $20-50k/day) and high-market (TCE greater than US $50k/day).

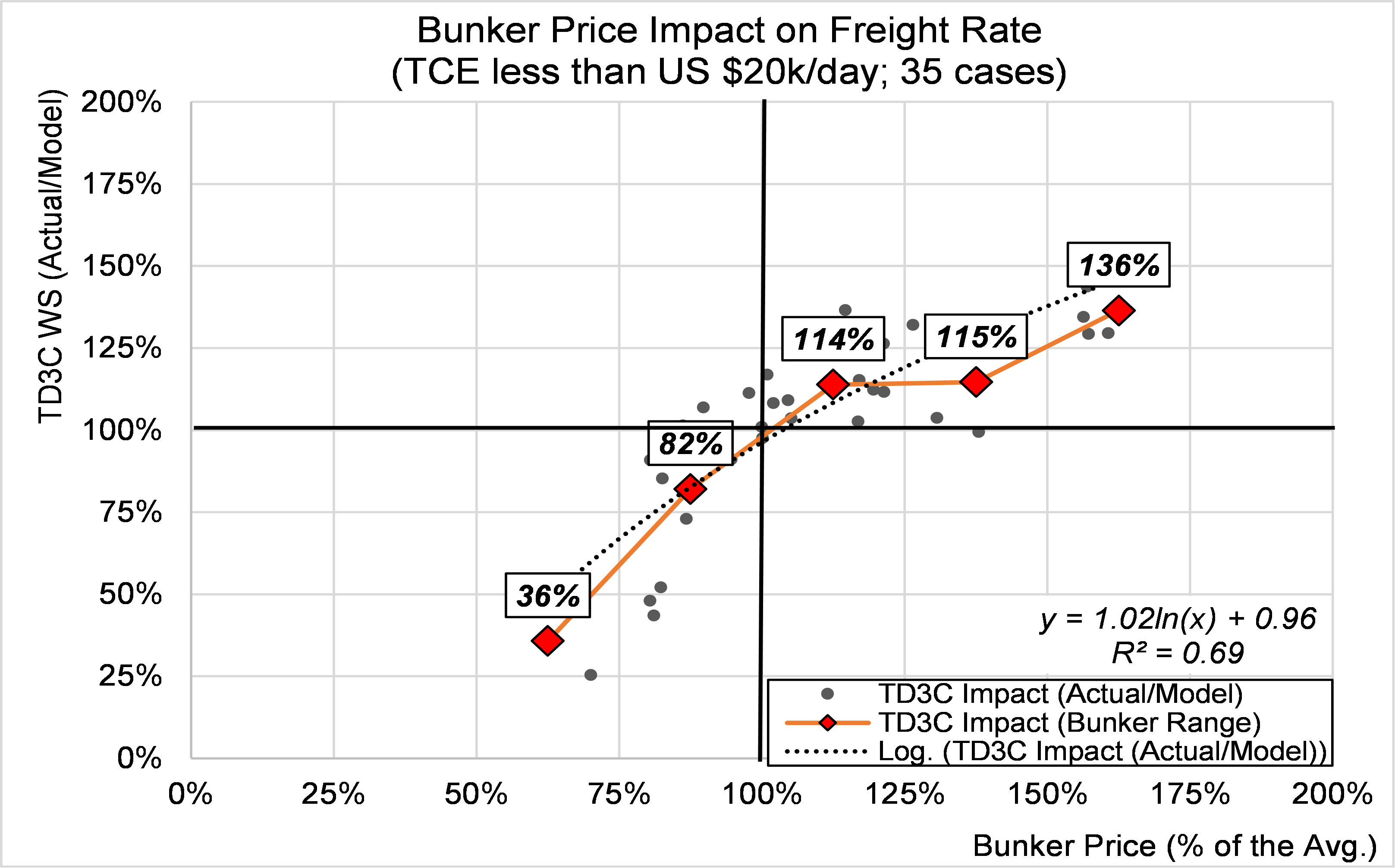

Our findings revealed that in low-market conditions higher-than-average bunker prices could potentially push freight rates (with r-square = 0.7). On average, VLCC freight levels will increase by 19% when bunker cost increase by 25% if the earning is below US $9,000/day (Figure 1). This support, however, quickly disappears as earnings move higher to the mid-market conditions (r-square = 0.52) and high-market (r-square = 0.44) conditions.

Utilizing the findings from our regression models, we expect the current high bunker price environment will positively influence the TD3C freight (average) higher by 4-5 WS points over the balance of the year. Nevertheless, the freight support from the bunker prices is in the context of a substantial supply imbalance, which will increase in the short-term from additional floating storage unwinding, the return of OTC vessels, additional newbuildings delivering and limited deletions as marginal buyers continue to pay premiums over scrap for vintage tonnage.

Figure 1 – Bunker Price Impact on Freight Rate – Low Market Case (TCE < US $20k/day)

Source: McQuilling Services