Cargo Switchovers and the CPP Market

Oct. 9, 2020

Last week we discussed if the DPP tanker market has reached the bottom, with a fixture done at single WS digits -something that even the most seasoned brokers have a hard time recalling ever happening. This week we want to highlight a more specific trend in the CPP sector, that of cargo switchovers.

Throughout this time of depressed freight rates, we have been talking about some opportunities in the CPP sector, such as the emerging naphtha trade from West to East. By analyzing product balances, we are confident that the trade has the potential to continue, showing limited support in the LR2 tanker sector, which is the most common vessel seen in this kind of voyage.

However, the LR2 sector has seen another kind of limited support, one that came on the supply side when a large number of LR2s were observed to switch over to dirty trading in order to capitalize on the significant returns observed from the beginning of the year until May – driven mostly by floating storage requirements as well as transportation demand before the spread of the coronavirus.

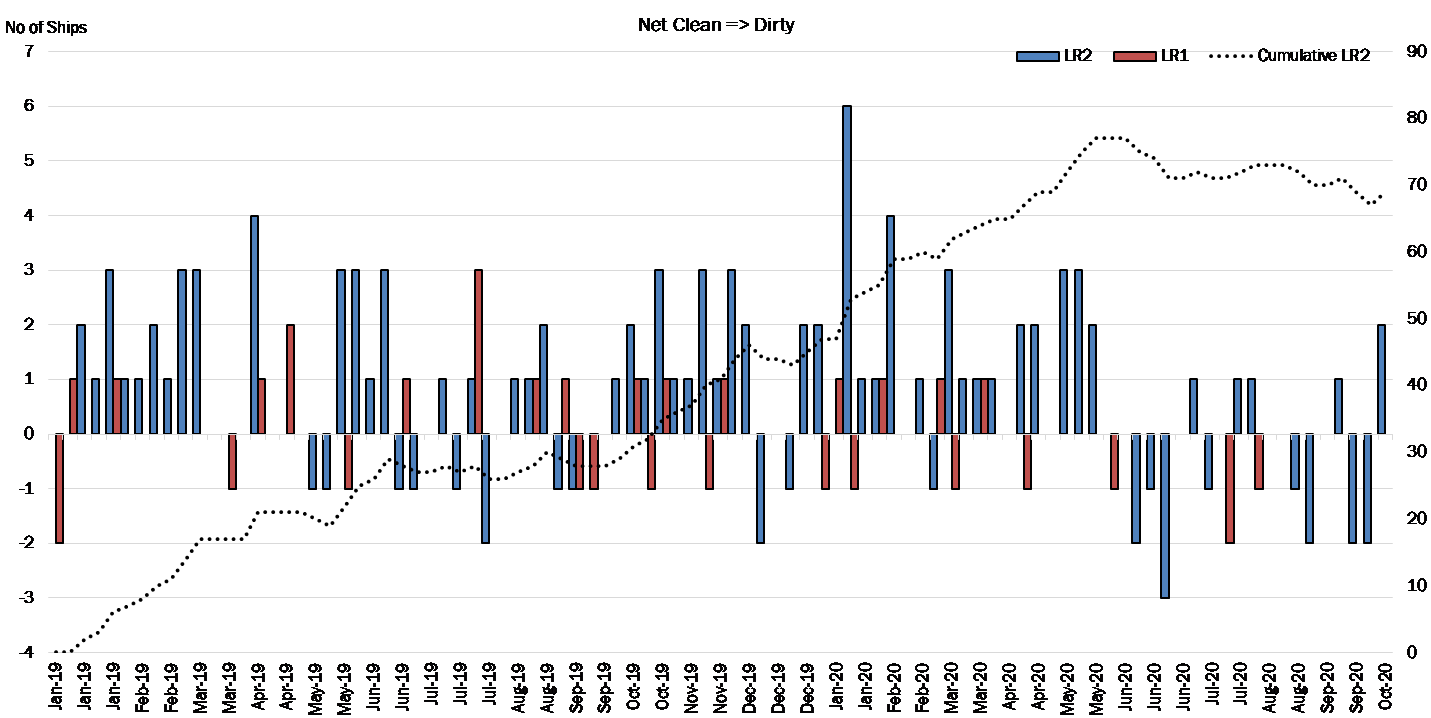

As we can see in the graph below, there was somewhat of a surge in switchovers of LR2 tankers to dirty trading starting in the beginning of the year with a net of 32 ships converting by the end of May (Figure 1). The highest number observed in a single month was 9 vessels in January, followed by 8 vessels in May. Coming back to the limited opportunities we mentioned, we can imagine that these became suddenly attractive to owners when the DPP market collapsed. The result was an immediate downward trend, with 6 vessels switching back to clean trading in June and net of -8 for the period from June to end of September.

Perhaps a statement for the overall state of the market is that even with continued switchovers, the Aframax market does not appear to gain any momentum, essentially waiting for something much “bigger” to happen, such as the return of production from Libya. On the other hand, we may see increased supply pressure in the LR2 and LR1 sectors and we may be revisiting the “is it the bottom” question soon.

Figure 1 – LR2 and LR1 Clean to Dirty Switchovers (Net)

Source: McQuilling Services