CPP Fleet Profile and Contracting

Sept. 17, 2021

On a relative basis, freight rates for CPP tankers have outperformed the DPP vessels segments, due in large part to the supply side variable. In fact, in our recent TMO Mid-Year Update we reiterated our call for a healthier and speedier recovery of the CPP sector (following our January projection), aided by the number of CPP tankers that have been deleted so far in the year as well as a more tempered orderbook.

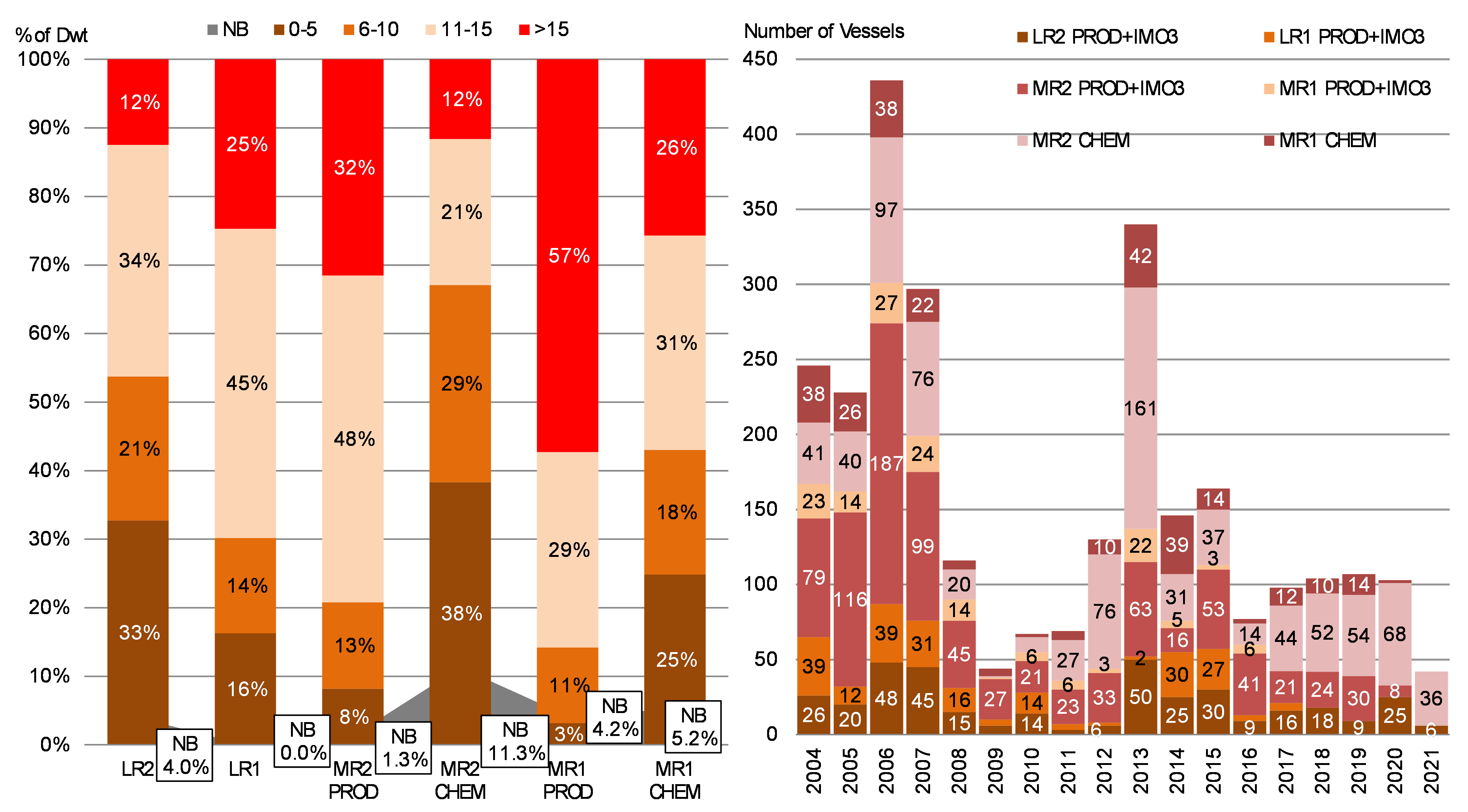

Continuing a multi-year trend, we note owners’ interests continue to lie within the LR2 (coated Aframax) and MR2 (Chemical – IMO II/III) sectors. Orderbook figures at this point are11.3% for the latter and 4.0% for the former (Figure 1). What remains interesting is the complete absence of LR1 orders, even though our analysis has shown that there may be some unique opportunities, which we highlighted in our Mid-Year update report.

Observing the fleet age profile, LR2 tankers remain relatively modern with 54% under the age of 10. The same cannot be claimed for the LR1 sector where 70% is over the age of 10, revealing a rapidly aging fleet. On the MR side, increased contracting on the MR2 Chemical side has led to a young fleet where 67% is considered modern (0-10 years old). The opposite is true for MR2 product tankers with the same characteristic applying only to a little over than 20% of the fleet. Finally, a similar trend is observed in the MR1 space, with 41.3% of the chemical fleet under the age of ten while only 14.1% on the product side (Figure 1).

Summarizing contracting activity this year, owners have exhibited discipline given the current state of the tight yard capacity and elevated newbuilding prices, helping to project a more sustained recovery deeper into the outlook period. A total of 6 LR2 Product tankers have been contracted year-to-date, with all other product segments at zero. On the chemical side, we have seen 36 MR2 tanker contracted at this point in 2021.

Finally, we highlight that 2021 is set to be a year of moderate delivery numbers, with at least 21 LR2 tankers expected to be added in the trading fleet, almost double last year’s figure, but below the 30+ levels observed in recent years. However, with 10 deletions expected for the full year, the fleet is likely to remain relatively modern. For the next two years, LR2 deliveries are projected at 10 and 11, respectively per year before picking up again toward the latter part of the five-year projection period basis our long-term modeling. Similarly, MR2 chemical tankers are projected to see an average of 60 additions per year (2022-2024) compared to the 71 over the 2019-2021 period. Contracting demand for LR1 product tankers has been non-existent, with zero orders recently as owners sway towards the perceived efficiencies of the larger tankers.

Figure 1 – CPP Fleet Profile (Left Graph); Newbuilding Orders Placed 2004-2021YTD (Right Graph)

Source: McQuilling Services