CPP Tanker Supply Fundamentals

June 18, 2021

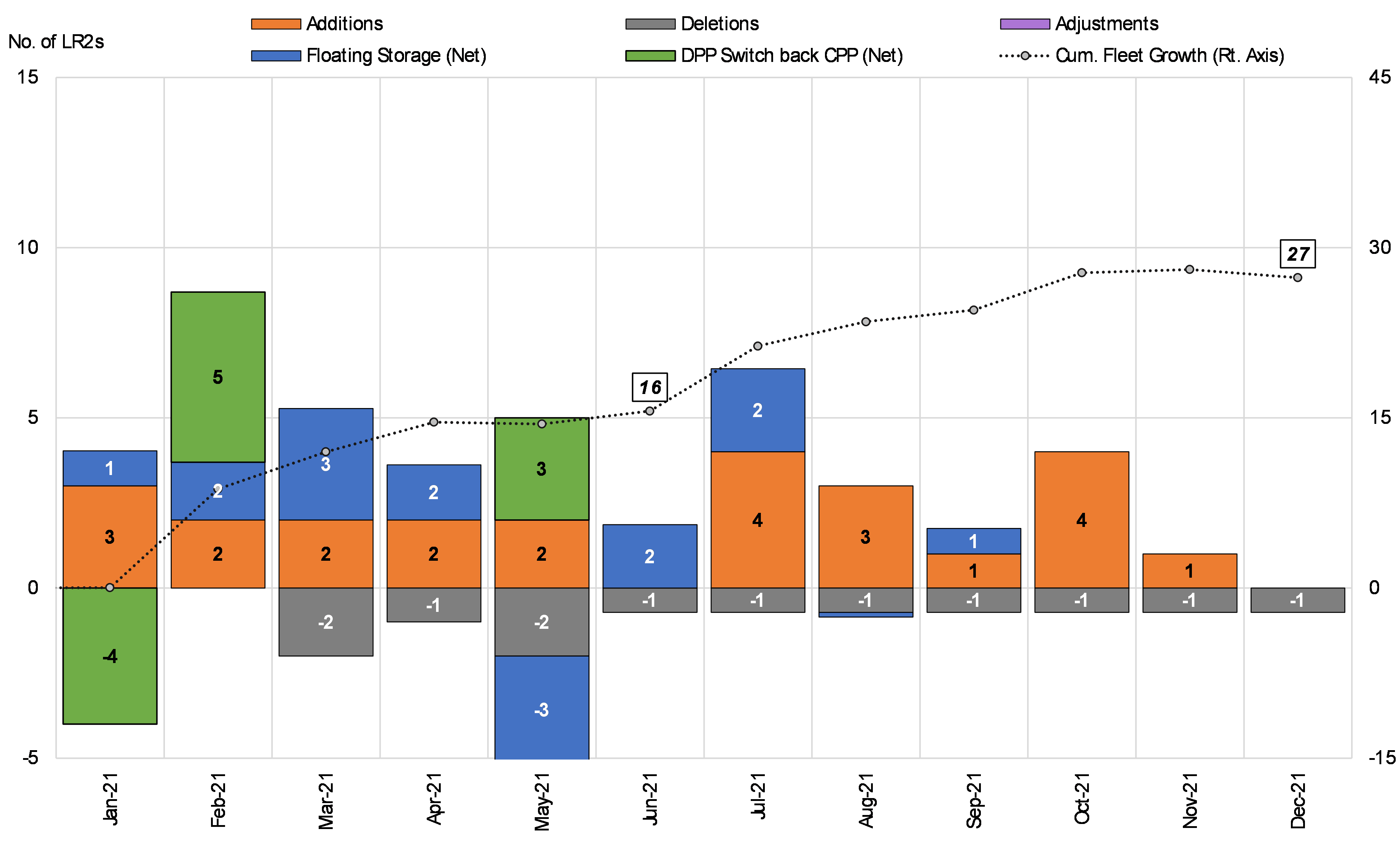

This week we highlight supply side developments for the CPP fleet, including an updated look at net fleet growth in 2021 and a summary of the CPP fleet’s orderbook and age profile to contextualize our views for the medium term. Starting with the current year, from January to May our vessel tracking data captured a return of five LR2s to the trading fleet from floating storage operations, 11 newbuilding deliveries and a net of four dirty-trading LR2s switching back to carry CPP cargoes. Compared to the DPP fleet, the CPP market has observed healthy tanker exits so far this year, with a total of five LR2 being sold for demolition since January. We project an additional seven ships to exit the trading fleet by the end of the year. This analysis shows that LR2 net fleet growth for 2021 is expected to reach its peak in October, at 28 vessels, before subsiding slightly to end the year (Figure 1).

Overall, CPP tanker contracting in 2021 has reached 35 vessels according to our latest available data. This number is slightly lower than the same period last year and heavily skewed towards the MR2 sector. The month of May saw a drop in contracting with a total of three MR2 tankers, while no LR orders were reported. Overall, the orderbook for clean tankers remains low and unlikely to pick-up in the short term due to 1) the uncertainty in shipyard input costs (steel); and 2) tighter global shipyard capacity from robust ordering of other vessel classes (containers, bulkers) over the last six months. Therefore, we remain cautiously optimistic that a favorable supply-side variable, augmented with our view for expanding product trade over longer distances due to structural developments (additional Middle East product length, refinery closures, re-opening economies) will underpin an upward trend in clean tanker utilization and subsequent spot market returns in the near term.

Broader analysis of the CPP fleet data shows that the LR2 and MR2 (IMO II/III) segments have 53% and 66% of their respective tonnage between 0 and 10 years old; reflecting robust interest from owners to contract these vessels in recent years. However, a slowdown in tanker contracting has been generally observed across the clean tanker segments over the last 12 months with the current orderbook for LR2s and MR2s (including both pump-room and chemical designs) representing 4.7% and 7.0%, respectively. Interestingly, we note 0 LR1s on order, while the age composition of this segment can be viewed as ageing, with 70% over the age of 10. While we note owners’ skepticism to contract LR1s over inconsistent trading patterns, we have a different (and more favorable) view for this tanker’s demand prospects, leading us to sneakily believe that this vessel class can outperform its peers over the next 12-24 months on a relative basis.

Figure 1 – LR2 Fleet Development

Source: McQuilling Services