CPP Ton-Mile Demand Development

Sept. 3, 2021

Continuing on the theme of tanker demand updates, this week we focus on the CPP sector. Since the publication of our January Tanker Market Outlook report, we have been constructive on CPP tanker demand growth, a position that we retained in our recently published TMO Mid-Year Update, owing to overall increasing demand for refined products as well as the structural benefits from expanding voyage mileages. Downside risk to clean tanker demand from Crude Tanker newbuildings is expected to continue for the next six months but subside by 2H 2022.

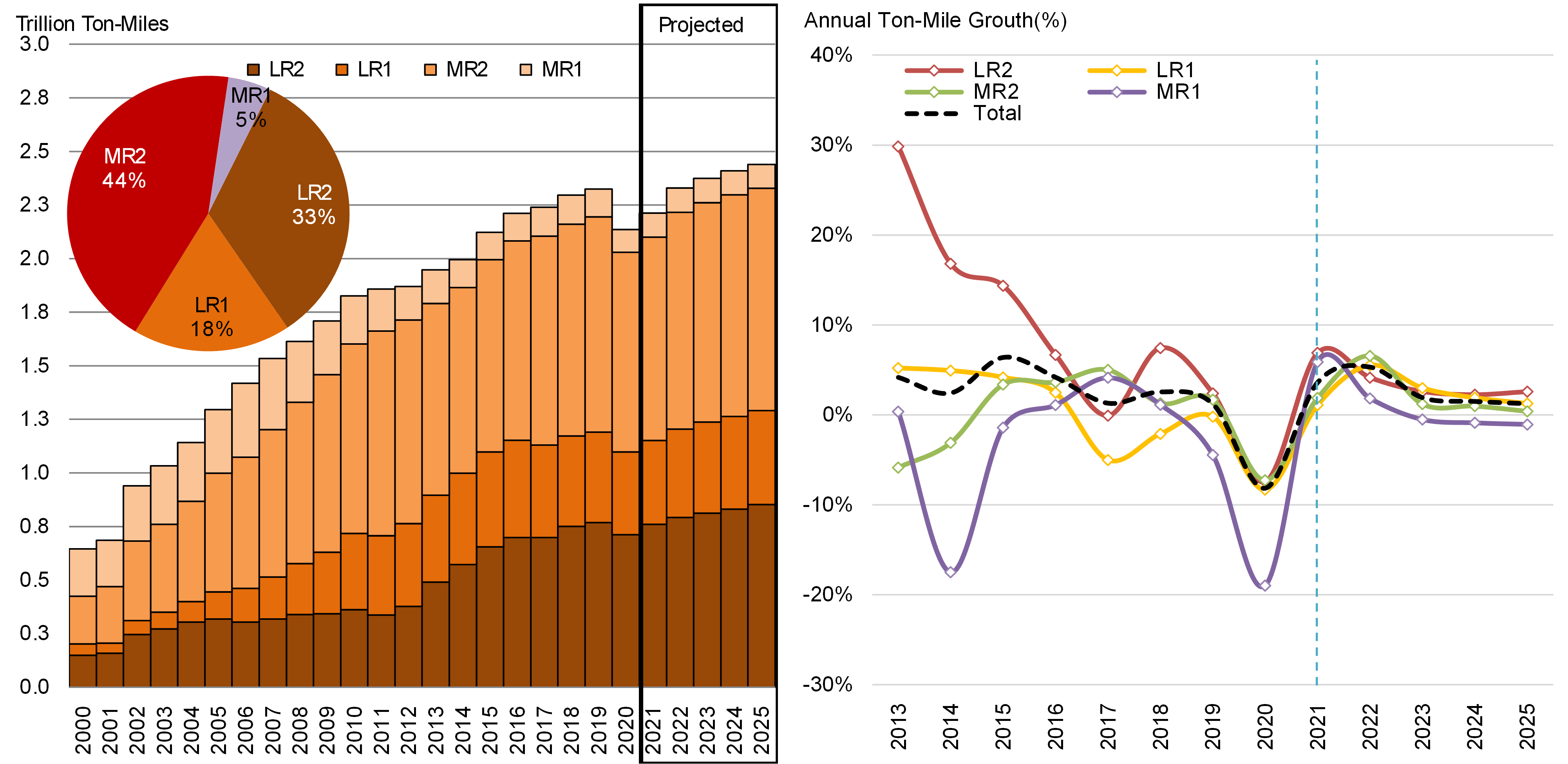

The aggregation of ton mile demand reveals an increase of 3.6% in total for 2021, compared to the 8.4% dip in the previous year (Figure 1). This is the beginning of the recovery for the sector, with ton mile demand expected to grow another 5.3% in 2022, with incremental increases through our forecast period.

Increased refining capacity in the Middle East is expected to support LR2 ton miles, with growth of 6.9% projected for 2021 and another 4.1% in 2022. Perhaps equally important for the LR sectors is the strengthening naphtha trade from the West to East. As petrochemical demand grows in Asia, we expect additional naphtha flows from the Med and Northern Europe (longer mileage), especially after the Dangote refinery comes online in 2022 and curbs the popular UKC/WAFR clean trade. This point leads us to a conclusion that LR tanker demand will in-fact benefit (net basis) from the Dangote refinery, a position quite different from one of our “peers,” who failed to grasp the overall implication on demand from this development.

Higher LR2 utilization, will have drop-down benefits on the smaller segments, with the LR1 sector moving in to capture demand on intra-Asian trades as well as Middle East loadings to the East and West. With a lengthening distillate balance in the Middle East, LR tankers will undoubtedly see increased utilization to Northern Europe. In-turn, we find increasing light-end product flows from Europe into Asia emerging, offering owners exceptional triangulation opportunities over the medium term.

The MR2 class is projected to show moderate growth for 2021, with an additional 1.9% in ton mile demand, owing to the slow recovery of some key markets. For 2022 we project a 6.6% increase, with an annualized growth of about 1.0% for the remainder of our forecast (Figure 1). We consider one important growth driver to be the US Gulf to East Coast South America gasoil trade, given the lack of refinery expansion in the latter region. In addition, the lengthening gasoil and jet fuel balance in the Far East will likely incentivize flows to Australia (amid refinery closures) as well as to the West Coast of the Americas, while strong demand from the Middle East to East & South Africa is expected, considering the high growth features of the former and conversion projects in the latter.

Figure 1 – Historical & Forecasted CPP Ton-Mile Demand (left) and Growth Rate (right)

Source: McQuilling Services, JBC Energy, IEA, IHS Global Trade ATLAS, US EIA