CPP Vessel Contracting & Fleet Profile

April 22, 2022

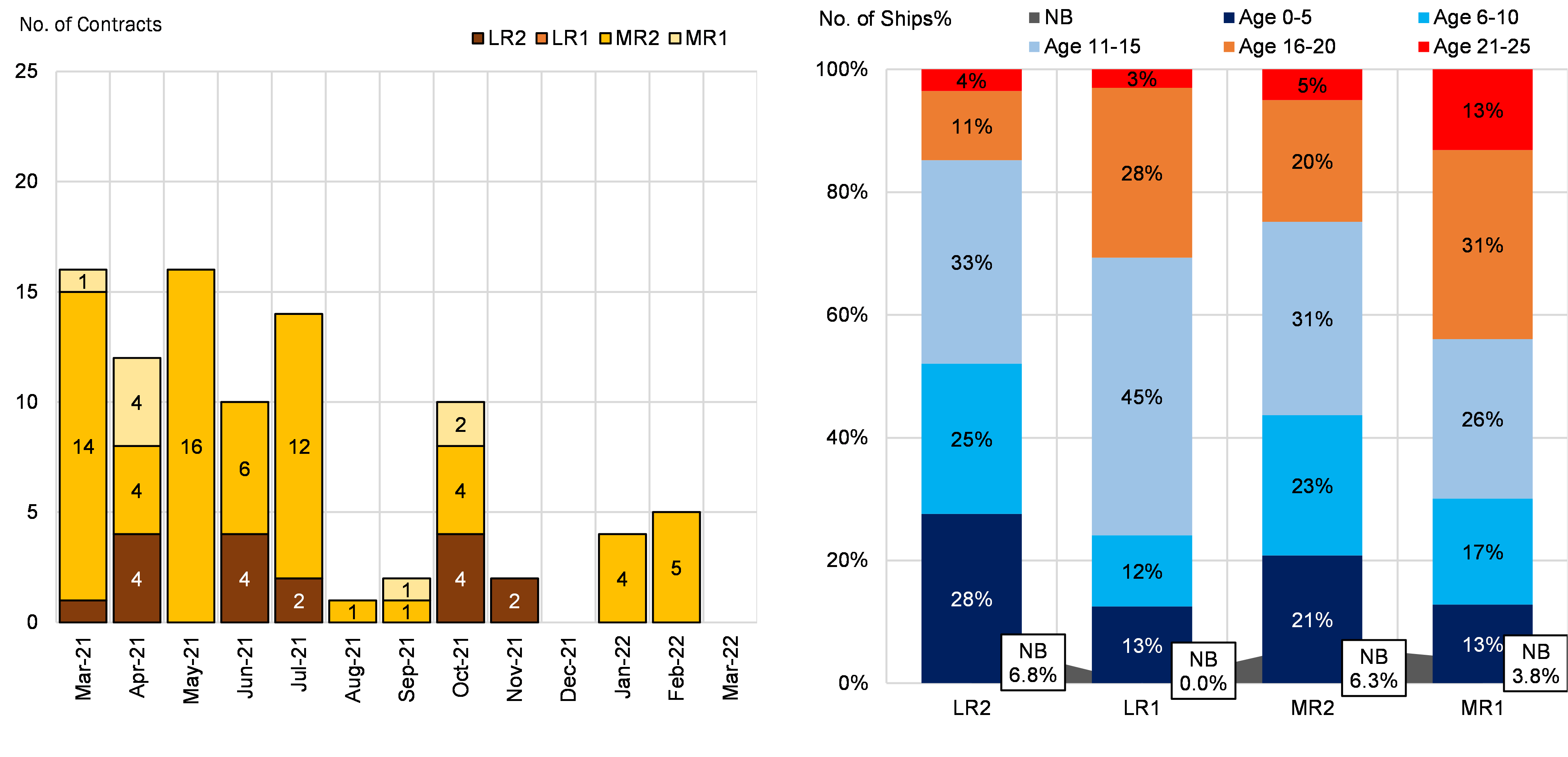

CPP vessel contracting activity has been significantly lower than the same period last year, with only a total of 9 orders for MR2 tankers, compared to 29 MR2 orders for Q1 2021 (Figure 1). Similar to the DPP sector, subdued activity can be partially attributed to shipyards being close to their full capacity (on mostly other type of vessel orders such as containerships) as well as the very high steel prices that make a newbuilding uneconomical for the long run, even if the current volatile environment is currently benefiting rates.

With our multivariate models pointing to the price of steel remaining high throughout 2022-2023, it is likely that reduced ordering activity will lead to the total of the CPP fleet growth remaining flat for 2023-2024, possibly even going to a negative for 2023 although the current year is likely going to see elevated additions.

Fleet composition has benefited from much better deletion activity in the CPP sectors. The percentage of newbuildings against the total fleet have actually gone slightly down since previous months, with 6.8% compared to 7.3% for LR2s and 6.3% compared to 6.6% for MR2s. The number for LR1s remains at zero, which with every iteration pushed the average age of the LR1 fleet higher. Thus, this sector has the lowest percentage of vessels under the age of 10. The LR2 fleet is the youngest, with 53% at ages 10 and under, followed by the MR2 fleet with 44% (Figure 1).

Finally, we note that under our base case scenario published in January, clean tankers were poised to benefit from good supply fundamentals, increasing demand and from the lengthening of mileages with a potential increase in activity from Northern Europe to Asia. However, with Russian sanctions (formal and self-sanctions) in place, we may well witness this key component disappearing from the market soon due to tightness in the loading region that may result in lower LR utilization, in fact adding to supply side pressures. On the other hand, shorter product supply from Europe into the Caribbean and the Americas is likely going to benefit MR activity from the US Gulf, something that we have already seen materializing and likely to continue.

Figure 1 – No. of CPP Tanker Orders (Left) & CPP Fleet Age Profile (Right)

Source: McQuilling Services