Crude Tanker Bull Run on the Horizon?

May 29, 2015

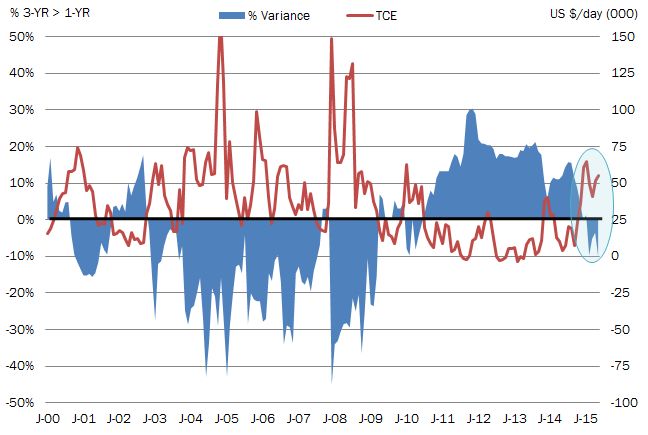

Among the many questions facing the tanker markets today, none stands out more than whether this recent rally in rates is a long-term cyclical shift or little more than a head fake? While not all sectors of the tanker market will trend in the same direction, we note a recent development that may provide some clues about the direction of the crude tanker markets. For the first time in 55 months, the 1-year time charter rate for the VLCC and Suezmax sectors has risen to a level greater than that of the 3-year time charter rate (Figure below).

In May 2015, the 1-year time charter rate for a VLCC was pricing at US $43,250/day while the 3-year rate was measuring at US $39,250/day. The blue area in the figure above represents the variance, as measured by percentage, the 3-year time charter rate is above (or below) the 1-year time charter rate. When graphed along with the average TCEs for the VLCC sector, we note an almost perfect inverse relationship between this percentage and actual earnings. When the 1-year time charter rate is higher than the 3-year, TCE earnings for the VLCC sector were firmly above the US $25,000 per day level, which represents for many owners an “all-in” break-even level accounting for financing and operating costs. The explanation for this relationship is based on supply and demand. When owners believe the market is firming, they are not as eager to “lock-up” vessels until period rates reach an equilibrium level. While this development is a recent one and may be a head-fake instead of cyclical shift, it warrants close attention. Historically, we note however; that while head-fakes are possible (2000-2002), directional shifts as measured by the 1-YR/3-YR time charter rate relationship could indeed foreshadow a much longer market rate environment (2003-2008) and (2010-2014).

SOURCE: MCQUILLING SERVICES