DPP Fleet Profile and Contracting

Sept. 10, 2021

Since the beginning of the year and our Tanker Market Outlook, we have been noting the importance of the supply side dynamics in both DPP and CPP sectors, with an emphasis on the former given past two years saw historically very low deletion numbers. In our recent Mid-Year Update publication, we reiterated our position, especially since 2021 is shaping up to be another year of low DPP tanker deletions amid a depressed freight market.

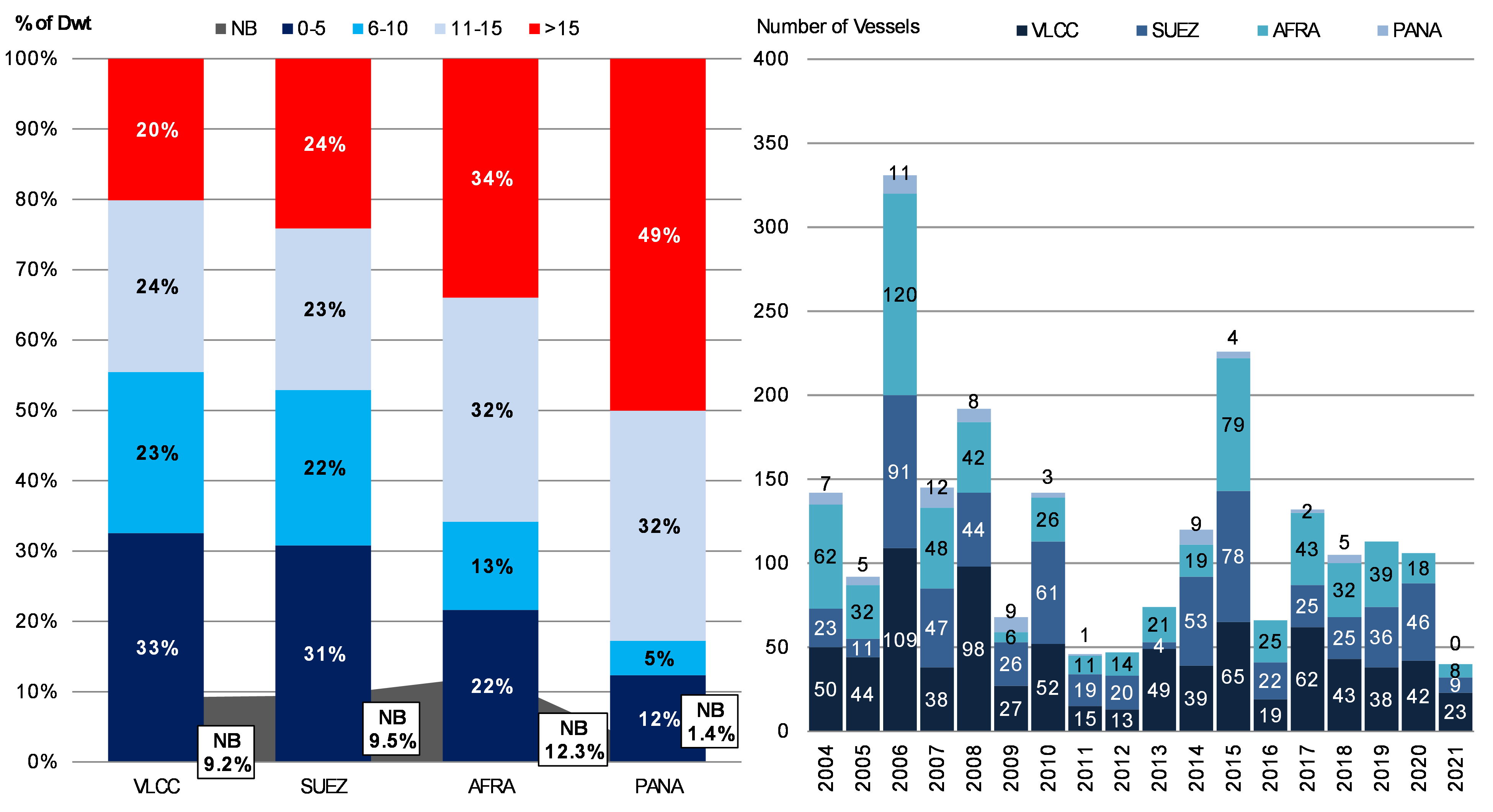

Looking at the DPP fleet orderbook percentages, they have increased for VLCCs and decreased for Suezmaxes from the beginning of the year. For the former, the current orderbook represents 9.2% of the total fleet, while for the latter it stands at 9.5%. These two segments have a younger profile than Aframaxes, with 56% and 53% respectively aged 10 years or younger (Figure 1). These orderbook percentages represent the number of known orders against the total number of trading fleet younger than 25 years.

However, the orderbook percentages tell only one side of the story since the denominator part of the equation has risen dramatically over the last couple years with high deliveries and limited deletions. This oversupply of DPP tankers puts increasing pressure on freight rates amid a relatively low demand environment and still unwinding VLCC floating storage.

Looking at actual contracting numbers this year, In the DPP segment we counted 40 new orders placed in 2021, of which 23 were VLCCs, a relatively high number considering the total for the year so far. In contrast, we have so far seen only 9 Suezmax orders compared to the 48 total in 2020. Uncoated Aframaxes had only 8 new orders so far in the year (Figure 1).

Overall, our models still point to a relatively high delivery year 2021 (95 DPP deliveries) and an even higher 2022 (127 DPP tankers), especially considering the current freight rate environment. The influx of new tonnage is indeed one factor of the continued weakness in the freight rate structure over the 2021-2022 period. However, as the market projects cyclicality, we see the middle years of our forecast with substantially fewer additions for the DPP sector with special note the expected 25 VLCC deliveries in 2023, which combined with increased deletions could be a boon for tanker owners.

Figure 1 – DPP Fleet Profile & Contracting Activity

Source: McQuilling Services