Euro-zone Reaches New Highs

Dec. 12, 2017

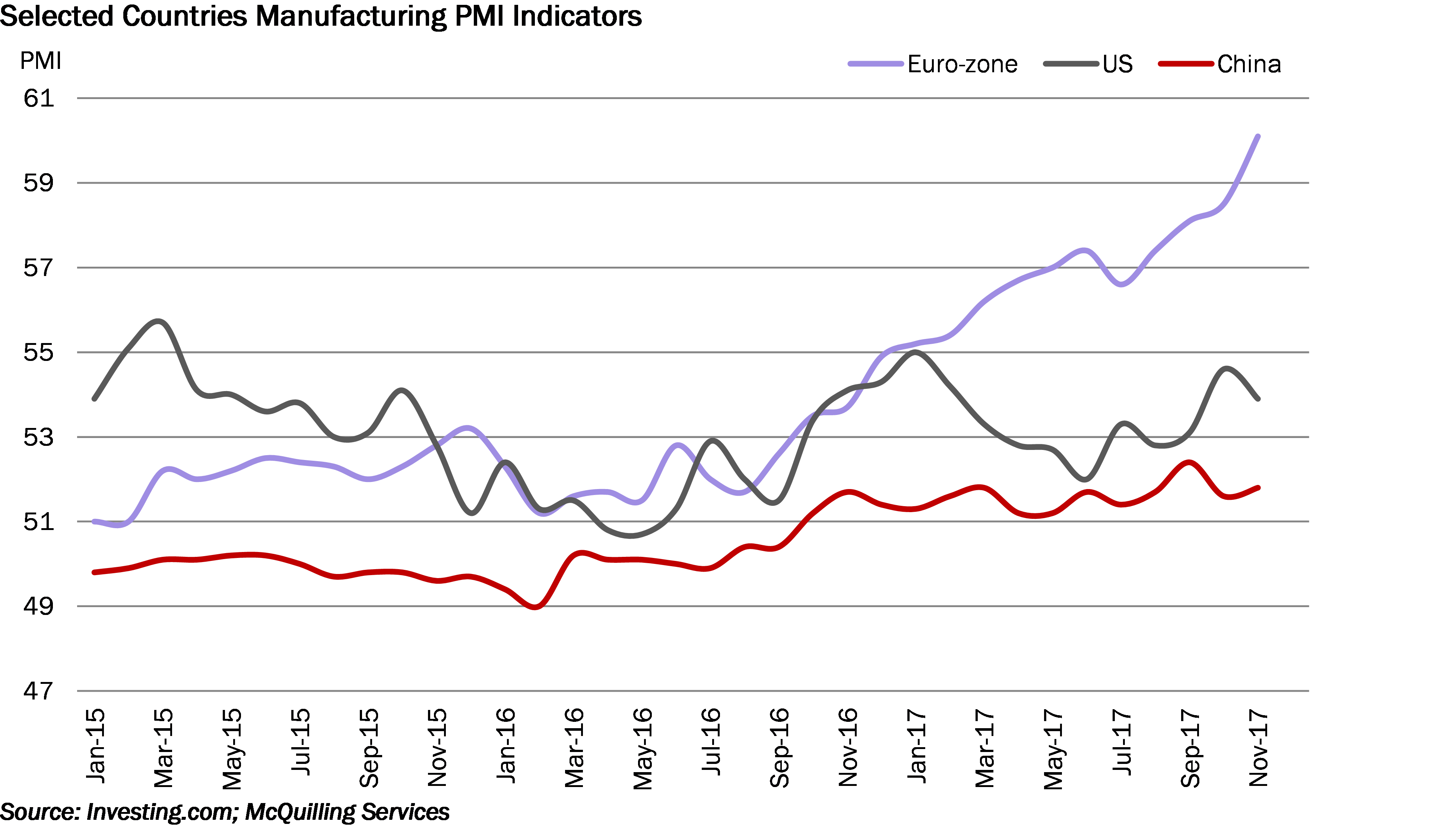

Global manufacturing PMI reached its highest level since March 2011 this past month amid increased levels from nearly everywhere. One of the main drivers behind this growth has been the Euro-zone, which according to preliminary data reached its highest level since April 2000 at 60.1. While this data is based on preliminary estimates, we tend to believe the bullish trend as official monthly data from October indicates a surge in manufacturing activity. The manufacturing PMI of the Euro-zone has outpaced that of the US since the beginning of the year as European countries continue to hold the top eight positions in the global manufacturing rankings. Specifically, the UK is seeing growth in its manufacturing sector, likely supported by a competitive exchange rate boosting export volumes of goods, somewhat offsetting lower domestic demand.

The health of the European manufacturing sector likely coincides with increased refinery utilization experienced over the course of 2017. We have seen this trend develop on the back of strong refining margins, buoyed by both domestic demand and cheaper refinery feedstocks. Nearly a 500,000 b/d boost in Mediterranean crude supply from higher production in Libya and the Black Sea region has allowed refiners to source proximate crude at a lower cost as refinery runs have increased by 125,000 b/d in Northern Europe and 220,000 b/d in the Mediterranean when compared to 2016. Aframax owners have particularly enjoyed this trend as ton-mile demand is on track to rise 23% year-on-year in 2017 for intra-Mediterranean trading. Volumes into Northern European have also been healthy with Aframax ton-mile demand from along the Mediterranean > Northern Europe projected to rise 63% from 2016 levels. As we move into 2018, we expect growth to remain healthy, but not as strong as observed this year, mainly due to the expectation of lower refinery utilization in Northern Europe. Aframax demand for trading within the Mediterranean and from the Mediterranean into Northern Europe is on track to rise by 2.3% and 1.3%, respectively, in 2018, although the impact from reduce Kurdish exports out of Ceyhan remains a going concern.