Examining the US Crude Supply Recovery

Feb. 26, 2021

Last week’s freeze and winter storm that swept through Texas brought low temperatures that in many cases had not been seen for generations. This kind of severe weather had a tremendous impact on US shale crude supply from the southern state. The freezing temperatures destroyed valves, pipes and other equipment and loss of power from an overwhelmed grid made it impossible for wells to keep pumping, resulting in a 1.1 million b/d less production according to the latest Energy Information Administration (EIA) estimates. The same combination of external factors led refiners in the region to shut down their units as well. By some estimates, almost a quarter of the US national refining capacity was taken offline and almost all these plants are still in the process of trying to restart.

These conditions had an immediate impact on tanker markets. In the CPP sector, cargo loadings from the US Gulf have been almost non-existent in the past two weeks. The product price uptick in the US has also resulted a surge in cargo inquiry (mostly gasoline) from the Europe and significantly supported the TC2 freight level. In the DPP market, the severe weather conditions resulted in delays in south Texas ports, which brought a rally on Aframax rates caught in the middle, with the Caribs/USG trade reaching a high of WS 155 this week from WS 75 in mid-Feb.

Looking forward though, what piques our interest are the scenarios on how US crude supply will develop for the year. As the spot price for crude rises, we recognize the temptation for shale oil producers to increase their output. However, with OPEC+ discussing the further curbing of supply cuts in Q2, US firms have many reasons to resist. In recent news, producers such as Occidental, Chesapeake and Pioneer stated that they will maintain output at current levels, perhaps fearing the fragile return of demand may not be enough to continue supporting oil prices when OPEC+ opens the taps.

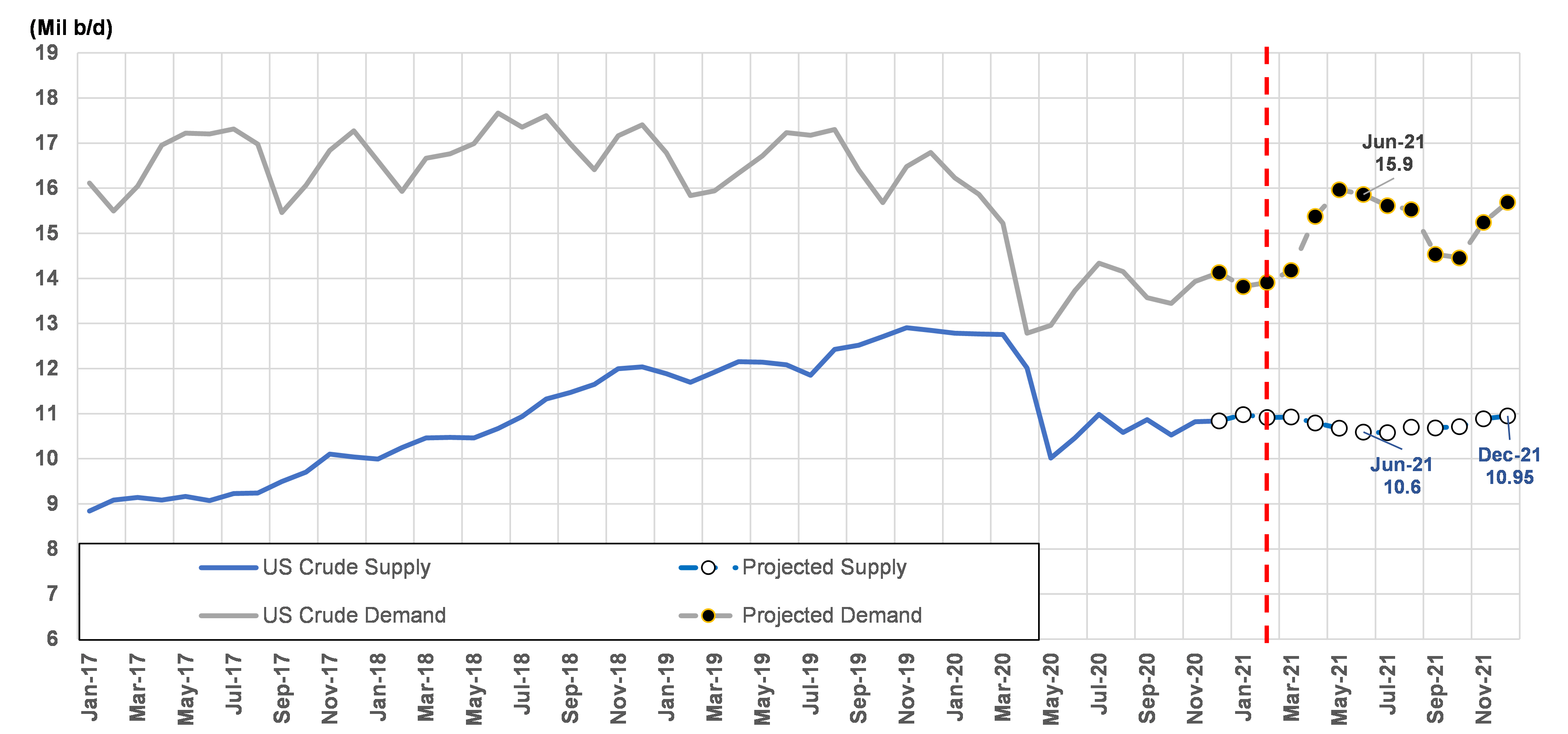

For those reasons, we do not foresee a notable increase in US’s crude production level in 2021, even as demand to slowly return to pre-COVID levels by the end of the year (Figure 1). The increasing domestic demand and flat supply could lead to more expensive WTI versus other crude grades, in turn limiting the US crude exports this year and pushing US refiners to import more crude from areas such as the AG and Northern Europe.

Read more about US crude supply scenarios and other topics in the recently published 2021-2025 Tanker Market Outlook.

Figure 1 – US Crude Supply and Demand

Source: McQuilling Services