Examining the VLCC Supply

March 12, 2021

We have been reading in recent news about relatively large orders for VLCC tankers have been placed, so far predominantly on South Korean shipyards. Only this week, Shell confirmed the chartering of ten VLCC newbuilds that will be equipped with dual-fuel engines and news circulated about a Greek shipowner that doubled their initial order of four VLCC to eight. In this low-freight environment, the price of newbuildings tends to be on the lower side although it also raises questions to the expectations on tanker freight in the near future. This week, we are going to look at where we are so far in terms of DPP vessel supply with a focus on VLCCs.

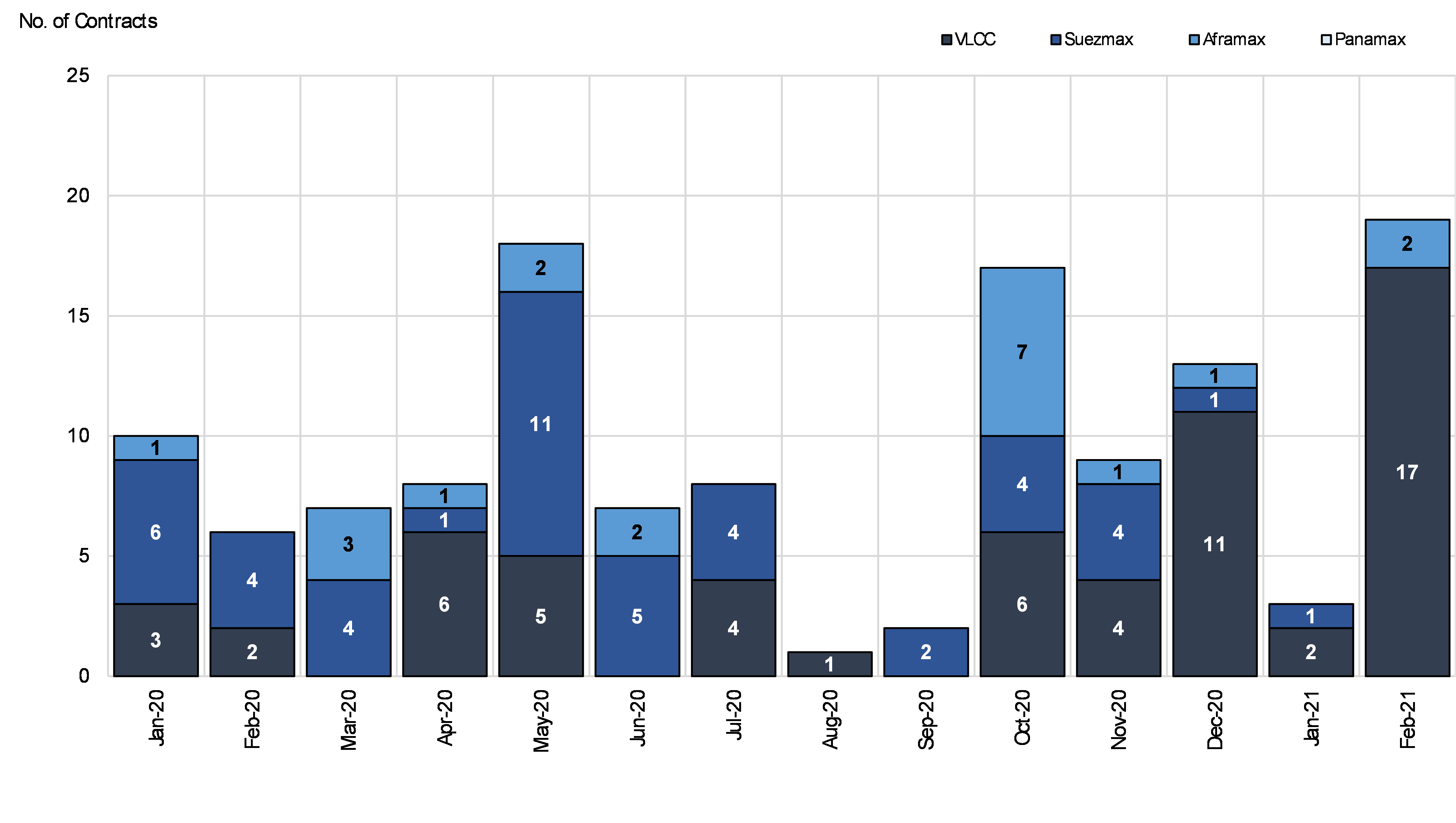

According to our data of confirmed orders, January started slow with only two VLCCs reported as compared to December of 2020 when we saw at least 11 confirmed orders. Despite that, ordering activity increased significantly in February, with 17 confirmed VLCC orders and at least two Aframaxes (Figure 1). This is a number we have not seen in one month for a very long time and in a way confirms that some shipowners will follow the “buy low” strategy.

On the other side of the very active ordering market is the demolition market, which so far has not shown significant movement in the DPP tanker and especially the VLCC sector. Indicatively, we have confirmed only three VLCC demolitions since the beginning of the year, one in January and two in February. This comes at a time when we have seen scrap prices as high as US $450-460/LT in recent deals, again a number not observed in a long time.

Putting it all together, we do expect demolition activity in the VLCC tanker sector to begin increasing in the coming months, to reach our Tanker Market Outlook projection of 39 vessels by the end of the year. A multitude of factors such as the high scrap prices and low earnings environment combined with the fleet age profile as well as upcoming regulation changes (such as the IMO’s Energy Efficiency Design Index – EEDI) are likely to act as incentives for shipowners to dispose of tonnage and potentially add some supply side support to the market going forward.

Figure 1 – DPP Confirmed Tanker Orders

Source: McQuilling Services