Filling the Gap: Part 1

Nov. 14, 2017

The Middle East and West Africa stand as two of the largest oil producing regions in the world accounting for over 32 million b/d of crude supply in 2017 and exporting 75% of that to refiners across the globe; however, their largest clients are located in Asia. Within Asia, the Far East and South East Asia regions currently account for around 29.3 million b/d of refining capacity; however, by 2025 this figure is on track to rise to over 32 million b/d. The outlook for regional crude supply is not as promising and expected to fall by over 620,000 b/d through the same period, while demand will remain robust due to refining capacity additions, maintaining the need for heavy import volumes.

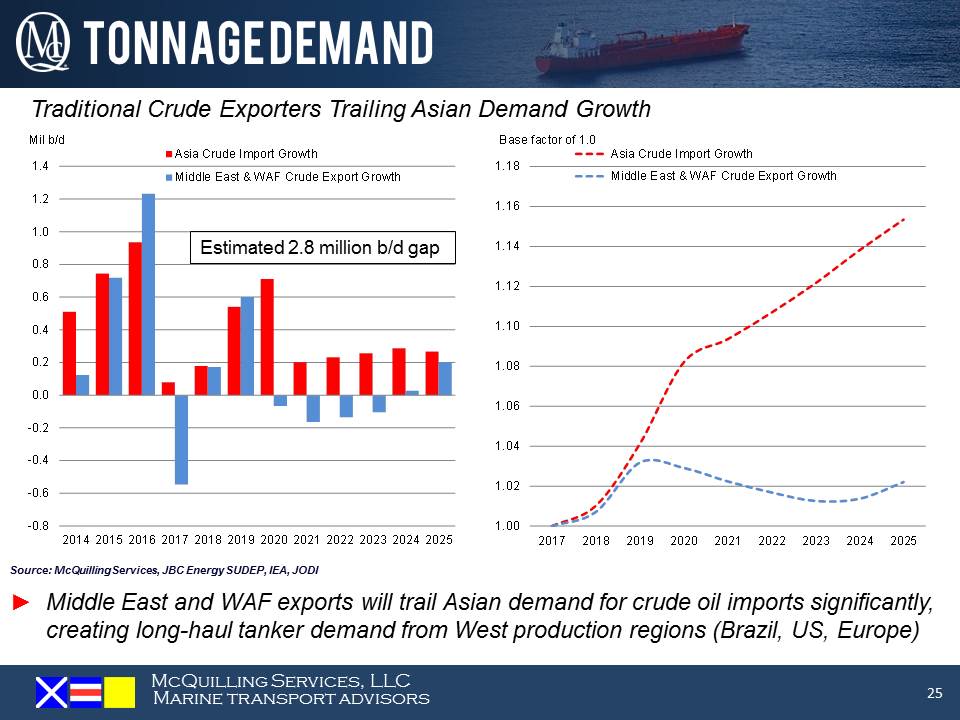

Over our forecast period (2017-2021), we expect Middle East & West Africa crude export growth to trail Asian crude import growth on the basis of higher refining capacity in the former reducing the available crude balance for export. Middle East refining capacity is on track to expand to over 11 million b/d in 2022, a 1.3 million b/d expansion from 2017-year end levels, while West African crude processing capacity will nearly double to just below 1.4 million b/d in 2022 amid new refinery additions. More capacity within these regions is likely to support crude intake at refineries and pressure the availability of crude for export, which, in our view, will greatly impact the evolution of tanker trade flows into the East. We believe 2.8 million b/d of additional supply will be required to fill this gap through 2025 and will likely stem from Atlantic Basin producers; however, what nations will have the proper fundamentals to meet this requirement?