Fleet Utilization

Oct. 18, 2017

Our analysis of remotely-sensed vessel position data captured only a small (+0.3%) rise in daily Suezmax demand in September versus August, but up 8.5% from the same month last year. Demand is projected to increase in October and November, likely placing some modest upward momentum in freight rates. Similar to the VLCC segment, a supply of tonnage has outpaced demand growth. As of the end of September, we calculated a 10.6% rise in Suezmax supply from year-ago levels, outpacing demand and reducing utilization to just 60.7% last month, the lowest rate since October 2015, highlighting the impact from a heavy delivery schedule this year and only modest deletions by owners.

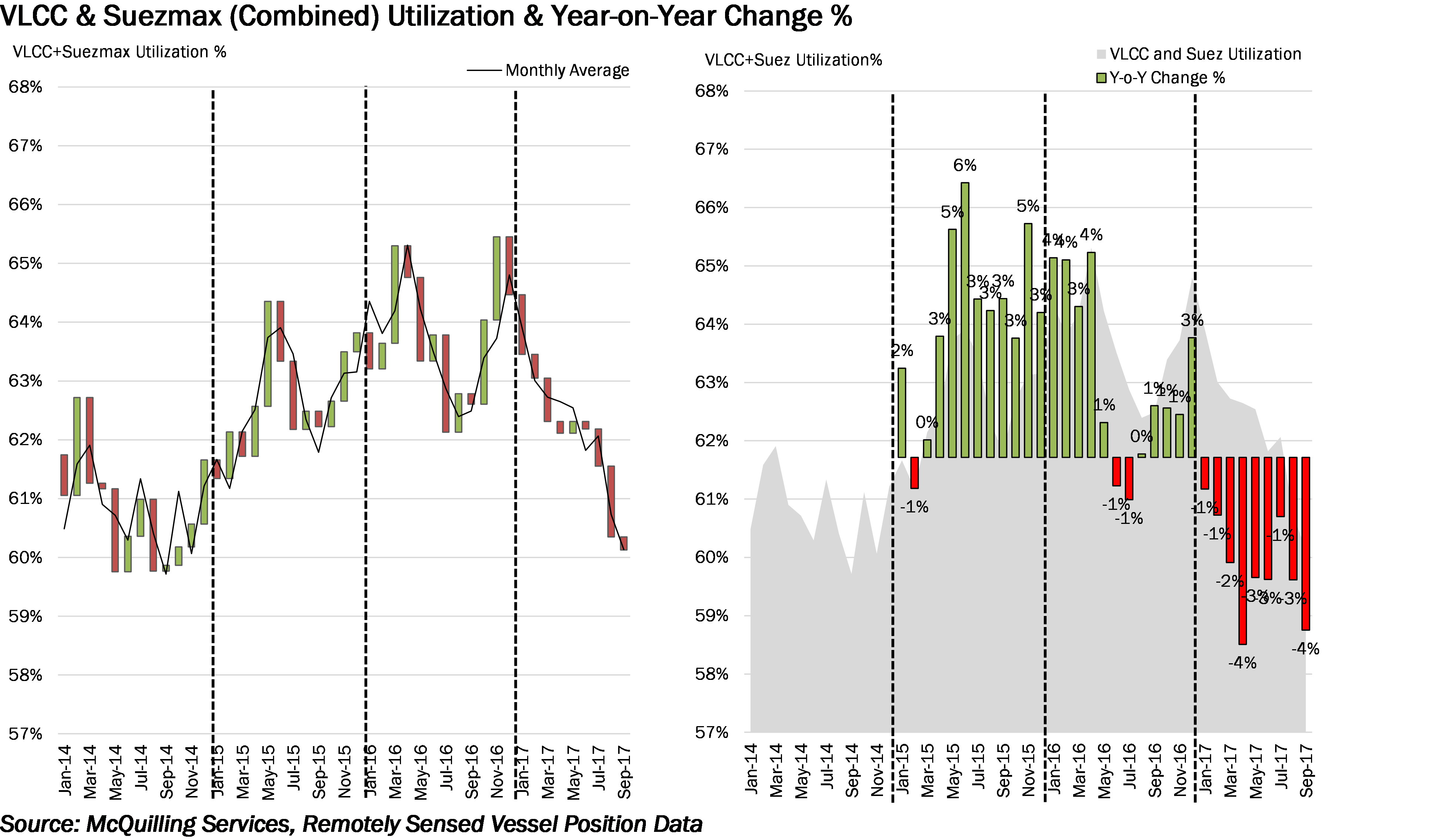

Combining the VLCC and Suezmax sectors, September’s utilization stood at 60.13%, a decline of 3.8% year-on-year, highlighting the lower trend of freight rates for these segments (Figure below). September now marks the ninth straight month, where the combined utilization of these segments is lower from the same month in 2016 and has lowered 2017’s year-to-date utilization to 62.18%, down 2.4% from the same period last year.

Order a copy of McQuilling Services 2017 Mid-Year Tanker Market Update

The Mid-Year Tanker Market Outlook Update provides an outlook for spot market freight rates and TCE revenues for 19 major tanker trades, including two triangulated trades, across eight vessel classes for the second half of 2017 and the remaining four years of the forecast period to 2021. We revisit our forecasting process at the mid-year point, distilling data from the first half of the year to better understand recent market developments and expectations for the future. In our view, this process allows us to accurately adjust our forecasts and provide additional value to our clients.