Floating Storage: Is There a Second Wave?

Sept. 18, 2020

We couldn’t help but devote some time into assessing whether the recent “chatter” about a second wave of floating storage has the potential to become a reality and thus support tanker rates; rates which have been suffering by all accounts lately. In short, we feel that there isn’t enough yet to warrant such a development, but as we have seen lately, stranger things have happened.

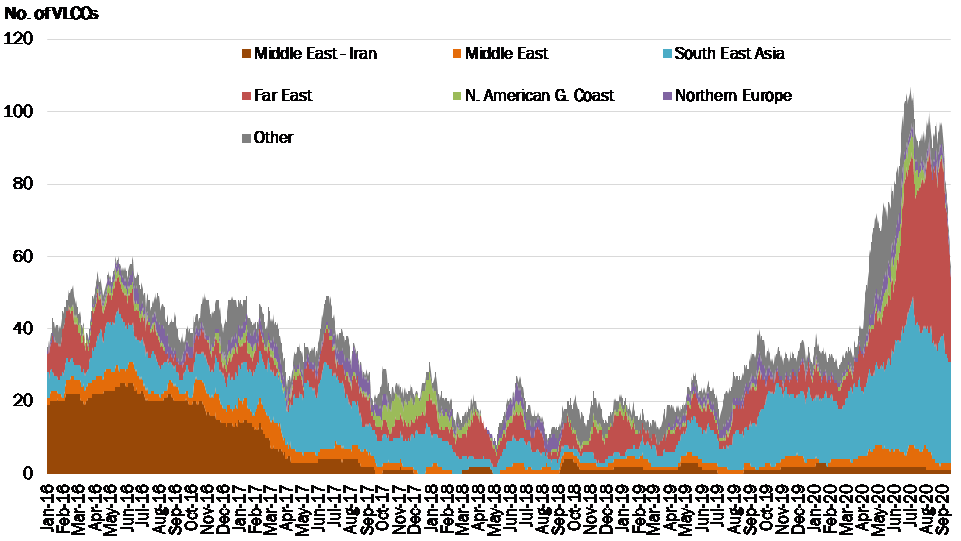

The conversation began when a well-known trader fixed at least 5 VLCC tankers on short-term time charters, presumably to be used for floating storage purposes - well after the observed peak in May-June (Figure 1). Those fixtures were followed by similar ones from other major traders within the same week. All fixtures showed a similar pattern regarding the type of ship (VLCC) and duration of 4 to 12 months. We are not privy to the motivation behind these fixtures although we do understand that at least some of them pertain to newbuildings that are going to be loaded with clean products (Gasoil) instead of crude, influenced by a contango opportunity.

Additionally, the fixtures coincided with a drop in crude oil prices last week, which somewhat increased the contango spread of the commodity. Indicative is that the Brent 1/12 spread in the beginning of the month was at US $-3.21/bbl, whereas on September 15th it had reached US $-4.80/bbl. The flurry of time charters immediately impacted the spot market thinking from owners. The benchmark AG/CHINA voyage was at WS 25 on September 8th and reached WS 39 by week’s end.

Everything that followed is pointing to this being an isolated event and not a trend. Tanker rates have retreated alongside increasing oil prices and narrower spreads. However, we feel that the “final word” lies with crude oil supply and demand going forward. We know that transportation demand is struggling to return to previous levels and it is indicative of not only a slower rebound from the pandemic, but also the glut of inventories. High inventories combined with increased OPEC output, which is losing some ground due to the weaker demand, could mean another round of lower prices and possible profitable contango structures. Having said that, we also anticipate OPEC and its allies reacting very quickly to such scenario and possibly curbing production once again. With all that in mind though we still feel that tanker returns have a long way to go to reach “healthy” levels again.

Figure 1 – VLCC Floating Storage Development

Source: McQuilling Services