Fuel Oil Spread Ebbing and Flowing

Oct. 29, 2021

With decarbonization dominating discussions around fuels these days, the reality is that the vast majority of the merchant fleet is and will continue using conventional bunkers for its needs. Before alternative fuels were the main topic, the IMO 2020 regulation brought VLSFO to global bunkering hubs and with it the discussion on the viability of scrubbers. The economic case for them was based on the price differential between high sulfur and low sulfur fuels.

This price differential has allowed vessels with scrubbers to increase their TCEs by consuming cheaper high sulfur fuel oil. As an example, our calculations for the TD3C AG to China VLCC trade show an average of between US $5,000 and US $6,000 of additional earnings compared to tankers that are obligated to burn VLSFO.

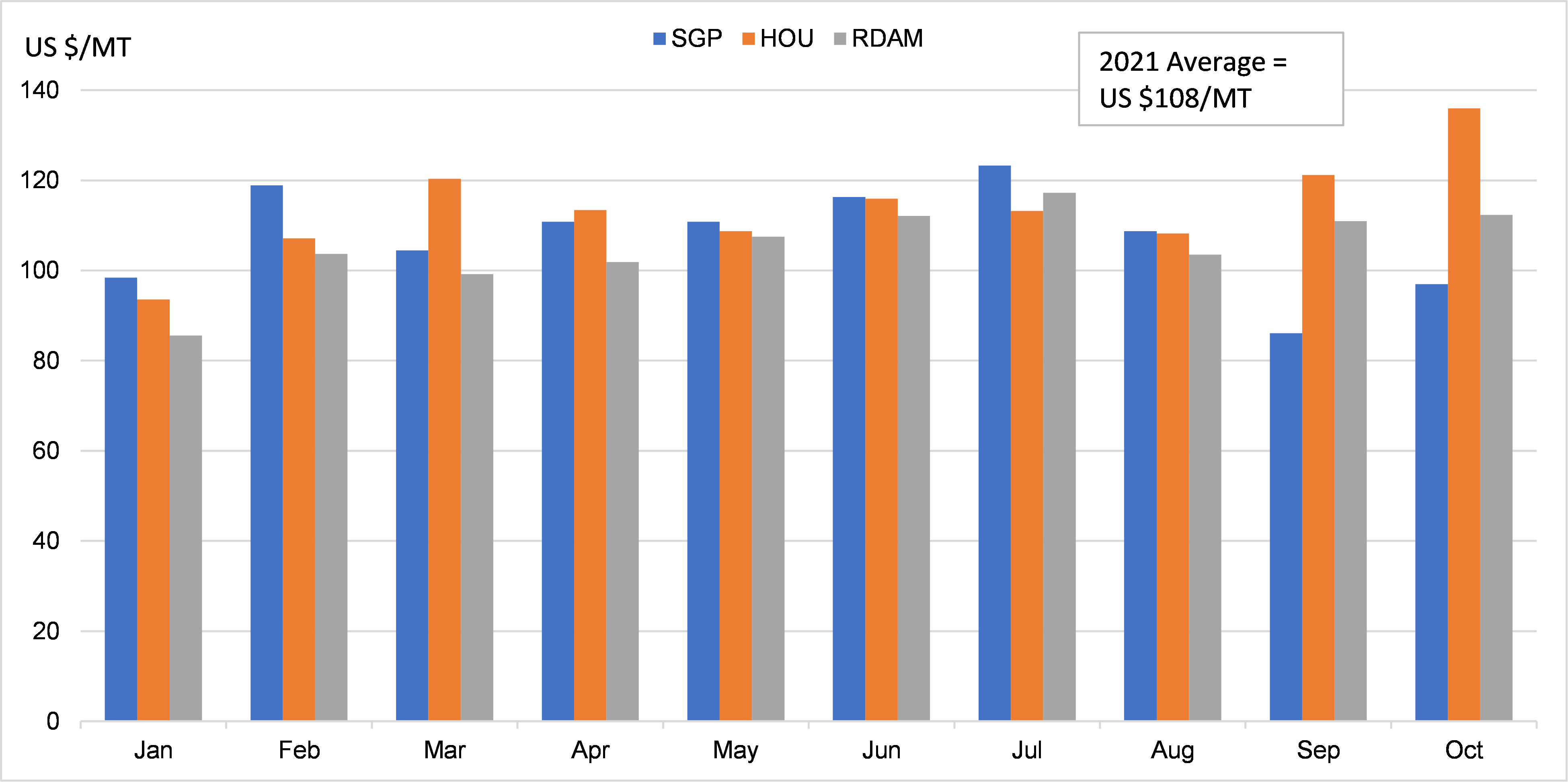

By graphing the price differential between the two fuels in three major bunkering hubs, we see that the average spread so far in 2021 has been at US $108/MT, without significant variations throughout the months. One exception is Singapore were the differential dropped to less than US $85/MT in September, something that could potentially mean a switch to fuel oil for power generation plants in the region, pushing the price of HSFO higher (Figure 1).

In fact, as power demand in Asia as well as West of Suez markets (Europe) is surging, we have been observing record high prices for coal and natural gas, typically used for power generation and heating. While there has been some easing of the pricing pressure in recent days, one plausible scenario is that the “power crunch” will continue well into the winter months, putting further upward momentum into these resources. As a result, more power plants could make the switch to alternative fuels for generators such as high-sulphur fuel oil and in-turn support additional crude demand at the refinery level.

Figure 1 – HSFO – VLSFO Price Spread in Three Key Bunkering Hubs

Source: McQuilling Services