Hurricane Harvey Wreaks Havoc

Sept. 7, 2017

Hurricane Harvey broke the Texas coast on the night of Friday August 25 as a category four hurricane and within a day was downgraded to a tropical storm; however, massive rainfall placed the US’ fourth largest city under water. Record flooding has been reported throughout the Houston area, causing many oil majors to shut refinery operations. It is estimated that around 4-5 million b/d of primary distillation capacity was impacted with some operations returning quicker than others; however, the impact on 1.5 million b/d of capacity in the Port Arthur area has yet to be fully determined. As a precaution, about 500,000 barrels of crude were released from the US strategic petroleum reserve in order to meet demand once refineries begin operations.

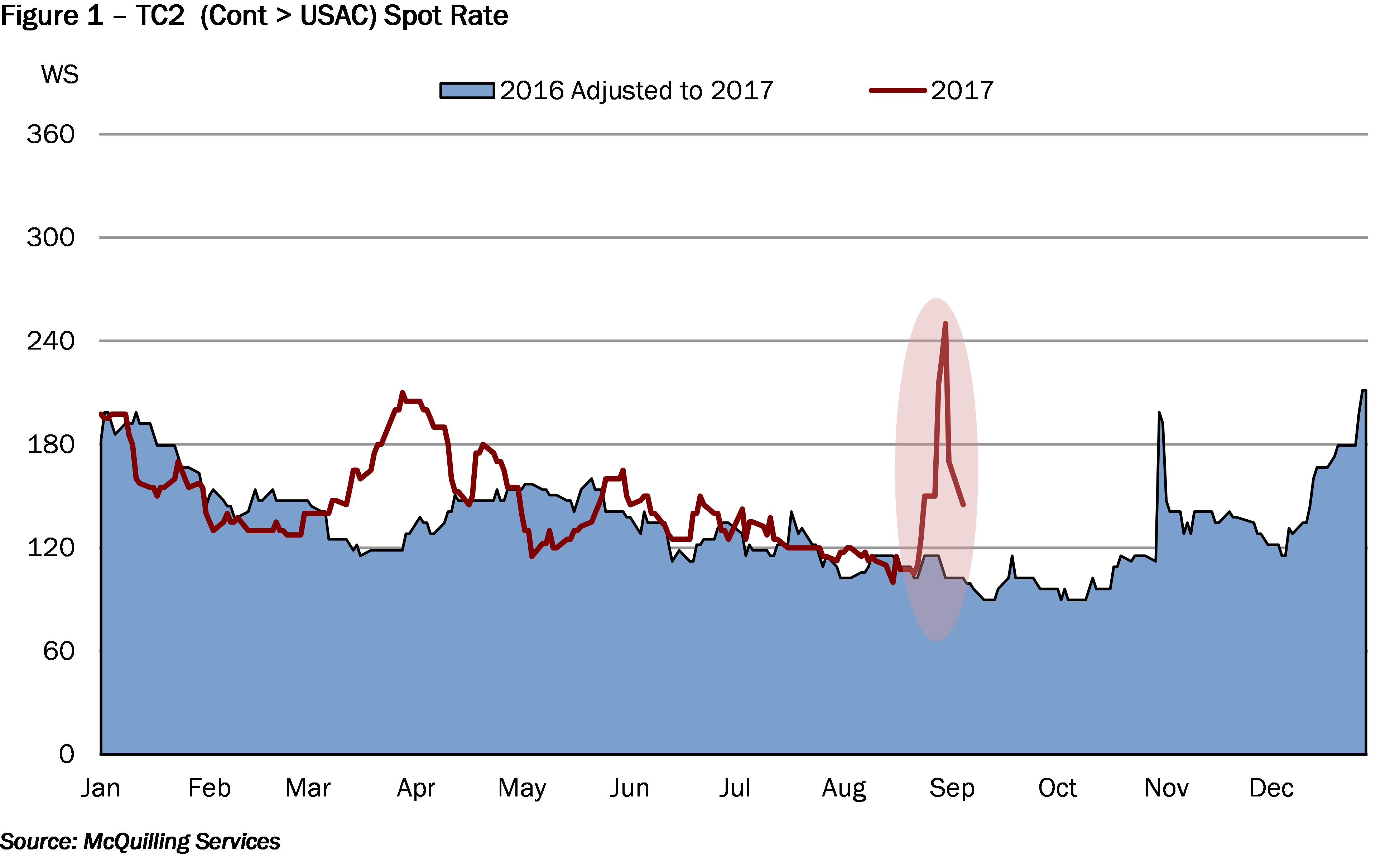

While fixture activity in the Gulf has been hampered by port closures and infrastructure damage, interest to import products out of Northern Europe to the US Atlantic Coast has surged to meet the demand gap. As a result, we observed TC2 trade up to WS 250 in the final week of August. In the short-term, we would expect these shipments to continue to mitigate the demand gap as US refinery runs are expected to average at about 16.25 million b/d over September; however, support for freight rates is likely to be short-lived due to interest from ballasters to enter the Northern European region (Figure 1). Import volumes have also been witnessed out of the Far East with numerous Korean and Singapore cargoes booked for US West Coast discharge in the first week of September. The draw on Asian volumes is likely to continue to support regional product margins in the short-term. In our view, the majority of the product demand gap in the US will likely be filled by a return of domestic refining, yet, Asian and European exports will provide support as well as meet demand in the wider Americas, which would normally take US clean cargoes. We have observed interest from Mexican importers to take product volumes from Singapore. US clean cargo volumes are likely to be subdued in the coming days as refinery operations resume to normal levels.

The prolongation of shut refining capacity will support volumes of European products into the US and in turn TC2 rates; however, the support will likely be short-lived as we have already witnessed a fall in rates and reports out of the Gulf indicate that refinery operations are returning. Rates along this route are expected to average at WS 135 in September. Another storm system, Hurricane Irma, is currently on a path towards the US Atlantic and if it makes landfall in this region we are likely to see discharge delays over the short-term. This reduction in vessel supply coupled with higher tanker demand from a return of refining activity in the Gulf has the potential to provide some short-term support for rates out of the Gulf.

Order a copy of McQuilling Services 2017 Mid-Year Tanker Market Update

The Mid-Year Tanker Market Outlook Update provides an outlook for spot market freight rates and TCE revenues for 19 major tanker trades, including two triangulated trades, across eight vessel classes for the second half of 2017 and the remaining four years of the forecast period to 2021. We revisit our forecasting process at the mid-year point, distilling data from the first half of the year to better understand recent market developments and expectations for the future. In our view, this process allows us to accurately adjust our forecasts and provide additional value to our clients.