Impact of Cargo Switchovers on LR2 Utilization

Sept. 24, 2021

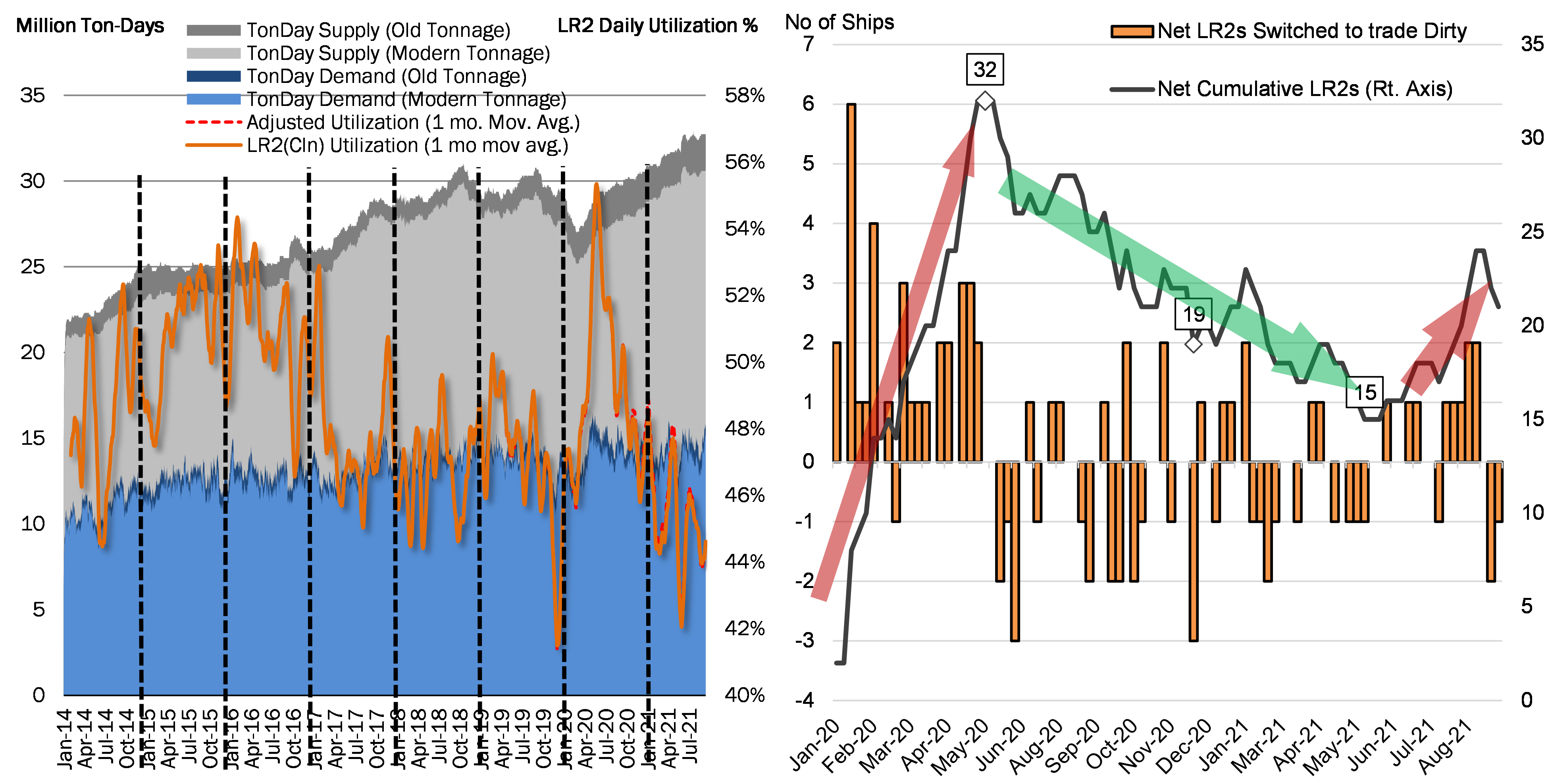

Tracking and measuring CPP demand on LR tonnage can be challenging at times, due to the fact that these vessels are able to switch between carrying clean petroleum product and carrying dirty ones such as fuel oil and crude. The practice is especially prevalent on the LR2/Aframax class since most of these tankers (especially the more modern ones) come coated with materials that allow both instances. To address that, we have developed a methodology that accounts for the actual cargo carried by these vessels when measuring ton-day demand, with some interesting patterns emerging.

After the intense volatility recorded in 2020, the clean-trading LR2 fleet utilization significantly dropped in the beginning of 2021 due to the weaker oil demand impacted by the COVID-19 Pandemic as well as the LR2 floating storage unwinding. In the meantime, we have captured a rapid pickup in clean-trading LR2 ton-day supply (grey area in Figure 1). This could be partially explained by a net of 17 coated LR2 switched back from dirty-trading since mid-2020. The strong spot earning for DPP tankers the beginning of 2020 due to the “Price War” has given LR2 owners strong incentives to “dirty-up”, reducing the LR2 (Clean) ton-day supply. However, as the DPP tanker earnings remained weak over the past three quarters, we have observed a reverse trend for LR2 tankers rejoining the CPP tanker fleet, despite the approximately US $1 million expenses for tank cleaning and vessel repositioning. As a result, the monthly average LR2 utilization has declined from the peak of 54.8% observed in April 2020 to 44.6% in February 2021 (Figure 1).

The LR2 utilization slightly rebounded in the 2nd quarter, mainly due to a pickup in ton-day demand. The quarterly LR2 ton-day demand increased by 3.4% or six equivalent LR2 tankers (average cargo size at 75,000 mt) in the Q2 2021, pushing ton-day utilization to 45.6%. As COVID-19 related restrictions eased in Europe and the East of Suez markets, we have observed a rapid development of West-to-East naphtha flows as well as East-to-West gasoil/diesel flows in 2021. Due to the long sailing distance, these new developments have supported the LR2 demand in recent months. With gasoil balance in the Middle East expanding amid additional refining capacity, we foresee a continued upward support on LR2 ton-day demand moving forward.

In terms of cargo switchovers, we do once again observe an upward trend since July, a surprise as the DPP market earnings remained significantly below the CPP market. However, as we noted in the 2021 Mid Year Tanker Market Update, the strong LR2 demand due to the active East-to-West gas oil flow and the West-to-East naphtha flow, will keep LR2 tankers busy. We project the current will be reversed quickly, with more dirty trading LR2s cleaning up and rejoining the CPP fleet.

Figure 1 – LR2 Ton Day Supply/Demand & Utilization (Left Graph); Observed LR2 Cargo Switchovers (Right Graph)

Source: McQuilling Services