India Demand Implications

May 14, 2021

India is the world’s third largest crude oil importer and it has been on the news lately due to a massive surge in COVID-19 infections that brought renewed movement restrictions and measures in an effort to address the problem. For this week, we are going to look at some of the headline numbers for crude demand in the country and explore some possible scenarios for the near-term.

The new coronavirus crisis in the country started to become apparent in mid-April, when infection numbers started to surpass 200,000 a day. Soon the government ordered new expanded lockdowns that had an almost immediate effect on tanker charters. A cursory look at our fixture data reveals that while in March there were about 83 fixtures reported with India as the destination, for April the number dropped to 62. This includes major loading zones such as the AG, the US Gulf Coast, West Africa and Brazil.

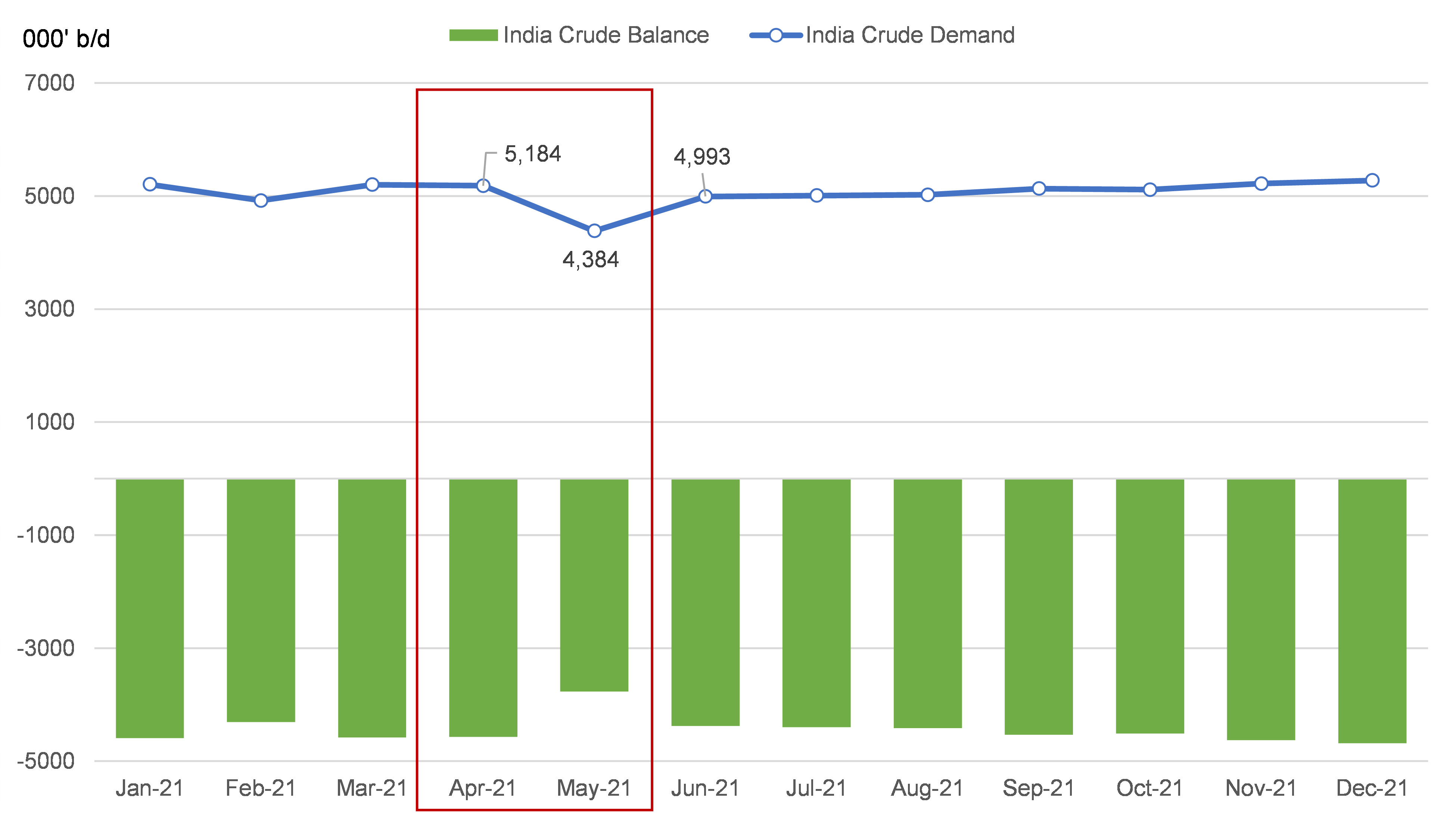

The latest available data from JBC Energy tells a similar story. As news reports were coming in on Indian state refineries reducing runs, we saw that projected crude demand in the country fell from approximately 5.2 million b/d for March and April to 4.4 million b/d for May (Figure 1). Crude balance is also a very good indicator of imports and exports and for May, we saw a projected deficit that is lower by a little over 800,000 b/d.

Given the reduction in refinery runs, India’s crude imports over the short term will logically be skewed to the Middle East (term contracts) with a sharp slowdown in imports from other load regions. This call is supported by our proprietary fixture data for May, with month-on-month declines from other regions like West Africa. For the clean tanker markets, we favor the scenario that the stringent lockdowns, and subsequent product demand declines in India, will outpace the decline in product supply, effectively lengthening the product balance. Those additional barrels would be a welcome sign for LR and MR tankers. Through the first half of May, LR fixtures are fairly even when compared to month-ago levels; however, within the data, we observe a 75% reduction in India-loaded LRs destined for the US. Looking further at the US Atlantic Coast imports, we note that the lost volumes from India were replaced by cargoes from the UKC region, which may be explained by the increasing refinery runs in Northern Europe and still tepid product demand in the Continent.

Figure 1 – Crude Demand & Balance for India – Jan -Dec 2021

Source: JBC Energy, McQuilling Services