Is a Crude Tanker Recovery on the Horizon?

Jan. 14, 2022

As revisions on global crude balances become available, we like to dive into the data to attempt to extract insight as it relates to the tanker markets. With a new year beginning, we are still in a very volatile environment, with a pandemic that lingers and new variants like Omicron once again generating more questions than answers for the global economy. On top of that, inflationary pressures, high energy prices and supply chain bottlenecks, all add to the uncertainty surrounding economic recovery in general and the tanker markets more specifically.

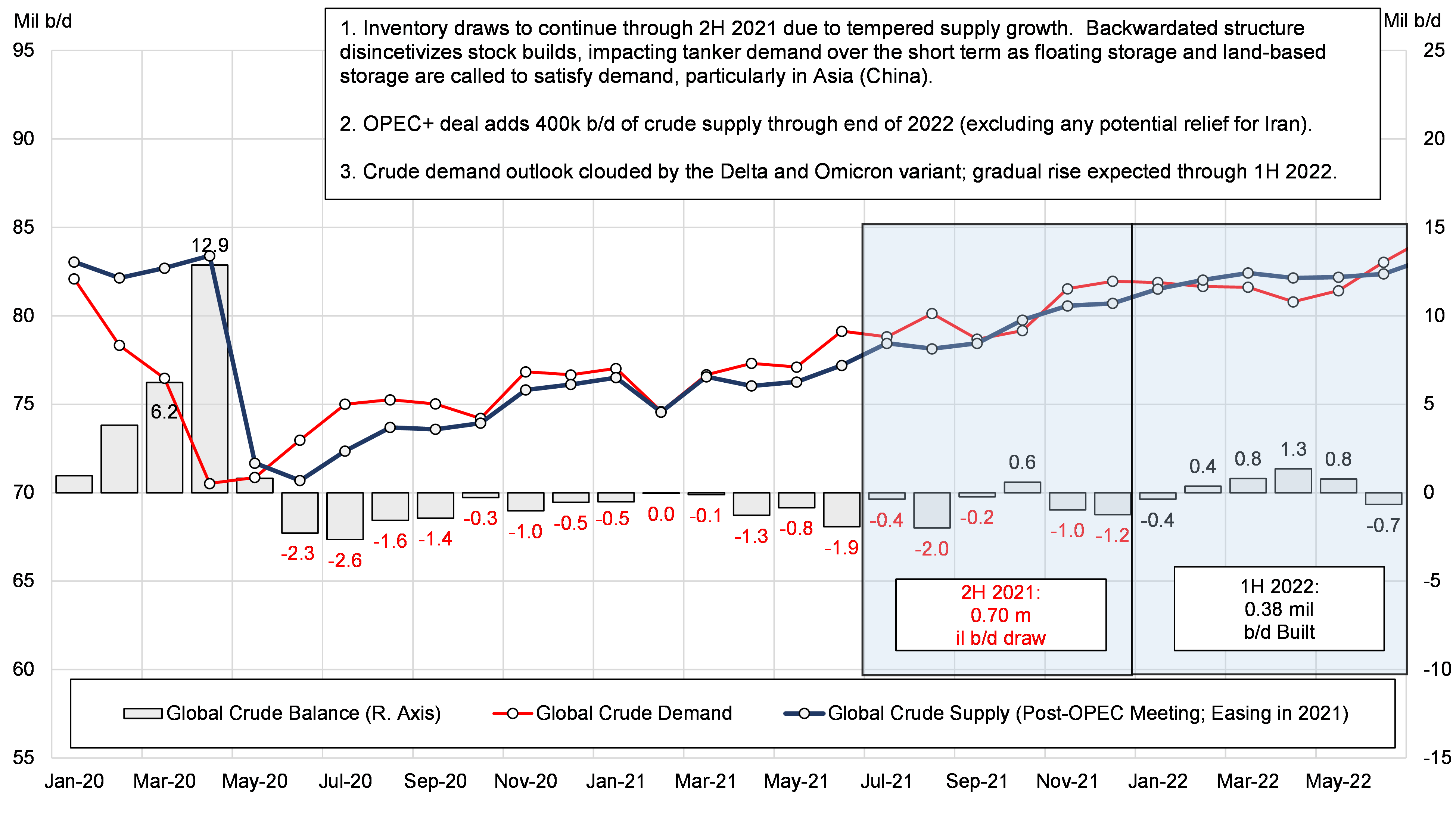

The latest data from JBC Energy reveal that the global crude oil balance stayed at a deficit beginning in November and expected to last through January (Figure 1) as some OPEC+ members are struggling to meet their production quotas. A harsh start to the winter in the Northern hemisphere has intensified heating and power generation requirements, prompting increased gas to oil switching, exacerbated by high LNG prices. This dynamic has increased crude demand, albeit temporarily, shifting balances once again into draw-down mode. Indeed, the global crude deficit is projected to average 809,000 b/d for Dec-Jan, supporting flat pricing, and likely behind the recent reports out of China for additional crude destocking. We believe that most of these draws will be land-based, but also a smaller percentage from floating storage. Overall, in the short-term, this development will negatively impact crude tanker fundamentals as inventory draws remove demand for transportation, while any floating storage releases further add to the trading supply.

As we move through Q1 2022, the expectation is for increased OPEC+ and Atlantic Basin crude oil supply to outpace crude demand growth, shifting the crude balance to a surplus. Assuming a moderate impact from Omicron, tanker demand will find support from these lengthening balances. In fact, our models point to approximately 20 VLCCs worth of equivalent demand introduced over the next 6-12 months from the change in crude balances. However, when matched against an orderbook that stands at roughly 45 VLCCs for the year, it doesn’t take complicated math to understand that owners will need to delete 25 VLCCs to keep the market in its current balance. Of course, the current balance results in TCE levels that are below OPEX for most modern tankers (without scrubbers), and thus, owners will need to accelerate deletions beyond this level to see any meaningful improvement in earnings. While we project 2022 will see elevated deletions as compared to previous years, we remain skeptical that this number will exceed 30, ultimately leading us to conclude that earnings are likely to average below US $10,000/day in 2022 for VLCCs with non-eco engine designs. A review of our full five-year projections will be published in the upcoming 2022-2026 Tanker Market Outlook report.

Figure 1 – Global Crude Oil Supply, Demand and Balance

Source: McQuilling Services, JBC Energy