Is it the Bottom Yet?

Oct. 2, 2020

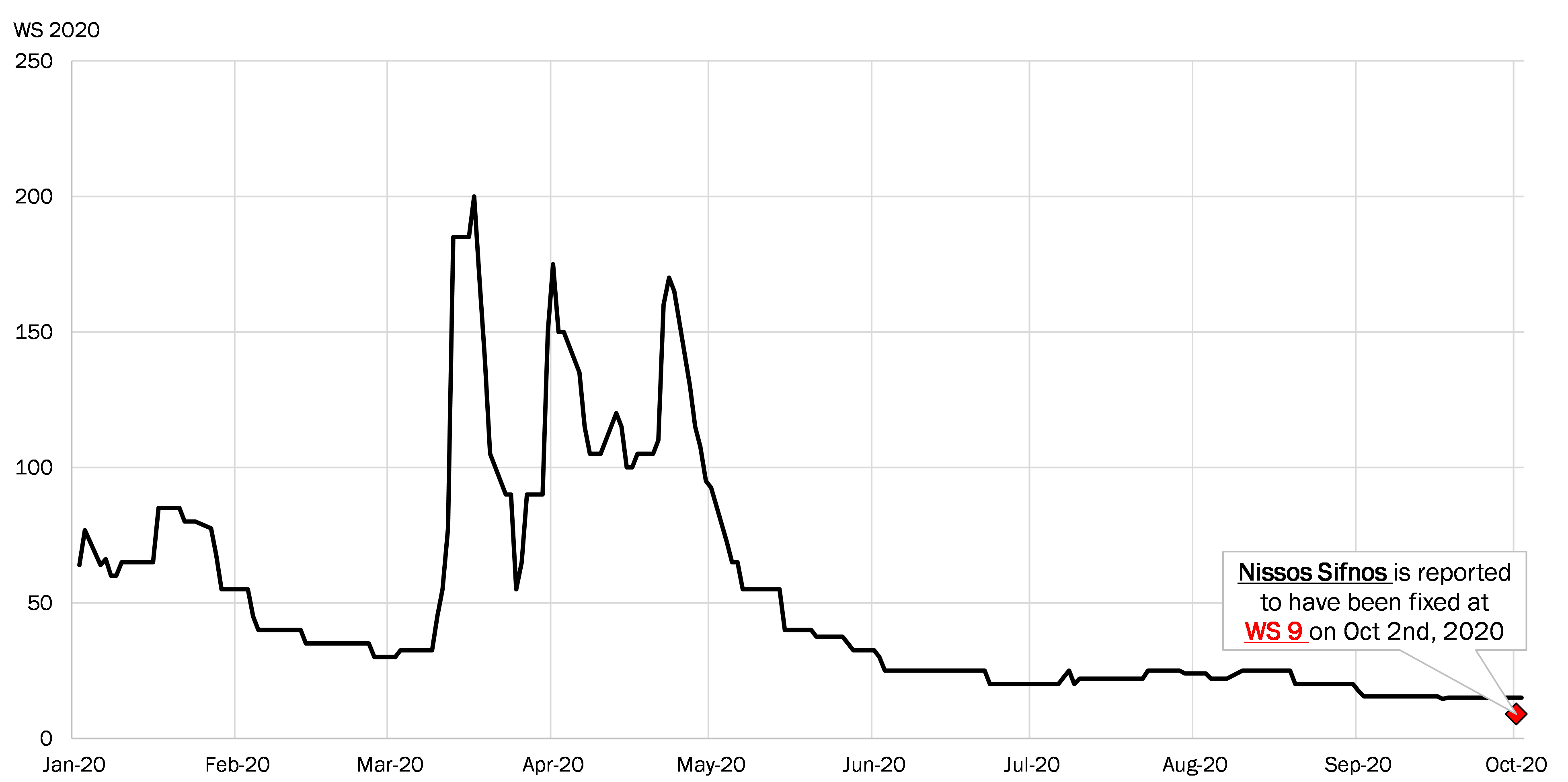

Over the last couple of months, the DPP market has gone through a tremendous downward correction, as we have to consistently adjust the Y-axis of our charts in order to display the spot market freight rates. Just when we are wondering whether we have reached the bottom and hoping for the normal “winter market” for the 4th quarter, the Suezmax tanker, Nissos Sifnos, is reported to have been fixed at WS 9 for Basrah Oil Terminal / Mediterranean.

Although this vessel happens to be a newbuild tonnage which typically fix at a lower-than-market level, this reported fixture has well-demonstrated the current weakness in the DPP oil tanker market. A wide range of discussions have been made upon this fixture in the tanker brokerage industry, and according to several McQuilling’s brokers who has 40+ years of experiences, “cannot ever recall a fixture of any size vessels being done in single digits”.

Both weak tanker demand and the over-populated tanker supply have contributed to the current softness in the DPP tanker market. On the demand side, we count a total of 194 VLCC and 196 Suezmax fixtures in September, compared to 239 VLCC and 246 Suezmax fixtures the same period last year, nearly 20% decline year-on-year. Meanwhile on the supply side, significant pressure has been put on the freight market amid limited amount of tankers sold for demolition and tremendous amount of DPP tankers released from the floating storage since June 2020. According to our floating storage statistics as of this Thursday, there are 62 VLCCs and 49 Suezmaxes currently being deployed as floating storage (at least 10 calendar days), down from the peak of 108 VLCCs and 100 Suezmaxes we observed in June/July. The increasing number of DPP tonnages went into the drydocking yards could lead some support, especially some delays in/out have been reported in some Chinese yards amid the “Golden Week”. However, the support seems to be marginal with a healthy amount of ships coming out of drydocking yards and fixing at lower levels for their maiden voyage.

As we heading into the 4th quarter, leverage from the so-called “Winter Market” is likely to be minimal this year. Instead, “Uncertainty” could again be the name of the game, to lead us into the 2021.

Figure 1 – Historical Suezmax AG/MED Freight Assessment Jan 2020 – Oct 2020

Source: McQuilling Services