LR Cargo Switchovers

March 19, 2021

An interesting statistic we have been tracking for some time now is that of tanker switchovers from clean to dirty and vice versa. The one sector we see these transitions more prominently is the Aframax/LR2 and in lesser extent the Panamax/LR1. These vessels show higher flexibility to “adapt” to market conditions as opposed to the larger crude tankers such as Suezmax and VLCC, which we usually see carrying clean products only under special circumstances such as when they are newbuildings and just out of the shipyard.

The reason this statistic is important is because it affects the supply side of the tanker market by adding or removing ships that are trading in a specific sector. That in turn affects the total tanker utilization, which as we have shown in our reports is closely correlated with freight rates and earnings.

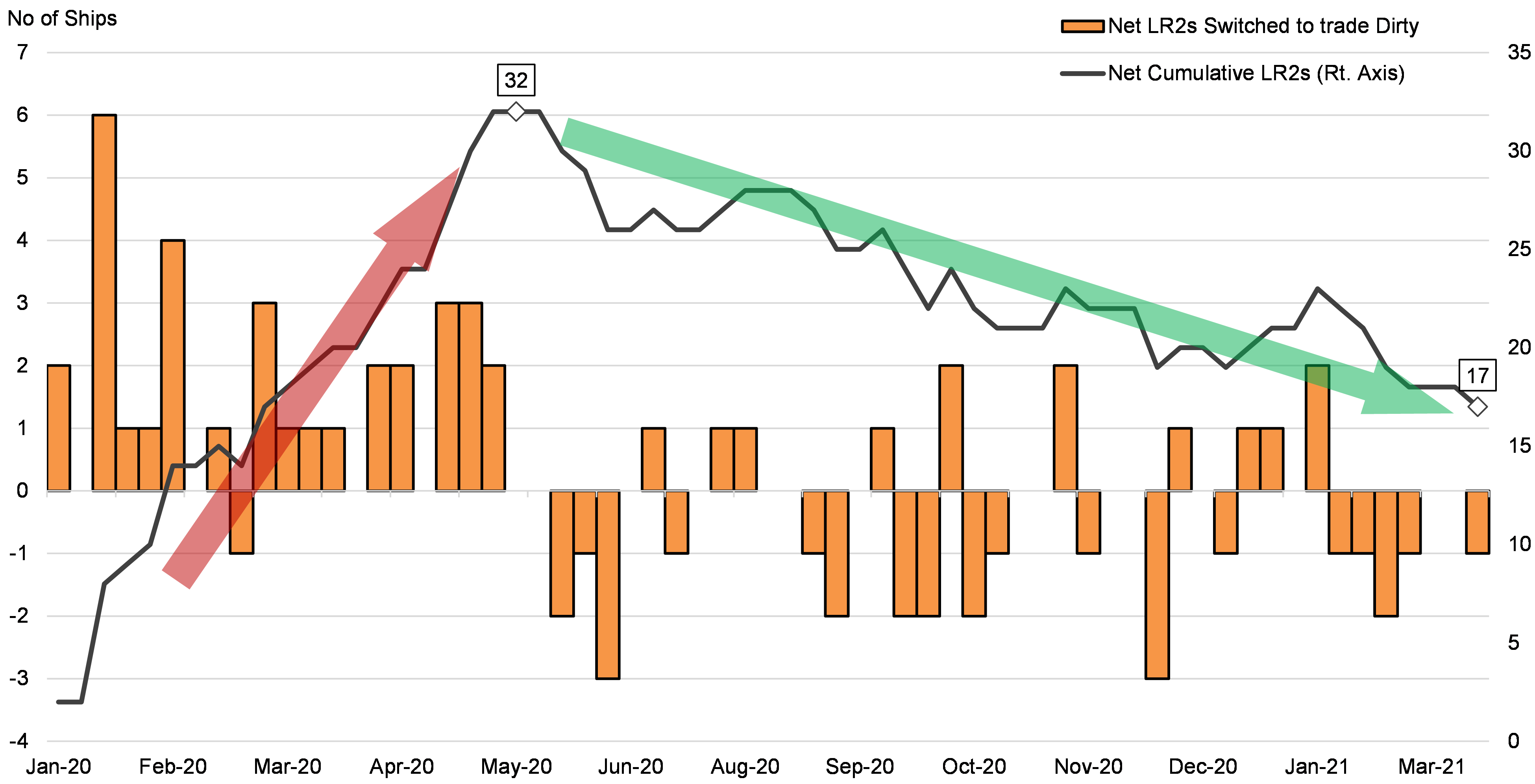

Looking at the data from the beginning of 2020, we see a cluster of clean to dirty LR2 and LR1 conversions from January to May of past year, something that correlates with the drop in oil prices and rush for transportation and storage (floating and otherwise) amid the covid-19 pandemic and the OPEC price war. From the second half of 2020 onwards, we saw a reversal of the trend as the DPP markets weakened and more opportunities presented themselves in the CPP sector, such as the West to East naphtha trade.

With the exception of January when we saw a net addition of 4 LR2 tankers to the Aframax trading fleet, the trend so far in 2021 has been in favor of DPP tankers switching over to the CPP side. In February we saw a net 5 Aframaxes switching to clean (Figure 1). So far in March we have observed one more LR2 switching over to clean. Overall, when looking at the net cumulative number of clean to dirty switchovers, we clearly see the downward trend from 32 net switchovers in May 2020 to about 17 for March.

As we discussed in our Tanker Market Outlook, we project the overall CPP market to fare better in terms of earnings than the DPP segments in 2021 and in the past couple of weeks we have seen freight for the benchmark TC1 and TC5 trade routes increasing. For those reasons, we expect to see more Aframaxes turning over to the clean trade going forward, perhaps lending limited supply side support for the sector along the way.

Figure 1 – LR2 Clean to Dirty Conversions (net)

Source: McQuilling Services