November Tanker Market Update: Asset Markets

Nov. 6, 2014

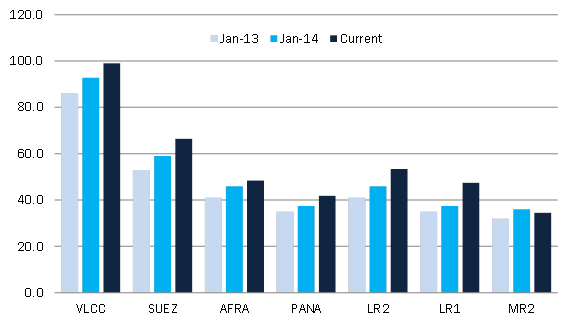

The first 10 months of 2014 has seen the majority of tankers increase in value on the back of higher earnings. Notable appreciation for newbuilding values has been witnessed in Suezmaxes and LR2 tankers which have risen by 13% and 16% respectively. However, LR1 tankers have seen the biggest increase since the beginning of the year, rising 27%. The lone tanker which has seen newbuilding values decline is the MR2 which has fallen by 4%.

The analysis appears to indicate a unique disconnect between MR2 tankers and the rest of the vessels analyzed. In anticipation of increased tanker demand, a surge of new orders for MR2 have imbalanced the demand/supply equation. This has translated into a softer earnings outlook. We have maintained the position that despite more volume of trade, new refining capacity is coming online closer to ultimate demand centers thereby reducing the average mileage per voyage. Furthermore, we expect larger product tankers to cannibalize some of the MR2 cargoes due to the economies of scale they may offer. The overall impact on MR2 indicates a softer ton-mile demand outlook with an alarming influx of vessels in the coming years.

To read more about our view on the asset markets, as well as a five-month tanker market forecast, contact services.us@mcquilling.com