OPEC+ Indecision and the Impact for Crude Tankers

July 9, 2021

The current “spat” between de-facto OPEC leader Saudi Arabia and the UAE almost feels inevitable in hindsight. The UAE has strategically set out a plan to diversify the country’s economic profile, most notably through the development of commercial centers in Dubai and Abu Dhabi, with the former a major hub for financial services industries as well as tourism. At the same time, the UAE has invested in increasing its crude production capacity to around 4.0 million b/d, coinciding with the introduction of Murban crude to the broader financial trading system.

In short, the UAE is asking for a recalculation of its baseline production numbers to be more closely aligned with its current production capacity of ~4.0 million b/d (based on April 2020 production levels); as opposed to the 3.14 million b/d reference level achieved in October 2018. A second point of disagreement is the UAE’s objection to extending the current production cut agreement to December 2022 from April 2022.

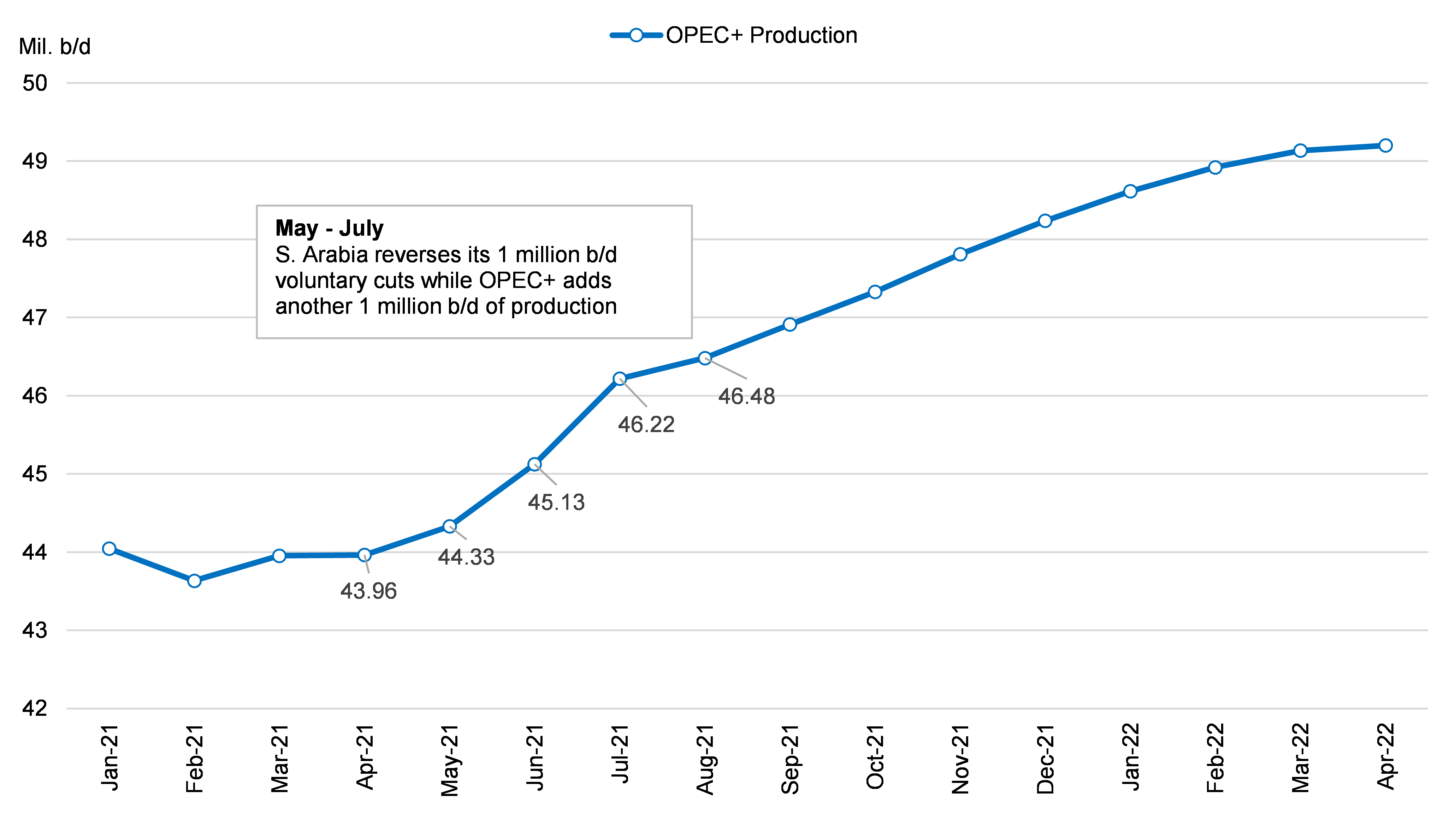

The by-laws of OPEC require consensus agreement to effectuate a policy change. Without the UAE’s agreement, the default position for the group is to maintain July’s output levels for the remainder of the original deal; something which we, and the broader analytical community, assess very little probability for. The latest data from JBC Energy embodies this viewpoint, in which OPEC+ increases production by 250,000 b/d in August and then continues with 400,000 b/d monthly increases through December (Figure 1).

Using JBC’s projections on crude balance changes, our models show a continuation of current freight rates for crude tankers through the summer, particularly for VLCCs. The introduction of 400,000 b/d in additional monthly supply is expected to add around 25 VLCCs worth of equivalent demand by the end of the year, a welcome sign for crude tanker owners. Despite this demand optimism, we remain cautious on the trajectory of crude tanker earnings over this period as our vessel supply forecasts show approximately 11 VLCCs delivering, and another 10-15 unwinding from storage operations over the next six months. Of course, there is one element of the supply equation, which can help improve the structure in favor of owners – and that is vessel deletions, and not in the sense of selling older assets to lesser-known buyers. The argument behind selling these older assets for further trading is that these vessels are involved in illicit trading (which yes, some are, but not all) and not actually competing with modern tankers – but anyone that understands demand and supply fundamentals knows this is far from true.

Figure 1 – OPEC+ Expected Production Levels

Source: JBC Energy, McQuilling Services