Pressure Mounts

July 18, 2017

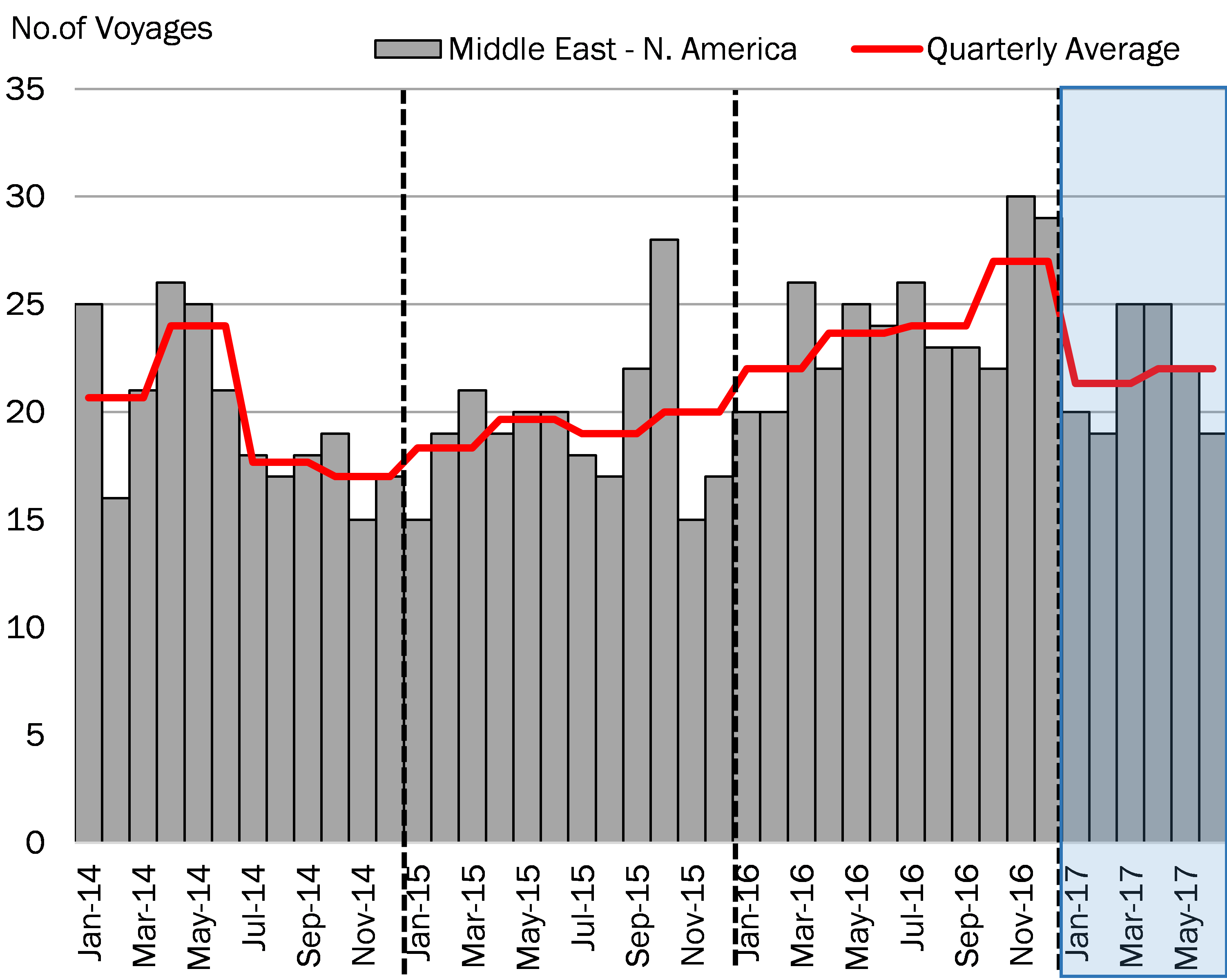

VLCC voyages from the Middle East to North America continue to decline this year, falling below 2016 levels and reducing TD1 earnings as pressure mounts from both sides of tanker fundamentals. On the supply side, OPEC’s efforts to rebalance global oil benchmarks has led to a reduction in Middle East crude volumes to the West as producers battle to retain market share in the East. From the demand side, rising crude supply in North America due to steady production gains in Canada and the US has reduced the reliance on imports from the Middle East. Vessels along this route have suffered from considerably lower earnings when compared to the remaining benchmark VLCC trades as TCE’s have averaged around US $4,294/day year-to-date, after returning to negative territory this month.