Project Investment Conundrum

Feb. 18, 2022

The “battle” between charterers and owners is alive and well in today’s projects market, precluding long-term time charter contracts from being executed. The disconnect between prevailing time charter rates and asset prices has likely never been wider, as asset values have found support from inflationary pressures and tight shipyard capacity, which in-turn have dissuaded owners from divesting out of existing tonnage as replacement costs are high. In that though, is the conundrum: asset prices are not reflecting demand/supply dynamics, but owners are unwilling to invest in modern tonnage at these levels because charterers are pricing contracts to reflect supply/demand dynamics. So, what gives?

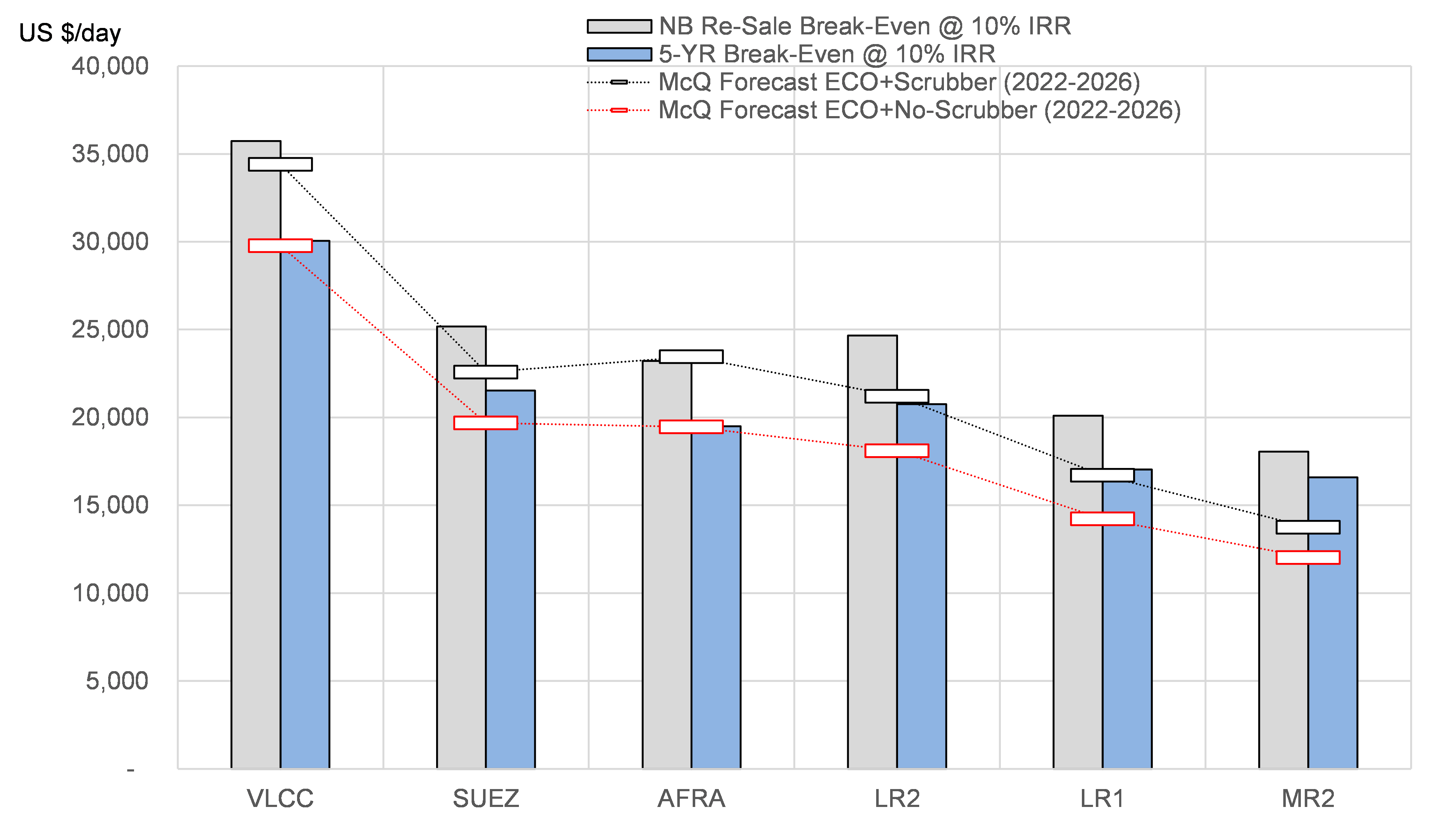

To assess the disparity between charterers and owners’ positions, we evaluated estimated break-even time charter equivalent earnings over a 5-year investment period using today’s asset prices. The calculation assumes: 1) current asset prices as entry point; 2) owner exits asset in 5 years at the historical average value of the asset at its then current age; 3) vessel-specific operating expenses, adjusted for inflation over the investment period and 4) debt financing in-line with current market dynamics. With these parameters in place, we solve for the break-even rate required over the 5-year period for the owner to generate a 10% IRR.

The results of this analysis revealed that in the NB re-sale category, an owner investing in a VLCC NB would require US $35,730/day in order to meet the 10% hurdle over the 5-year evaluation period (Figure 1). This compares to McQuilling’s forecast for ECO+Scrubber VLCCs to earn US $34,405/day over the same period. In the 5-year old segment, the break-even required to meet the 10% hurdle, is estimated to be US $30,054/day, while our forecasts for an ECO average to US $29,781/day over the period.

In each of these cases, a charterer would be under-water on the contract over the five years, more so if they were to be fixed at today’s assessed time charter rates of US $37,000/day (ECO+Scrubber) and US $33,000/day (ECO). As such, we are skeptical that without a correction in asset valuations, or owners lowering their hurdle rates, that any substantive amount of long-term projects will be executed. For the remaining vessel segments, our analysis shows that the Aframax segment displays the potential for project deals to be done basis the break-even calculations and our corresponding forecasts.

Additional market themes are covered in depth in our recently published 2022 – 2026 Tanker Market Outlook.

Figure 1 – Iran Crude Supply & Estimated Exports

Source: McQuilling Services