Refinery Closures and their Impact

Dec. 11, 2020

We have previously discussed refinery capacity additions outpacing underlying demand growth due to the resurgence of coronavirus infections, with unfavorable refining economics resulting from the subsequent lack of demand for products as well as the above average level of product inventories. A somewhat “natural” outcome, we predicted, would be to start seeing more consolidation, conversion of existing crude distillation units to storage terminals or biofuel processing facilities, and in some cases, outright closures.

Indeed, for the past few weeks we continuously see news reports on refinery closures, especially in Asia where the processing capacity expansions of 2019 - 2020 that reached up to 1.78 million b/d (JBC Energy) effectively led to refinery margin pressure on ageing, lower complexity units . With those developments in mind, the question becomes what kind of effect this could potentially have on ton-mile demand for product tankers in the short and medium term.

To answer this question, we look at core product (naphtha, gasoline, kero/jet, gasoil) balances in the region, focusing in the Far East. Based on the latest data from JBC Energy, total core product balance for 2020 in the region sits at a surplus of 877,000 b/d. As refineries increase utilization, the Far East is projected to increase its surplus to 1.07 million b/d for 2021. This will also lead to a recovery of ton-mile demand for product exports from the region, as is expected with almost every trade once transportation demand rebounds to somewhat normal levels after 1H 2021.

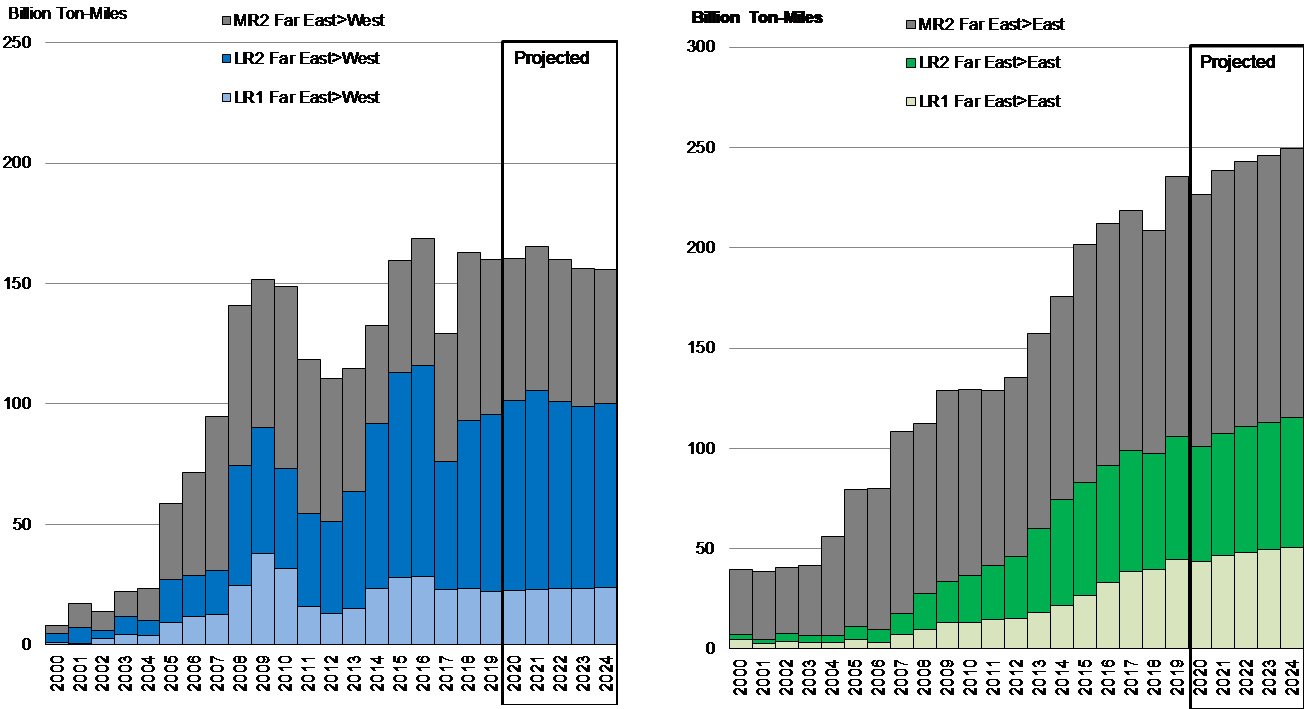

What is interesting is the development of product exports from the Far East from 2022 onwards. Taking into account refinery closures in the region, the absence of significant new projects and the overall demand increase, we see the total product balance in the region decreasing from a surplus of 1.18 million b/d in 2022 down to 839,000 b/d for 2023 -and continuing the trend towards the end of our forecast. This decrease in core products surplus translates into a decreasing pace of ton-mile demand growth from 2022 onwards, especially on trades from the Far East to the West, where a contraction is also possible (Figure 1).

Figure 1 – CPP Ton-Mile Demand - Far East Trades | 2020 - 2024F

Source: IEA, JBC Energy, McQuilling Services