Refinery Runs: A High-Level Overview

Jan. 21, 2022

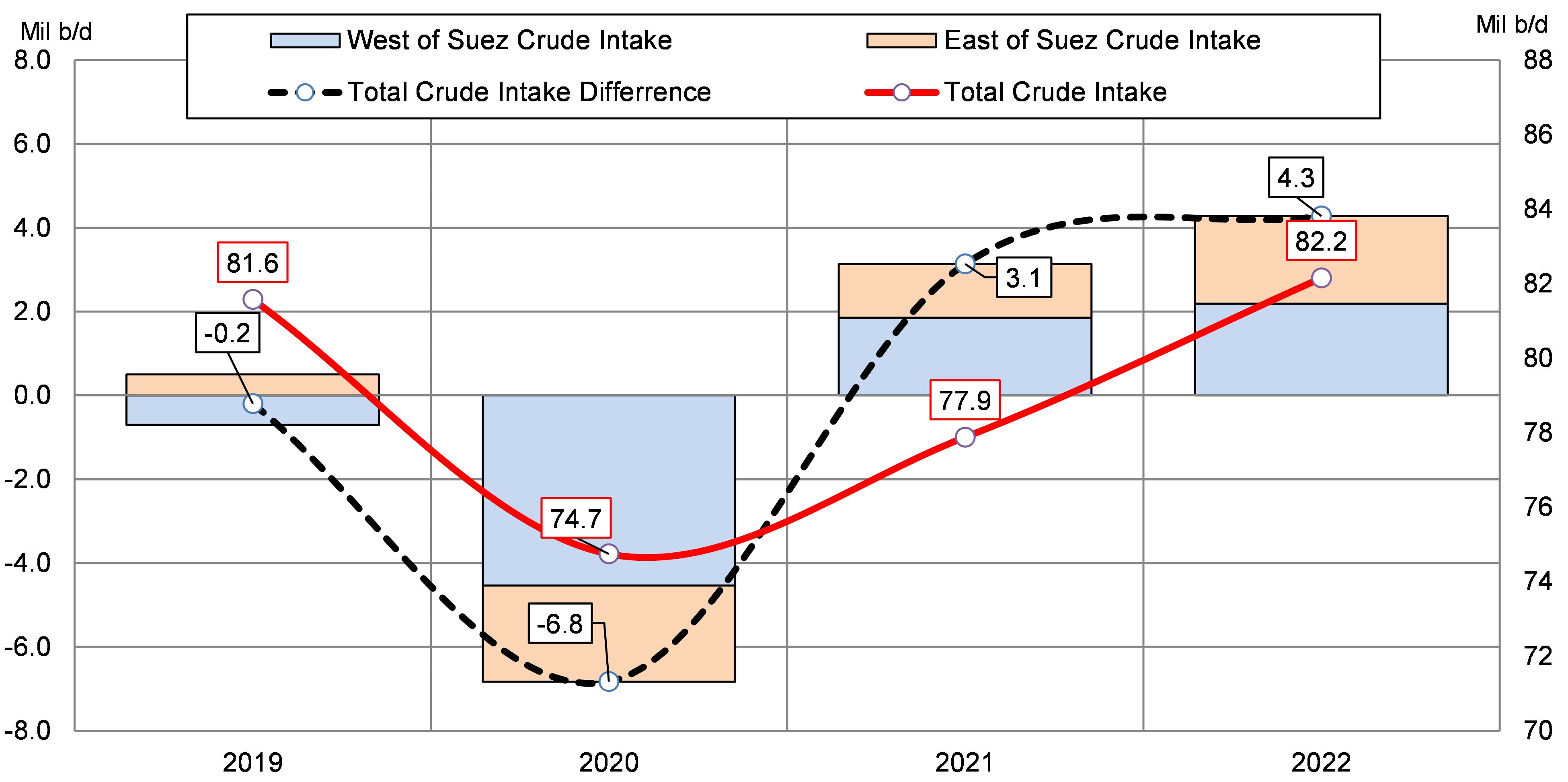

In 2021, total crude oil intake at the refinery level averaged 77.9 million b/d. some 3.1 million b/d higher than 2020 (Figure 1). This was the result of a world with less mobility restrictions, especially as vaccination programs became more widespread and efficient and healthcare systems increased their experience in managing infections. While this was a strong recovery figure, total intake did not reach pre-pandemic levels as many had predicted at the beginning of the year. Some of the reasons for that were the emergence of new virus variants (primarily Delta) that spread rapidly and forced many economies such as India in renewed lockdowns as well as the rally in crude and energy prices. In fact, we point out that increased levels of this intake were met by inventory drawdowns, bypassing, in the case of land-based inventories, tankers altogether and suppressing the crude tanker recovery prospects.

Moving forward to 2022, the latest available data points to a 4.3 million b/d crude intake increase at the refinery level, with total crude intake projected to surpass pre-pandemic levels at a total of 82.2 million b/d (Figure 1). Here, we note two important themes. The first is that the West of Suez refineries have largely been supporting intake increases in the two years of the pandemic. However, this dynamic is likely to change in 2022 as capacity is expected to expand significantly in the East of Suez regions, with about 1.23 million b/d. The caveat is that most of this expansion comes in the Middle East, a region that is likely to consume its own crude thus potentially bypassing crude tankers altogether.

Finally, the second major theme is the decarbonization push, which is intensifying as we move through the decade, especially in the West. While it is unlikely that refinery intake will be affected significantly by decarbonization efforts in the short term, we do project that total crude oil demand is heading to a plateau, especially as we move towards the middle of the decade. One region where we project refinery capacity to decline Is Northern Europe, which will influence tanker demand for both clean and crude tankers. Our views of this development, as well as our broader 5-year view on the tanker markets, will be revealed next week when we publish our industry leading 2022-2026 Tanker Market Outlook report.

Figure 1 – Crude Intake at the Refinery Level 2019-2022F

Source: McQuilling Services, JBC Energy