Saudi Arabia Production Cuts

June 16, 2023

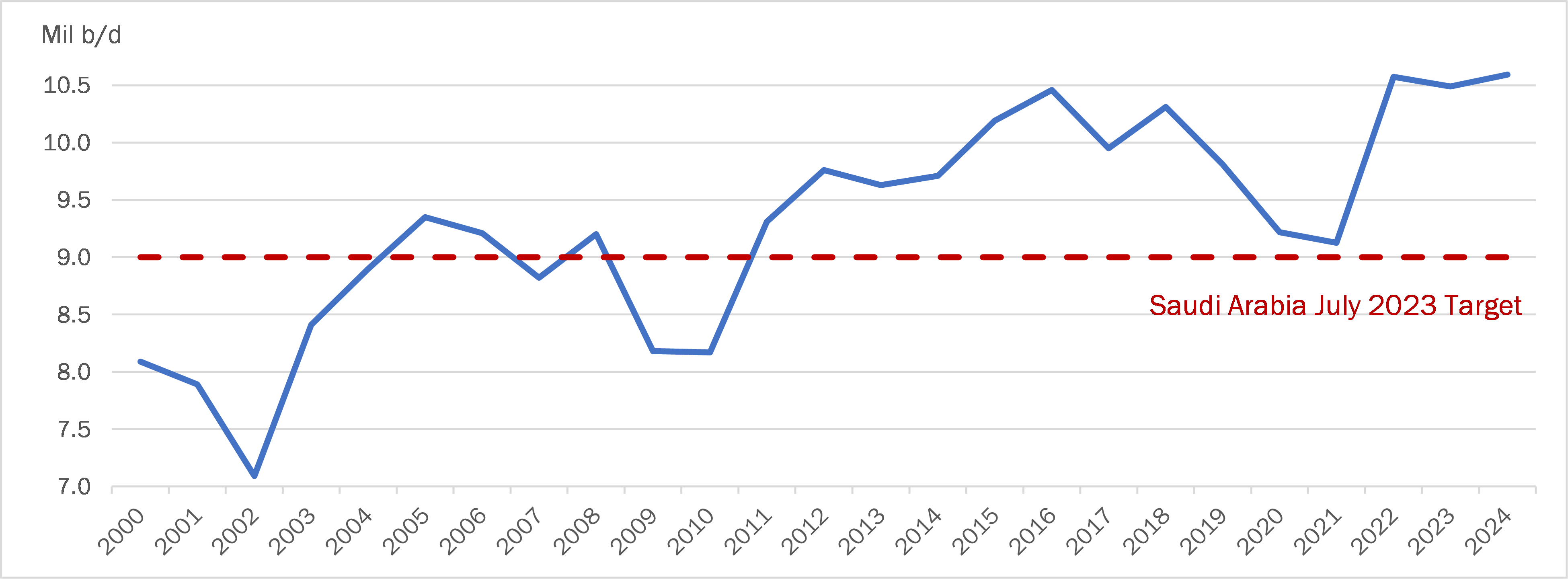

Saudi Arabia announced last week a unilateral production cut of 1 million b/d. This output cut is slated for July and comes on top of previously announced curbs, which would be extended until the end of 2024 while Russia, the second largest OPEC+ producer, made no commitment to cut output further. The Saudi announcement came soon after OPEC+ (including Russia) said the group had agreed to stick to current production targets until the end of the year. The broader 23-member group accounts for close to half of the world’s oil output. Saudi Arabia will now produce 9 million b/d of crude oil, according to their Ministry of Energy. This represents approximately 1.5 million b/d less than the country was producing in early 2023. A cut in production was expected to prop-up crude prices amid concerns about a slowing global economy that would put a damper on energy demand. Last week’s meeting also saw the UAE secure a higher production quota for 2024.

Figure 1: Historical and Projected Saudi Crude Production

Source: St Louis Federal Reserve Bank

Thus far the supply cuts have been largely countered by factors such as new petroleum from non-OPEC+ countries, by the prospects of economic slowdown and crisis, and by Russia’s unexpectedly robust oil exports despite Western sanctions. One key question will be the extent to which these production cuts are offset by increased imports into the Middle East, particularly cheaper Russian barrels. This would mitigate some of the extent to which total Middle Eastern balances would be impacted. In our April Industry Note, we projected crude demand in the Middle East to be revised lower by 581,000 b/d for the second half of 2023. We note downside risk to this projection, potentially a contributing factor to Saudi Arabia’s decision to cut production unilaterally beginning next month.

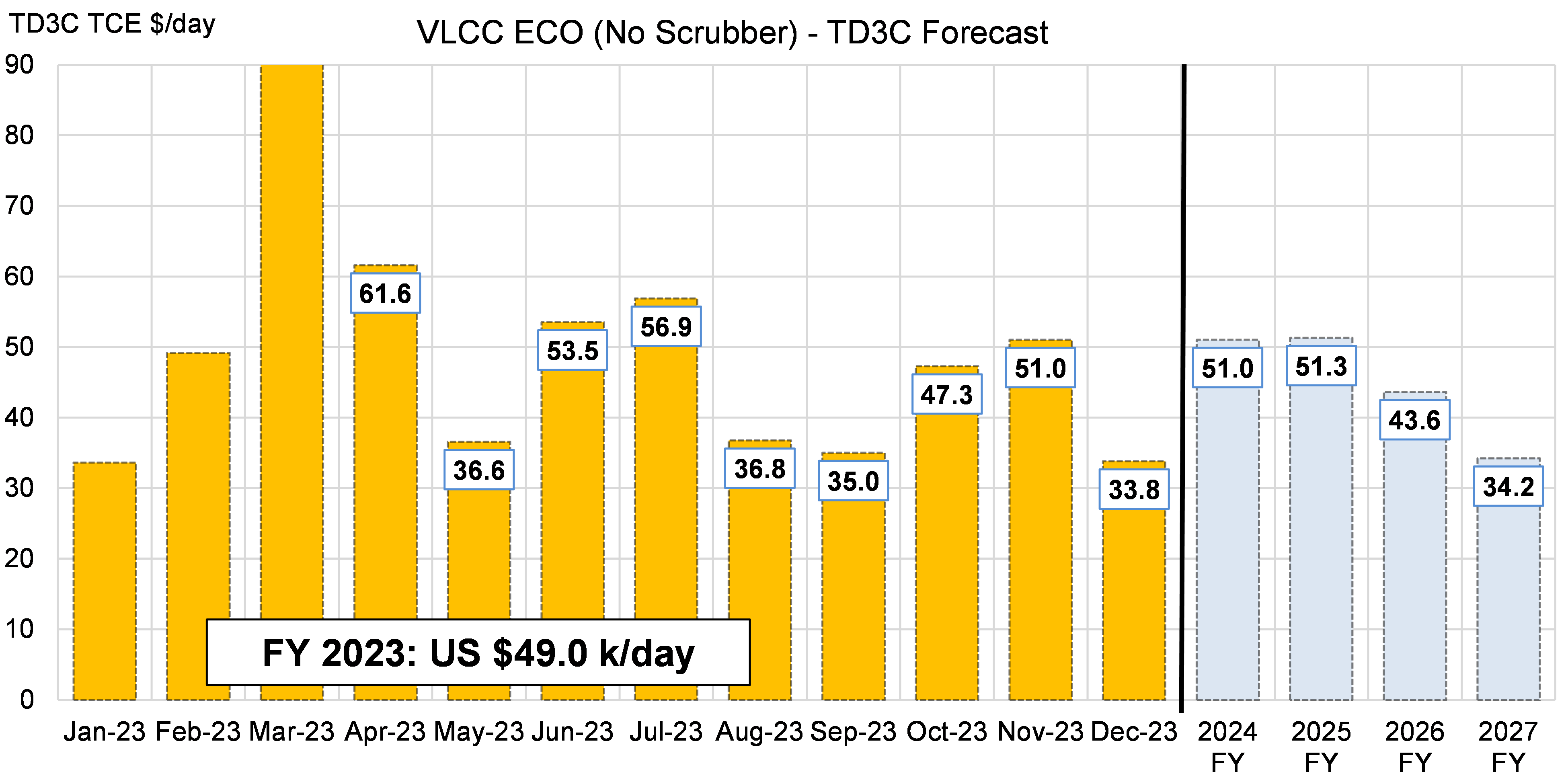

At the margin, this development does not impact our base case scenario with midsized tankers expected to outperform VLCCs. This development should be bearish for the VLCC market in particular as VLCC loadings from the Middle East have been for barrels predominantly headed to the Far East. Despite the recent surge amid the newly issued 3rd batch of crude import quotas, China’s crude imports have remained at relatively low levels due to the continued inventory drawdown from the stockpile during the 2019-2020 period. Therefore, a smaller Middle East supply of barrels coming to market, paired with slower imports in the East should pressure the freight costs for the TD3C (AG>China) route. In our May Short-Term Outlook provided to our premium subscription clients, we correctly called the freight bump in June/July due to the additional 26 million barrels of US SPR released but maintained that the 2nd half of the year would face structural challenges. With this additional cut by Saudi Arabia, we anticipate our demand/supply models will include further downward pressure in our earnings forecast, which is scheduled to be published next week.

Figure 2: McQuilling Services TD3C (VLCC AG>China) TCE Forecast (May Short-Term Outlook)

Source: McQuilling Services