Tanker Supply at a Glance: 1Q 2015

April 15, 2015

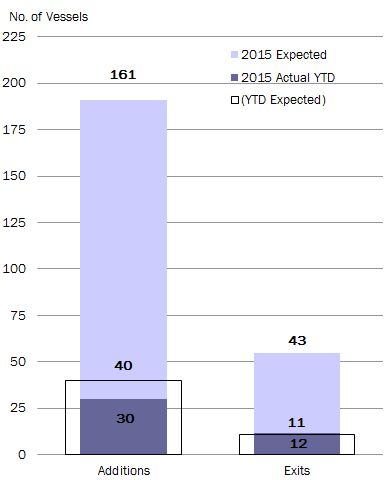

At the start of 2015, the tanker trading fleet* totaled 3,645 vessels. This represents an approximate 1% net fleet growth year-on-year. We expect that throughout 2015, there will be a total of 161 additions and 43 deletions, a net fleet growth of 118. The largest growth is anticipated to be seen in the MR2 sector, while the uncoated Panamax sector will experience negative net fleet growth.

So where does vessel supply stand at the end of the first quarter?

VLCC

Four newbuildings have delivered to the trading fleet, while two vessels were sold for demolition and and two for conversion. Deliveries are lagging slightly behind our year-to-date expectation of about eight, while exit activity is in-line with our forecast.

SUEZMAX

There have also been four newbuildings added to the Suezmax fleet through the first quarter and surprisingly no demolitions. Deliveries are fairly in-line with our year-to-date expectations, while demolitions are behind by two.

AFRAMAX

Eight uncoated Aframaxes joined the trading fleet through March and two demolitions were recorded – the Bramani and Jawaharlal Nehru, both ‘90s built. The FSO Banio was also sold for demolition in the first quarter, but does not impact the size of the trading fleet we track. Year-to-date we would have expected six Aframaxes to have delivered and two would have exited.

PANAMAX

There have been no Panamax newbuilding deliveries recorded to date, while there have been two demolitions. The 1993-built Elsa was sent to the breakers in India in March, while the Bei Hai Zhi Xing, also 1993-built, left the trading fleet in February.

LR2/LR1

Activity has been limited for these clean ships. LR2s recorded two deliveries and no demolitions in the first quarter and there’s been no change in the LR1 fleet.

MR2/MR1 (non IMO I/II)

The largest fleet growth has been recorded in the the MR2 sector as 11 newbuildings hit the water and just one ship was sold for demolition. Deliveries are lagging slightly behind our expectations, which is a positive sign for MR2 owners, as we would have expected 14 ships to have delivered so far this year.

It’s been a slightly different story for the MR1s as there has been just one delivery and three demolitions.

*27,500 dwt and above/excluding IMO I/II vessels

To receive tanker market information on a monthly basis, become a subscriber to our Monthly Tanker Market Summary or contact services.us@mcquilling.com