The Beginning of the Drawdown

July 2, 2020

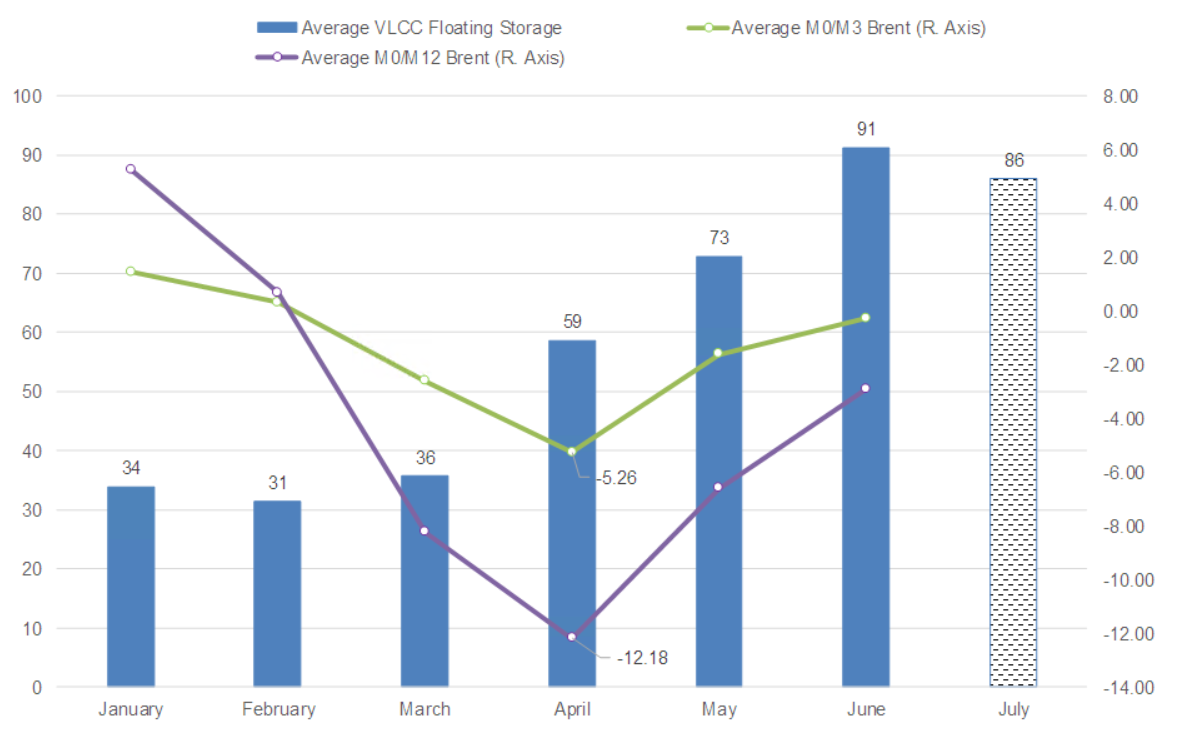

In previous weekly highlights and various of our reports, we have discussed potential scenarios regarding the development of floating storage for crude oil and products. Specifically, we projected that given the OPEC+ cuts, observed balances and the expected demand recovery after the pandemic lockdowns, floating storage would reach a peak in June and ships would start discharging and re-entering the trading fleet by July. As we are now “officially” in the second half of the year, we are going to take a look at floating storage in the VLCC sector.

We have been monitoring VLCC tankers using satellite data and assigning them on floating storage if a vessel remains loaded and stationary for over 14 days. However, due to delays in ports -especially lately in Chinese ports- we do understand that the numbers are likely skewed upwards. Having said that, it is the changes that are of interest in floating storage since they essentially signify whether additional ships are entering -or exiting- the trading fleet.

Beginning in April, we see a gradual but steady narrowing of the spreads between the 1/3 and 1/12 month Brent contract, something that by definition makes the storage of crude oil less economically attractive. However, given the time between fixing a cargo of crude and loading, as well as the time required for the ship to reach its destination, it is normal to observe the number of VLCCs used for storage growing well into the following months (Figure 1). As oil prices are recovering and the spreads are approaching zero, we have reached a point where there are probably no more opportunities in the floating storage space, but rather opportunities in discharging and cashing in on the cargo. Our preliminary data for July already shows a drop in the number of VLCCs assigned to floating storage (Figure 1).

The VLCCs returning into the trading fleet are adding additional pressure to an already low market and the second half of 2020 is likely to follow the same pattern. The initial OPEC+ cuts have already been extended into July and there are discussions for extending them even further into August. That, along with recovering demand may increase the pace of ships returning to trading. Potential developments that could “throw a wrench” in this scenario could be a second wave of COVID-19 infections that may lead to a second lockdown, as well as geopolitical factors such as a potential sanctioning of further vessels and companies trading with Venezuela.

Figure 1 – Observed VLCCs on Floating Storage & Brent Spreads, January – June 2020

Source: McQuilling Services

Source: McQuilling Services