Top 16 Events that Impacted Tanker Shipping in 2016

Dec. 30, 2016

6. Libya Oil Exports

Widespread civil unrest in Libya has had a significant impact on the African country’s oil and gas industry in recent years, pushing production levels to as low as 404,000 b/d in 2015 (CNN). In November, crude production averaged 575,000 b/d, a significant jump when compared to the 340,000 b/d witnessed in the first nine months of 2016. While geopolitical risks are high, it is our view that production will exceed 600,00 b/d in 2017, despite recent reporting from Libya suggesting production may approach 1 million b/d (Bloomberg). The increases have the potential to positively impact the Suezmax and Aframax classes in the coming year. Read more about this topic in Industry Note No. 17 – Med Market on the Move.

7. OPEC Production Cut

The Organization of the Petroleum Exporting Countries (OPEC) reached a consensus in late November to cut production amongst the group’s 11 of 14 members by about 1.25 million b/d. The initial announcement sent Brent prices soaring above US $50 per barrel, where they have remained through the end of the year. While the decision looks as though it could benefit the physical market we consider the uncertainty regarding participation from non-OPEC members as well as the level of compliance from those required to make the production cut. Other factors, such as the resurgence of US production could hinder the group’s efforts in balancing the market going forward. However, with the decision agreed upon, the production cut could have an impact on trade flow dynamics. Asian refiners will feel most of the effects as a majority of Middle Eastern crude heads East of the Suez. It is likely that Saudi Arabia will likely cut its least valuable grades such as Arab Heavy, a grade preferred among Asian refiners, incentivizing Asian countries’ search for new supply centers of heavy grades.

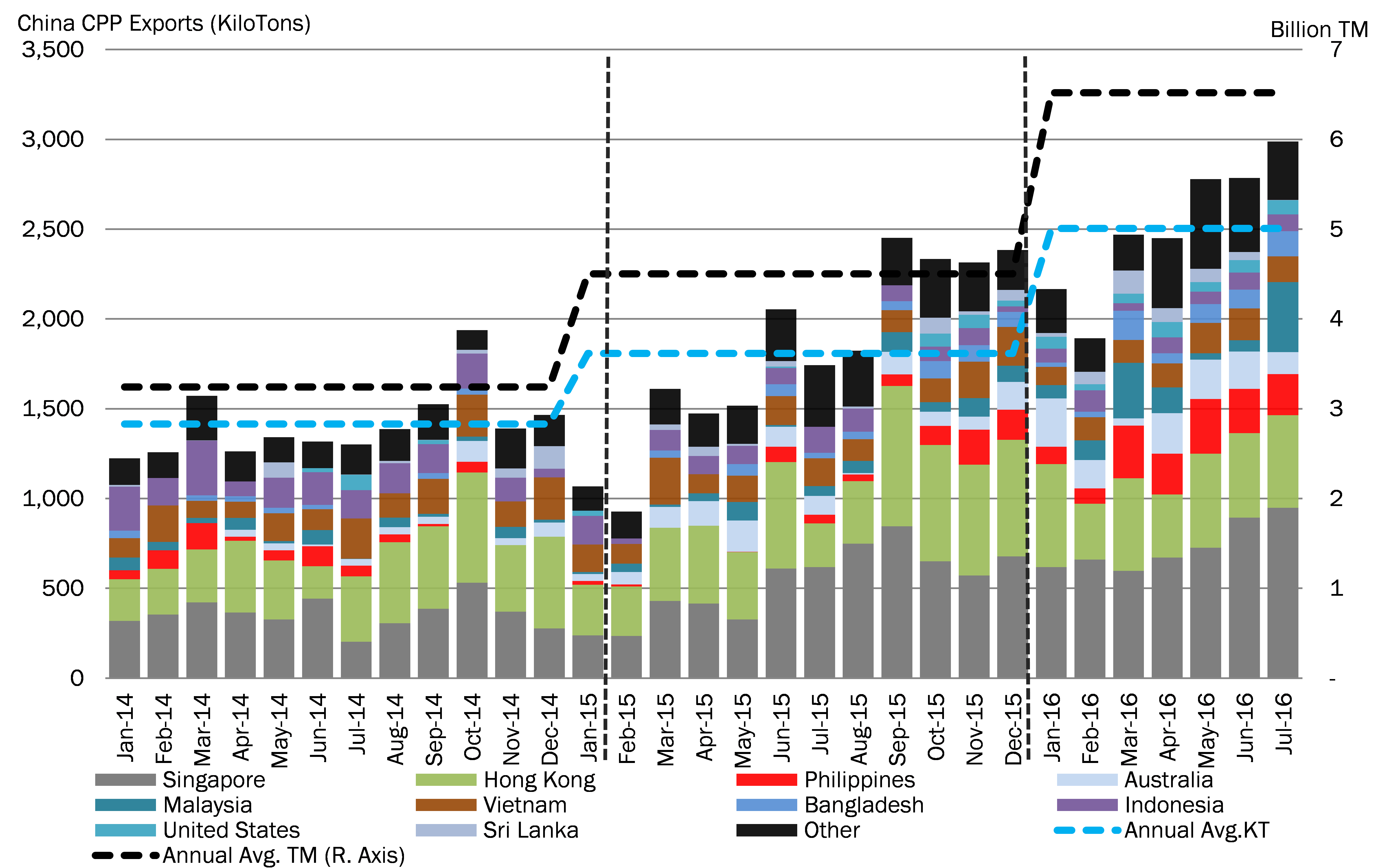

8. Chinese Product Exports

Traditional export volumes of products from Korea and Japan were joined by increasing trade originating in China, a trend likely to continue in 2017. One of the primary drivers of this growth has been the deceleration of Chinese gasoil demand as the country continues to move towards a services-based economy, slowing the demand from manufacturing operations. In 2017, JBC Energy shows Chinese gasoil demand falling to 3.4 million b/d from 3.45 million b/d in 2016, while at the same time, refinery output of gasoil is projected to increase to 3.6 million b/d from 3.54 million b/d. Our trade data shows Singapore has been the primary recipient of China’s CPP exports in 2015.

Figure 4 – China CPP Exports; Jan 2014-July 2016

Source: Customs Data, McQuilling Services

9. Panama Canal Expansion

After years of anticipation, the newly expanded canal began commercial operations in June 2016. The “Third Set of Locks Project” doubled the capacity of the Panama Canal by adding a new lane of traffic, and increased the width and depth of the lanes allowing larger ships to pass. The Suezmax tanker, Aegean Unity, was the first of its size to transit the new canal in August. The expansion has had a limited impact on crude oil tankers, including Suezmaxes and Aframaxes, and will likely remain that way until more ships are retrofit with the proper chalks required to transit.

10. IMO Sulphur Cap

Beginning January 1, 2020, a new 0.50% global sulphur cap on marine fuel will come into effect. This deadline was confirmed at the 70th sessions of the International Maritime Organization’s (IMO) Marine Environment Protection Committee (MEPC). As of now, the view taken by most owners is a “wait and see” approach, mainly because questions remain about what new fuel will look like, what scrubber technology will be available to them, but perhaps most importantly is the expected enforcement of this regulation. Already there have been a small group of shipping companies that have formed what is being referred to as the “Trident Alliance,” which is somewhat of a self-policing group to ensure a level playing field. The forthcoming 0.5% sulphur cap may materially alter trade flows of fuel oil and middle distillates in 2020 and beyond. It is expected that new bunker fuel will emerge that will be a 0.5% blend with fuel oil components and gasoil. Our partner and oil markets expert, JBC Energy will release a multi-client study on the impact and implications of the 2020 IMO emissions cap in bunker fuel use in mid-January.

11. Floating Storage

Throughout 2016, oil tankers were used on and off for floating storage purposes. In July, we published an Industry note titled “Floating Storage Opportunity,” as we observed a significant number of older tankers being fixed for operational floating storage. According to our daily analysis of remotely-sensed vessel position data, a notable buildup of offshore floating storage was observed in April and May. The average number of anchored VLCCs with cargo on board reached 51 per day in May, compared to only 21 in the beginning of the year. The Middle East and South East Asia were the top anchorage zones for this activity, accounting for 88% of VLCC floating storage. These storage opportunities helped to balance the tonnage lists during the year, supporting freight rates.

12. Modern vs. Disadvantaged Tonnage

A notable two-tier market emerged this year, specifically in the VLCC sector, as charterers used older “disadvantaged” tonnage to mitigate rising freight levels. In Industry Note No. 17 – Plenty of Suitors For These Older Ladies, we looked at total VLCC fixture counts through June and how many had been conducted by vessels 15 years or older. We observed that these older ships accounted for over 15% of total global spot activity, a 110% over 2015. This tactic helped to bring market levels back down after an increasing trend began to develop. More recently, this was seen this past week in the AG, as disadvantaged tonnage was accepting rates 5-10 WS points less than modern tonnage.

13. Colonial Pipeline Explosion

The Colonial Pipeline, which is the largest refined pipeline system in the US, supplying about one-third of the oil consumed on the East Coast, was shuttered by an explosion in late October. Prices at the pump climbed in parts of the US southeast following the explosion, but most of the country felt little impact. Freight rates for medium range tankers; however, soared in response to the news. The TC2 (Cont/USAC) benchmark route spiked from WS 65 at the end of October to WS 100 at the start of November, where they remained elevated for about a week. The TC14 route climbed in tandem reaching a high of WS 130

14. Newbuilding Deliveries

One of the more notable, direct impacts on the tanker market was the influx in tanker newbuilding deliveries. Each month, new vessels hit the water, adding to the already oversupplied markets. The VLCC fleet has experienced the most growth through November, with 44 new ships on the water and just three exits recorded. Following this are the Suezmax and LR2 fleets, both of which have expanded by 23 vessels. Aframaxes have seen a net fleet growth of 21 ships through November. The clean fleets, with the exception of the LR2s, have not expanded as rapidly as the large dirty fleets. MR2s have recorded a net fleet growth of just one ship, while the MR1 fleet contracted by one. Our expectations for fleet growth in 2017 and beyond will be discussed in our 2017-2021 Tanker Market Outlook.

15. Venezuela Port Delays

Venezuela’s economy has been on a downward spiral since the collapse of global crude oil and the cash-strapped country faced challenges throughout the year to pay oil suppliers. As a result, a high of 46 DPP tankers, 63% of which were Aframax vessels, were being held up around Venezuela’s main oil terminals, including Puerto Jose, Paraguana Refinery Complex, Bonaire Island and Bullen Bay in May. This was the largest buildup of tonnage we’ve recorded for the region since October 2015. These ships experienced an average discharge time of 10 days, while loading days reached an average of seven during this time. These delays provided support for Aframax tankers and even the VLCCs and Suezmaxes due to tightening position lists.

16. Big Data

Big data in the tanker shipping industry is becoming increasingly more important. International shipping companies, oil majors, tanker brokers and maritime consultants are learning to harness the power of data and technology when it comes to seaborne trade. From vessel tracking platforms, like AISLive, to cargo monitoring platforms, industry participants are using big data to improve ship performance, support decision making processes and promote business growth. With an in-house technology department, McQuilling plans to release new big data platforms to the market in 2017 and beyond.