Trans-Atlantic Crude Spread Gets Squeezed

June 28, 2018

The US crude export market continues to boom with the latest preliminary weekly estimates from the US Energy Information Administration (EIA) showing a record 3.0 million b/d. The main driver continues to be a wide discount for WTI crude versus other global benchmarks as North American crude supply growth outpaces demand, projected at 15.7 million b/d by the end of 2018. This is largely a function of rising crude output in the US and Canada; however, recent news indicates that supply outages in the latter could threaten this trend. The world’s fourth largest oil producer suffered a power outage last week, shutting Suncor Energy’s 360,000 b/d Syncrude facility in Alberta. The majority of these volumes are sent to the US oil hub at Cushing, Oklahoma, which observed stocks fall to 29.9 million barrels, excluding those in the strategic petroleum reserve, for the week ending June 22, 2018. On a national level, commercial crude inventories declined by 9.9 million barrels amid record refinery runs of 17.8 million b/d.

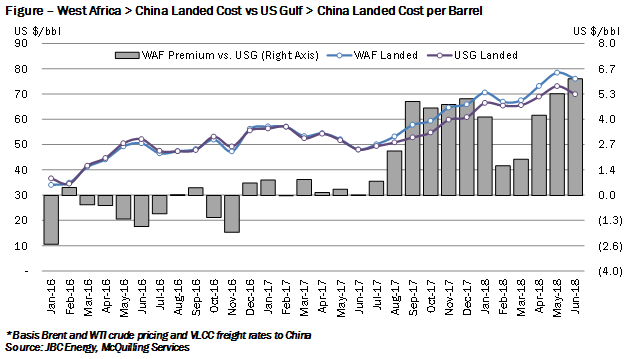

These factors have been supportive of rising prices for WTI-linked crude, which has appreciated over 6% since the beginning of the week. Brent crude has appreciated to a lesser degree, narrowing the trans-Atlantic differential below US $5/bbl for the first time since April. On a landed cost basis, the wide spread over the course of June put US crude at a significant advantage over West Africa (Brent priced) crude, when accounting for regional VLCC freight rates to China as indicated by the figure below.

In our view, the West Africa landed premium versus the US Gulf is likely to face pressure in the short-term, impacting demand for VLCCs and Suezmaxes in the Americas. The current Brent-WTI spread remains supportive of US crude exports to Europe, but less supportive to the East and therefore, we expect volumes to taper down over July/August as North American crude supply faces short-term pressure. The long-haul Carib/Singapore VLCC trade is likely fall from its June average of US $4.0 million back into the US $3.5-3.7 million range over July/August.