US Crude Export Scenarios - Updates

Oct. 30, 2020

Given the US is the largest crude oil producer in the world, it is worth taking a closer look at the potential scenarios that can develop for the region and its exports. We have touched on this subject a few months ago and we always like to take a fresh look and approach and data is refreshed and updated. As with other aspects of the crude markets, we like to focus on the crude balances as it has been demonstrated that they remain a main driving force of exports and imports in a region.

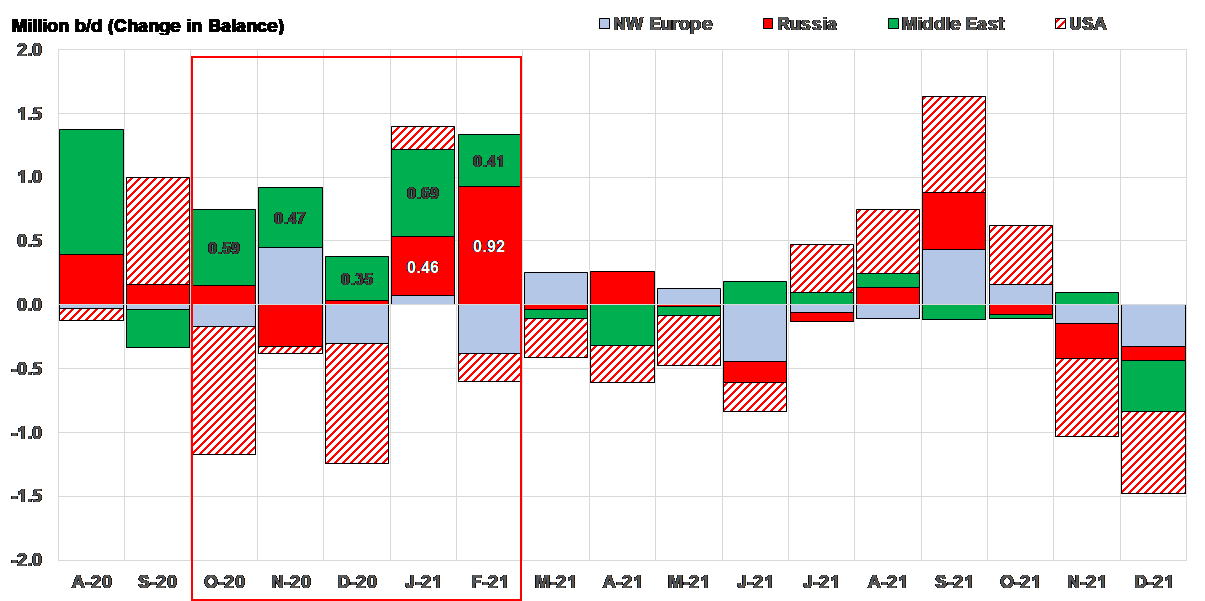

Looking at a high-level picture of crude balances, we expect crude length to grow in Russia and the Middle East within the next five months (Figure 1). The easing of the OPEC+ cuts is one reason. For now we believe that the organization will adhere to their plan since maintaining or extending the cuts could bring some OPEC members to a very difficult economic situation. Another reason is the expected round of refinery maintenance in Russia, which will result in less domestic crude consumed.

At the same time, struggling demand and unfavorable economics will likely lead to crude supply tightening in the US, making domestic crude scarcer for local refiners and exports alike. The difference between the two regions has the potential of closing the gap between Brent and WTI barrel prices as well. For 2021, we forecast a sub-US $2.00 spread between the two grades, another factor that could put the brakes in US crude exports. However, there is a flip side to that.

The movement of the price differential between Brent and WTI could also work towards eventually freeing up WTI barrels that could become available for exports after an initial slump. The reason is the bulk of the US refining system, which is set up to process heavier crudes. Should Brent and WTI equalize in price per bbl., we do see a reason for US refiners to start importing more heavy sour barrels from the AG, thus allowing for WTI exports to pick up, even if production remains subdued. This is a positive for VLCC tanker demand, considering that it would be based on increasing crude oil supply from the Middle East relative to current output.

Figure 1 – Anticipated Crude Balance Changes by Region

Source: JBC Energy, McQuilling Services