US Fuel Demand and Imports

May 7, 2021

In the past couple of years and thanks no less to a global pandemic, any market outlook contains the word “volatility” in generous amounts. Analysts are always looking for ways to “anchor” a projection to indisputable data and sometimes we are indeed seeing that despite the volatility, the overarching story remains true to the outlook. This week, we take a look at potential CPP import scenarios for the US ahead of a fast-approaching summer driving season.

The pandemic has had the entire world on lockdown with dire consequences for global oil demand. Even now, we see that wave after wave, infections continue to spread in places like India and Brazil, affecting mobility and subsequently demand for fuels. However, the US is showing a different story. As vaccination rollouts continue at a good pace, we see Americans’ mobility increasing and demand for fuels such as gasoline slowly starting to resemble what it looked like before the pandemic.

Summer is typically “driving season” for Americans and with the current state of vaccinations in the country, we can almost safely assume that gasoline demand is likely going to revisit pre-pandemic levels. This immediately raises the question on how this demand is going to be met and we can think of a few scenarios. We are likely to see increased refinery runs and perhaps additional inventory drawdowns, although the latter are currently slightly below the 5-year average (based on latest EIA weekly report). As the story relates to additional crude runs, we project US refiners importing more crudes (sour) from areas such as the Middle East, but also high-sulphur fuel oil from Europe and Latin America as refinery margins are conducive to this feedstock.

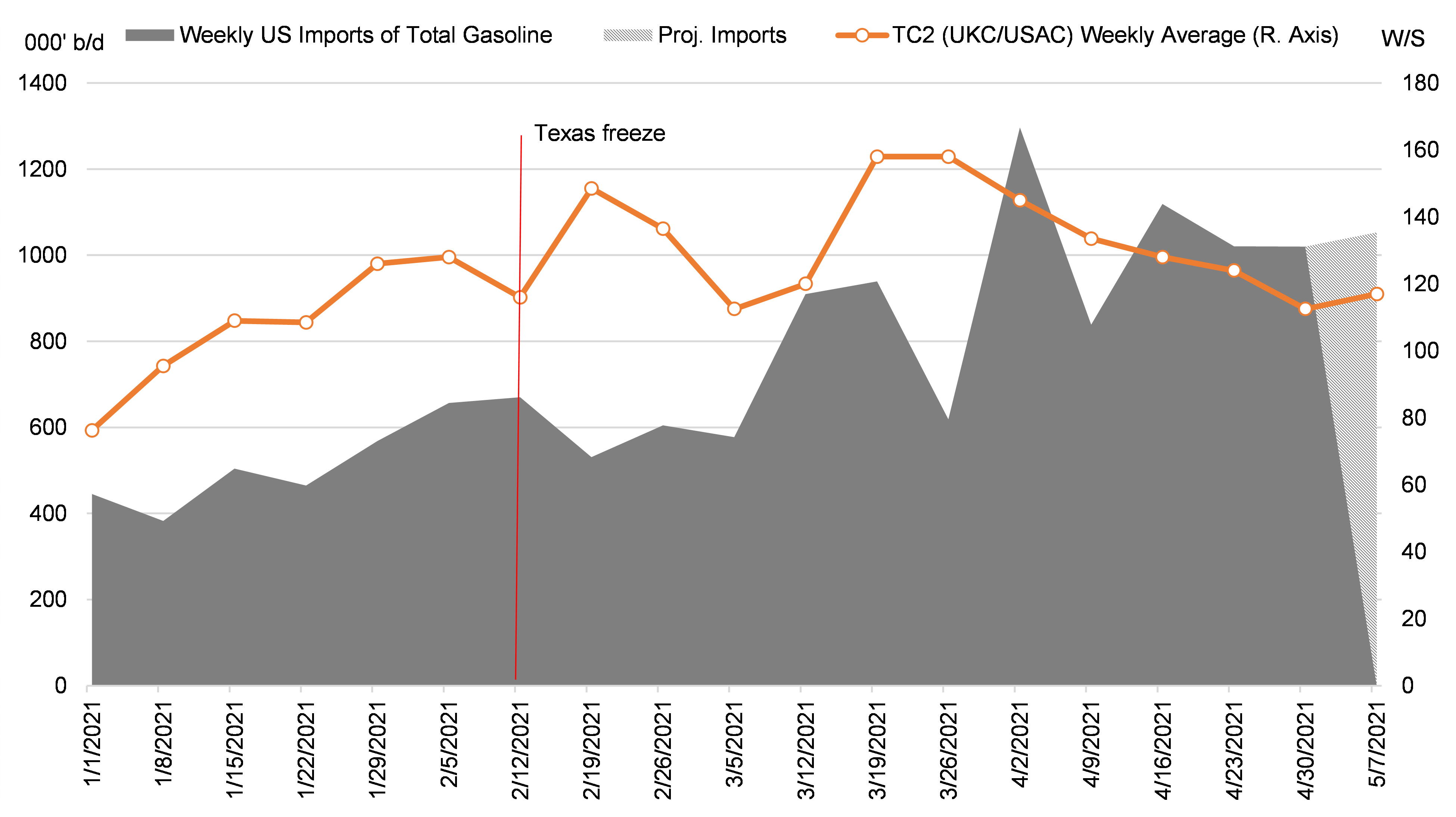

While increasing product supply from local refineries is expected so is the increase of gasoline imports, mainly from Europe. In the face of refinery closures in areas like the E.C. Canada and PADD 1, we project an increase of CPP voyages to those areas, especially as demand in Europe is still lagging, but refiners are ramping up. A similar pattern was observed after the Texas freeze in February, that forced CDU shutdowns. Immediately after we saw a spike in TC2 rates and about two weeks later a significant increase in gasoline imports (Figure 1).

As the eventual increase in demand is likely to be met with a combination of the above, May could be the beginning of an increase in both CPP and DPP cargos imported in the US, something that in turn could lend some support to rates.

Figure 1 – Weekly US Gasoline Imports and TC2 (UKC/USAC – MR2)

Source: McQuilling Services, EIA