US SPR Release and Crude Flows

Dec. 3, 2021

OPEC and allies reluctantly agreed to maintain the path of gradual, 400,000 b/d per month increases in their latest meeting that was concluded this week, although the organization stated that it could meet again if market conditions dictated it. Perhaps one of the deciding factors has been the mounting pressure from the US to open the taps in order to slow the crude oil price rally and ease some of the inflationary pressures in the country, especially on gasoline prices. To the same end, the US has also announced that it will release quantities from its SPR although US officials have mentioned that the timing of the release can be flexible depending on the prevailing price environment.

At the same time, global demand is facing another round of uncertainty, with the spread of the new Omicron variant already prompting countries to impose international travel restrictions. On the local level, infection rates are on the rise in the West and a few European countries have already opted for complete lockdowns (e.g. Austria), with others considering at least some restrictive measures going forward (e.g. Germany). As the situation regarding the spread of new infections is better in Asia, it would be logical to expect that the relatively tepid OPEC+ production increase will be absorbed by increasing demand, at least for the very short-term.

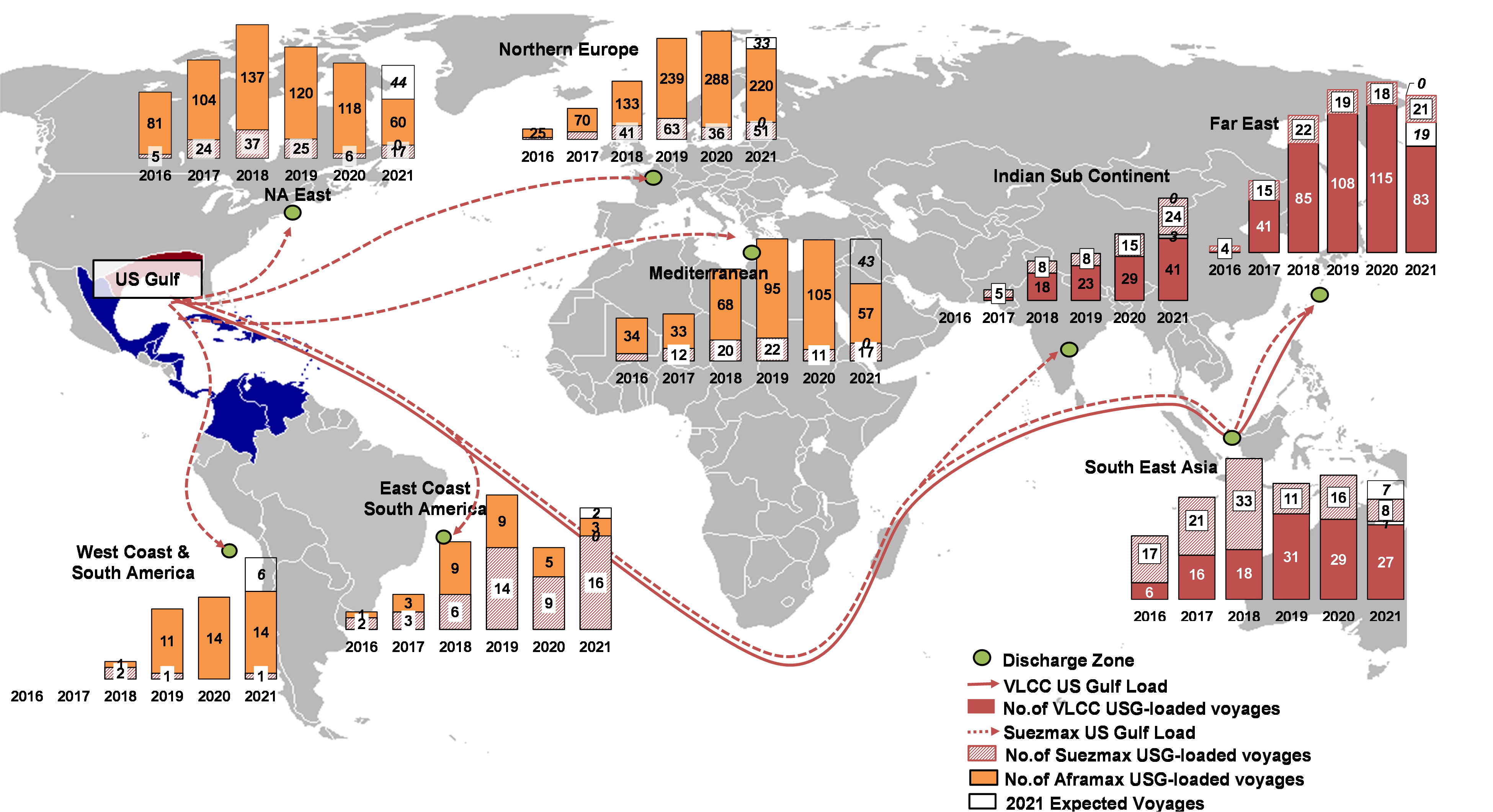

The combined factors of potentially lower demand in the West with the release of crude barrels from the US SPR could lead to arbitrage opportunities for US crude into Asia, especially as importers such as Korea have been actively looking to reduce their reliance on Middle Eastern oil, and the latter continues to be more expensive (Platts). If this scenario materializes, we may see more liftings out of the US Gulf in the short-term and for a short duration of maybe 30 to 60 days.

Figure 1 – VLCC, Suezmax & Aframax USG Export Voyages Jan-Dec 2021

Source: McQuilling Services