VLCC Drydocking: No Supply Side Relief

Aug. 6, 2021

In previous highlights we have demonstrate that the DPP tanker market is likely only going to find recovery with a relief coming from the supply side. Aside from typical tanker additions and demolitions, there are other supply side variables we also took into account, including drydocking activity, floating storages and vessels taken out of the trading fleet due to sanctions or being arrested.

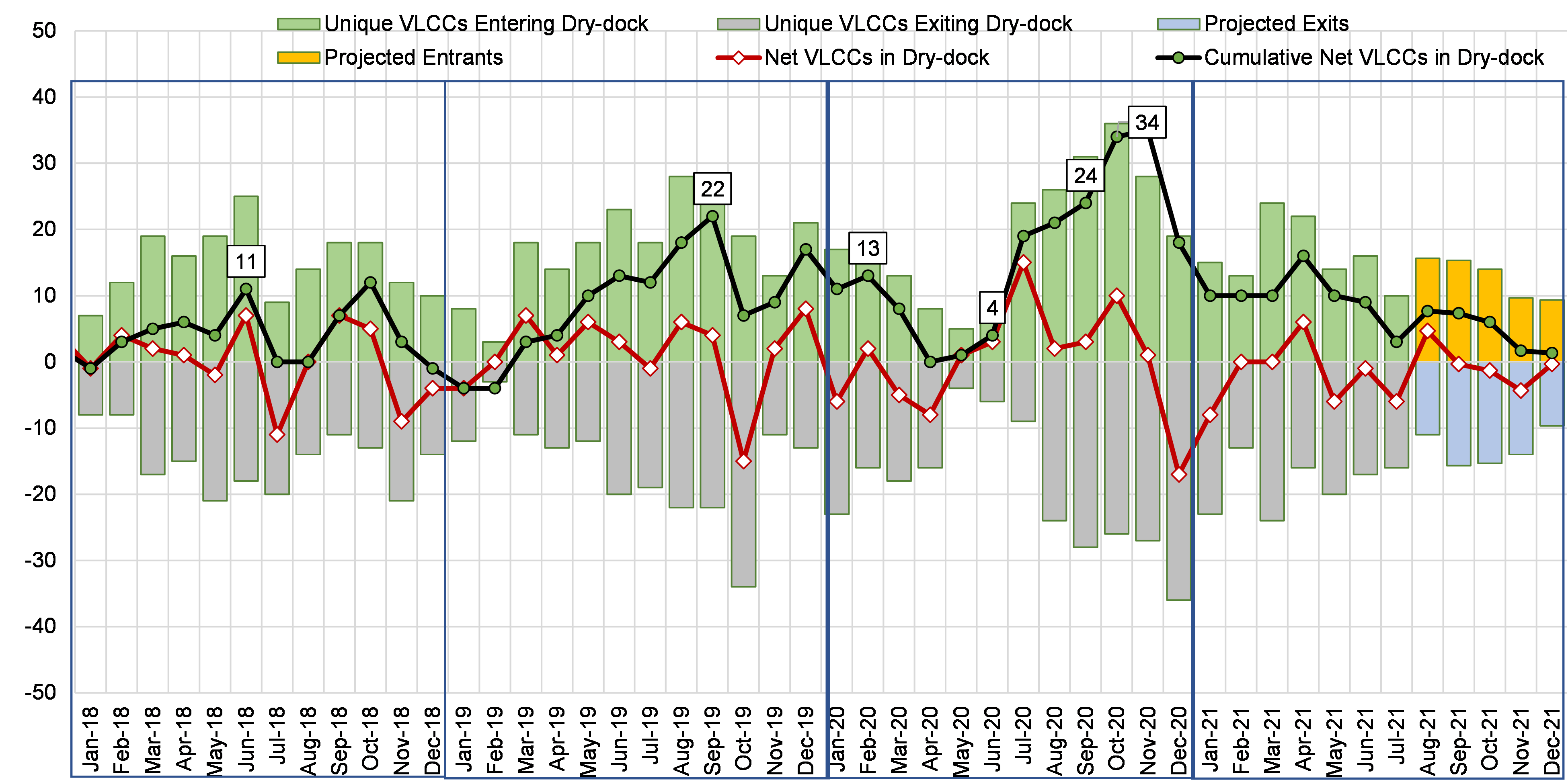

Drydocking, especially when it happens in irregular patterns can become a supporting factor for VLCC rates as tankers are removed from the trading fleet for approximately one month. In our analysis, we see that 2018 was the last year when VLCC drydocking activity followed the typical seasonal patterns. Most vessels entered for regular maintenance in the second quarter of the year, when market activity slows down and earning levels fall.

However, due to the upcoming IMO 2020 regulations, the curve for the year 2019 largely deviated from a seasonal pattern, with a much larger number of VLCCs into drydock for scrubber installations before the new rules took effect. Most of this activity took place in Q3, with a peak of 22 cumulative net VLCCs out of the trading fleet in September (Figure 1). Alongside with US sanctions on COSCO fleet which removed 26 VLCCs from the trading fleet, the surge in drydocking activity has pushed the VLCC benchmark TD3C from an average of WS 57 (WS 2019) in August 2019 to WS 113 (WS 2019) in December 2019.

2020 was another pattern-braking year, as a large number of drydocking yards were closed due to the COVID19 outbreak. In the meantime, the Price War between Saudi and Russia has flooded the market with cheap crude oil, and drastically increased the demand for VLCC floating storages. The skyrocketed tanker freight rates and earning levels provided shipowners incentives to apply for extension on survey. Once rates took a downward correction upon OPEC+ agreement and yards reopened, we observed a flurry of vessels entering for maintenance, peaking at a net 34 by October 2020 (Figure 1). This sizeable supply relief, nevertheless, did not provide notable support on freight rates, with tanker demand hovering at the bottom.

The 2021 data reveals a return of drydocking pattern for the VLCC fleet, leading us to believe we will hardly find any material market support from the drydocking activity this year.

Figure 1 – VLCC Drydocking Activity with Forecast

Source: McQuilling Services