VLCC Fleet Development: Newbuildings and CPP Trades

May 28, 2021

For this week’s highlight, we continue the same overarching theme of the VLCC fleet development. Through our analysis over the years, we have found out that about 63% of DPP marine demand is carried out by VLCCs, as compared to 23% on Suezmaxes and about 13% on Aframaxes. This statistic reveals that typically, as the VLCC market moves, so does the entire market, in a similar direction. In addition, as we noted last week, even if a few of these very large tankers are added or removed from the trading fleet, it could have a measurable impact.

Recently, we have noticed a few news reports talking about VLCCs that have been chartered by large global trading companies. While this is a normal occurrence, these ships made the news because their first cargo out of the shipyard was clean products instead of crude. This raised some questions regarding the motives of these traders and the purpose of these voyages. However, we believe that the true impact of this trend lies with the balance of demand and supply.

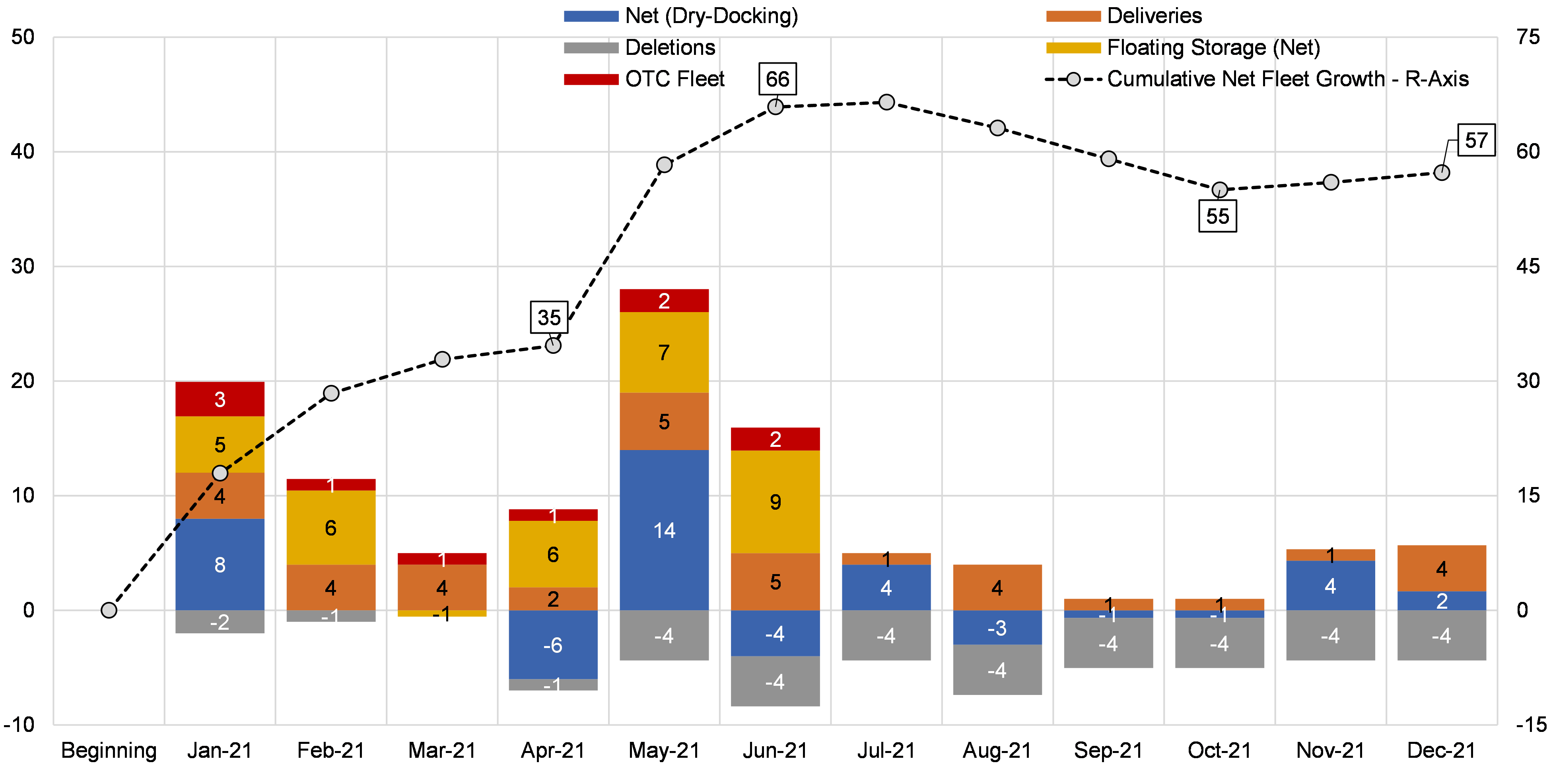

The chartering of newbuildings by large traders to move (or store in some cases) clean products on their maiden voyage is not a new practice and we see it relatively often with VLCCs and other classes such as Suezmaxes. In spite of its frequency, the impact is significant since these vessels are effectively excluded from the total sector supply for periods that exceed 30 days (typical East to West voyage duration). As the number of newbuild VLCCs is projected to decrease in 2H 2021 (Figure 1), we expect the demand “gap” to be filled by LR and MR tonnage, lending those sectors some support.

Lastly, it is worth noting that we anticipate a total of 50 VLCCs to be delivered in 2022 that could be used for the same purpose. According to our proprietary fixture data, most of these VLCC, maiden CPP voyages originate in Asia with W. Africa as destination. In that regard we are curious what impact the giant Dangote refinery in Nigeria will have on these flows. Our initial view is that the lengthening in product balances in West Africa will dissuade these movements, but likely not eliminate them altogether. As such, we find the East of Suez clean tanker demand fundamentals finding additional support as these barrels will be traded in traditional trade lanes.

Figure 1 – VLCC Fleet Development 2021

Source: McQuilling Services