VLCC Fleet Development: Ocean Tankers

May 21, 2021

We regularly look into the VLCC fleet and how it is expected to develop, as well as try to analyze the impact of various events that we become aware of. The reason is that given the size of a single VLCC, even small numerical adjustments in the total number of ships in the fleet tend to have a meaningful impact in the ton-mile demand and supply balance - something that inevitably “spills over” to the smaller classes as well.

For this weekly highlight, we are going to look at one of the events that have been discussed recently and had impact on the market – the return of the Ocean Tankers (OTC) fleet. By looking at the latest data, we will attempt to project their impact in the short and medium term.

The arrest of the Ocean Tankers fleet was a widely publicized case of 2020 when the high-profile shipowner declared bankruptcy and went under judicial management, which is currently ongoing. The initial fallout had the company’s VLCC fleet arrested at various ports by creditors. According to OTC’s official website, we counted a total of 14 VLCCs (and four floating storage units) controlled by the company prior to the bankruptcy.

In 4Q 2020, we began to see these vessels getting sold, with four of them back into the trading fleet under new ownership before the end of the year. Of those four VLCC tankers, Tai Huang San and Tai San were sold to Maran Tankers, while Wu Tai San and Kun Lun San were sold to Zodiac. The ex-OTC tankers continues to rejoin the trading fleet moving into 2021, with at least another six sold in the secondhand market. Tracking by the AIS data, we only count two OTC VLCCs (Sea Latitude and Sea Horizon) still at anchor in South East Asia, and the rest of the fleet sold or currently underway using engine (Figure 1). According to a variety of ship news, Zodiac (four VLCCs) and Maran (three VLCCs) remain to be top buyers of ex-OTC VLCC tonnage at the time of reporting.

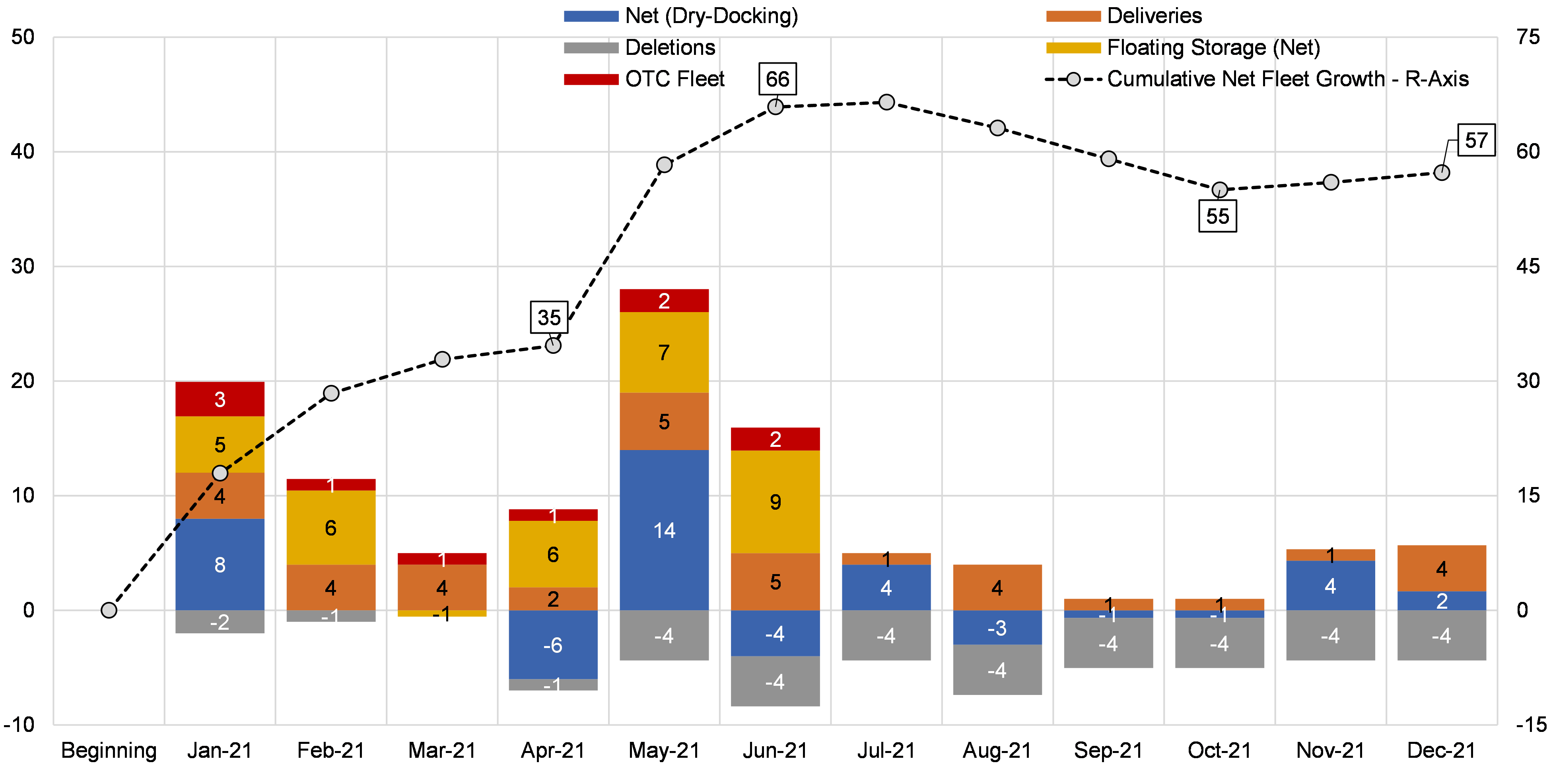

The return of OTC fleet has added further pressure to the already over-supplied VLCC tanker market. Alongside with additional floating storage unwinding, additional newbuildings delivering and unmatched deletions as marginal buyers continue to pay premiums over scrap for vintage tonnage. We expect the freight support from stronger demand to largely be offset by a substantial supply imbalance. The bearish market sentiment is likely to continue into the 3rd quarter.

Figure 1 – VLCC Fleet Development 2021

Source: McQuilling Services