VLCC Floating Storage Update

Oct. 1, 2021

This coming week, OPEC and allies are meeting to decide on whether they will remain on the current plan of production increases of 400,000 b/d until the end of the year or modify it to better address rising global oil demand. This is especially important if we consider the current energy crunch China is facing, as well as pressures from Europe and the West who are experiencing increasing gasoline prices, more so after hurricane Ida and other storms shut in production and disabled refineries in the US Gulf region, but also due to the concurrent rage in natural gas prices which have shifted feedstock demand to fuel oil for power generation.

With that in mind, we find important to assess the current state of crude floating storage as an OPEC+ decision to boost production numbers could disrupt the current balance and create short-term opportunities, especially if the winter months bring more pandemic-related volatility in the markets.

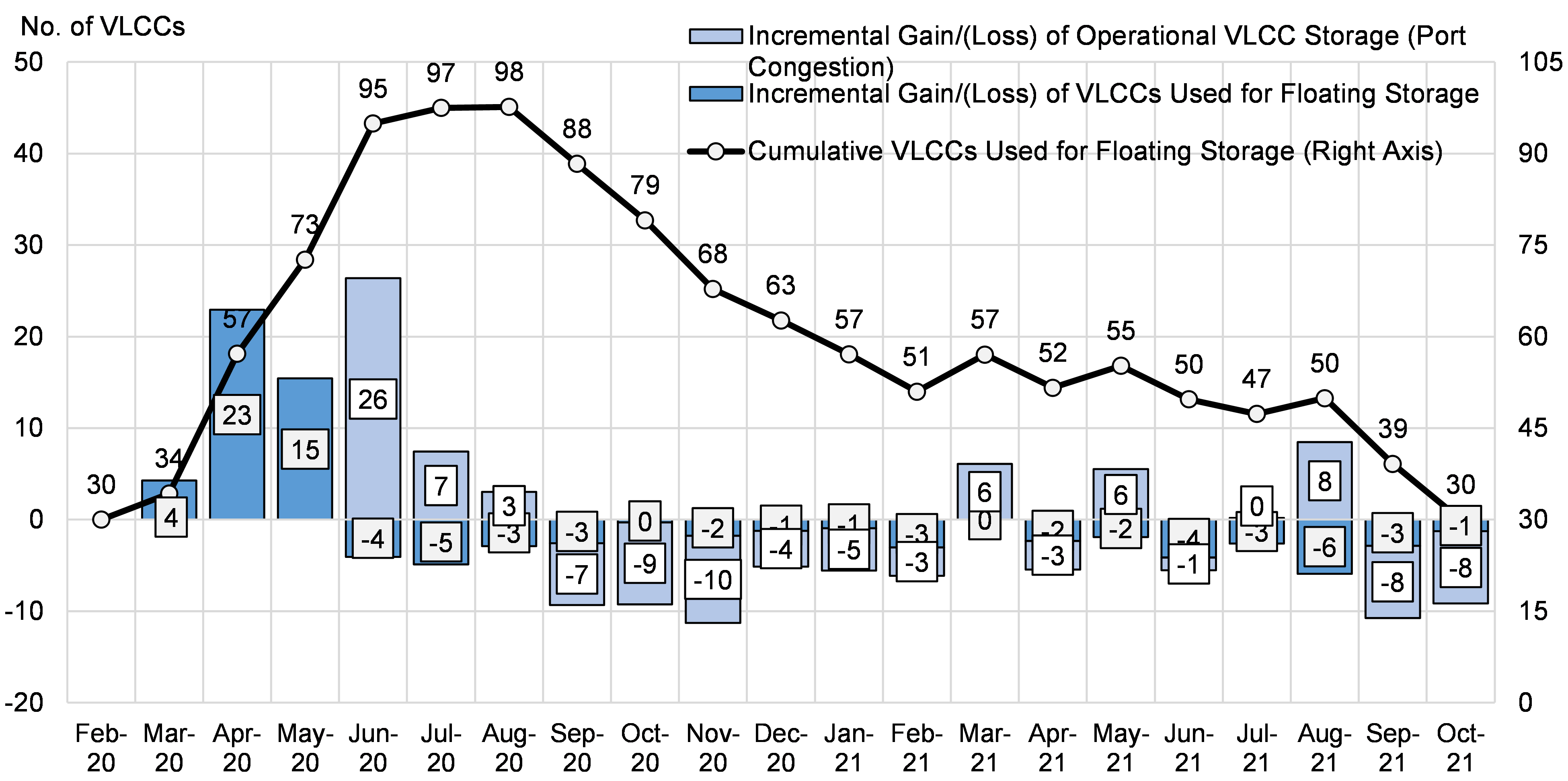

Our call on our August Mid-Year Update was for VLCC floating storage to reach pre-pandemic levels by September. However, as we progressed through August, we observed a slight uptick in the count, with the number of VLCCs assigned to floating storage increasing to 50, from 47 the previous month. Our assessments point to this being a case of operational floating storage due to port congestions and weather delays, including from the effects of typhoons and tighter regulations on crew changes in the East (Figure 1).

On the way forward though, the importance of the upcoming OPEC+ decision cannot be understated. If the alliance proceeds with no changes to the plan, we expect global demand to continue to outpace supply, resulting in further inventory drawdowns, with potential nine more VLCCs discharging their cargo and bringing the total to pre-pandemic levels by the end of October (Figure 1). In an alternative scenario which sees a surprise increase to production levels, we could see a slower drawdown than initially expected, giving the VLCC market some additional support and certainly instill more positive sentiment in the minds of crude tanker owners.

Figure 1 – VLCC Floating Storage Statistics

Source: McQuilling Services, JBC Energy