What is Driving the US Export Growth?

Sept. 12, 2017

Since the former US administration lifted the ban on US crude exports at the conclusion of 2015, this market has experienced considerable growth within the global oil and gas industry. In 2016, US crude export volumes averaged about 591,000 b/d with a majority of the volumes to Canada and regional trading partners in the Caribbean. Some barrels were shipped to Northern Europe and the Far East; however, in relatively low quantities, when compared to levels witnessed today. Through the first half of 2017, we have observed US crude exports average at about 918,000 b/d with just 33% bound to Canada, while 23% has been sent to Europe and another 33% to nations East of the Suez. As global crude pricing rose on the back of confidence that OPEC production cut efforts would rebalance the market, the US upstream sector witnessed a resurgence in production. This coupled with higher crude output from Canada has increased North American supply and allowed WTI-linked grades to price more competitively in the global market.

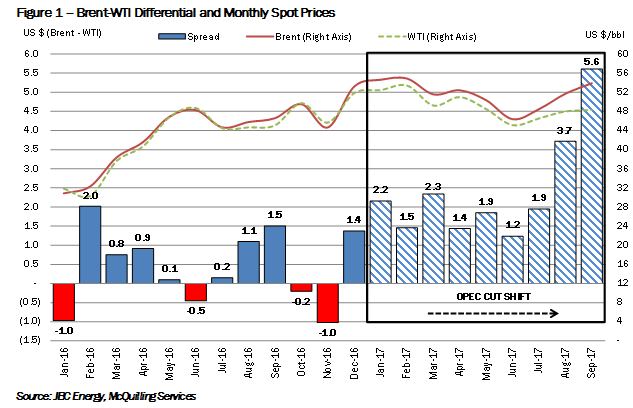

As we can see from the figure below the Brent-WTI crude differential has widened considerably since the implementation of OPEC cuts, incentivizing Eastern and European importers to source US crude in a subdued freight rate environment. As August rolled into September the crude spread expanded significantly, averaging at about US $5.60/bbl through the first 12 days of September, mainly supported by a reduction in US crude demand as Hurricanes battered the region’s largest refining center. In our view, this differential is likely to draw more interest from foreign importers, specifically those in the East and we would expect US crude export volumes to remain fundamentally supported over the remainder of the year; however, as the US Gulf port infrastructure continues to recover we may see a stall in cargo shipments in the near-term. The return of cargo activity to this market will likely support VLCC and Suezmax demand amid long haul trading to the East; however, we note a recent slowdown in Chinese imports may pressure these volumes as refiners have been subject to prolonged safety inspections.

Order a copy of McQuilling Services 2017 Mid-Year Tanker Market Update

The Mid-Year Tanker Market Outlook Update provides an outlook for spot market freight rates and TCE revenues for 19 major tanker trades, including two triangulated trades, across eight vessel classes for the second half of 2017 and the remaining four years of the forecast period to 2021. We revisit our forecasting process at the mid-year point, distilling data from the first half of the year to better understand recent market developments and expectations for the future. In our view, this process allows us to accurately adjust our forecasts and provide additional value to our clients.