Asset Market Review – VLCC

Feb. 20, 2018

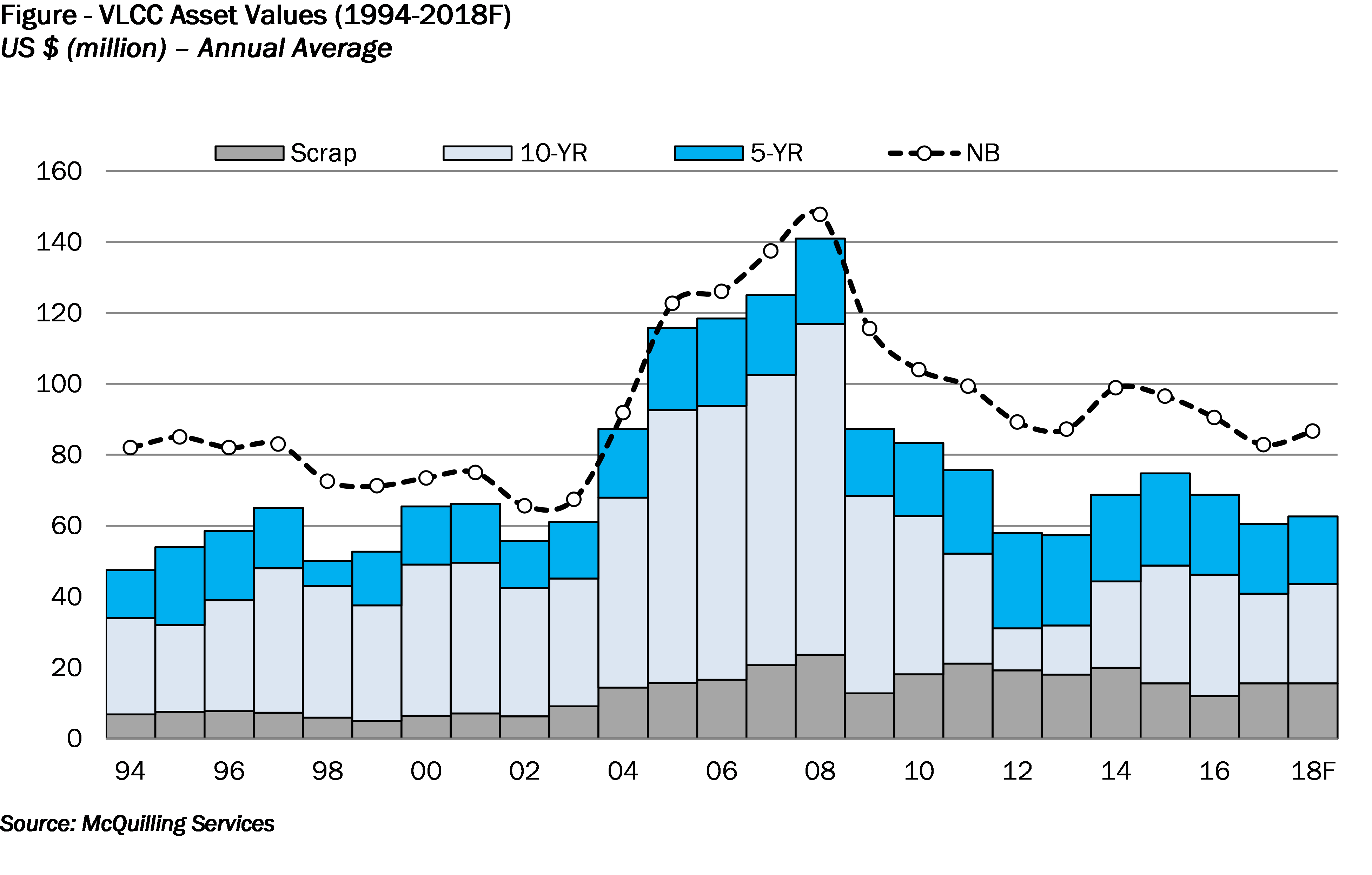

Over the course of 2017, VLCC tanker values exhibited price depreciation for the second consecutive year, as the market fundamentals put pressure on earnings. Newbuilding contracts averaged US $82.8 million (basis Korea/Japan), a decline of 8.5% from 2016 average values; however, the second half of the year is pointing to a firmer market as yard capacity remains constrained and owners, backed with charter coverage, look to capitalize on the lowest annual prices since 2003 (Figure).

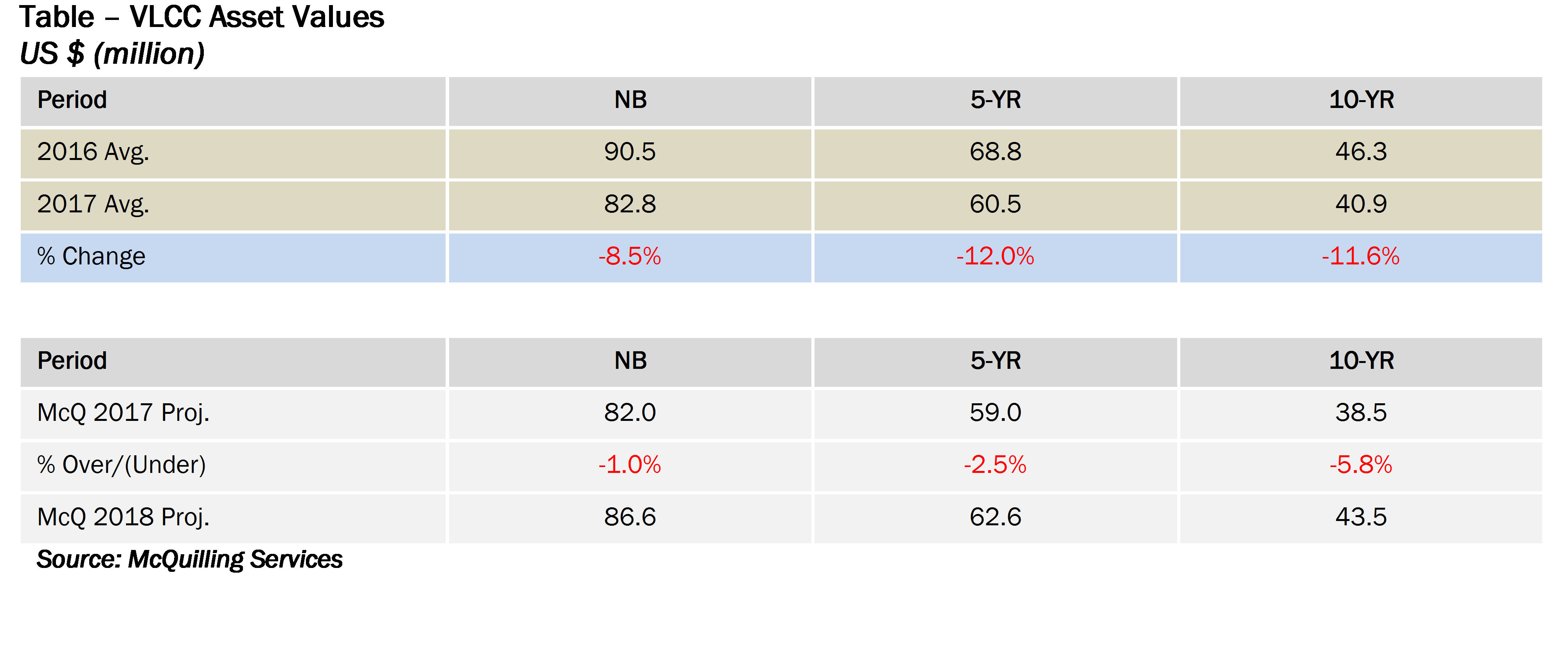

In 2017, 5-YR old tankers averaged US $60.5 million experiencing pricing pressure through the year, with a low of US $56.5 million recorded in February. On a year-over-year basis, this represented a 12.0% decline from 2016 levels. The 10-YR old tanker depreciated at a similar pace, falling 11.6% in the year, averaging US $40.9 million (Table).

In January 2017, we called for Newbuilding values to average US $82.0 million, with our projections falling only 1.0% below actual levels. Our 5-YR old vessel forecast of US $59.0 million (annual average value) was 2.5% below the actual recorded average value of US $60.5 million. The 10-YR old average value of US $40.9 million in 2017 was 5.8% above our original forecast.

Historically, our data shows that the price of a 5-YR old VLCC trades at around 79% of the Newbuilding contract value. In 2017, this ratio fell to 73% as weak earnings pressured the secondhand market more vigorously. In 2018, we expect 5-YR old values to account for 72% of a Newbuilding value, while the 10-YR old price should increase to 50%, below the long-term average of 57%. With scrap prices projected to remain at around US $16 million, our 10-YR price forecast of US $43.5 million, indicates that the scrap ratio will remain about 10% higher than the long-term average.