Petroleum Demand Outlook

Jan. 10, 2018

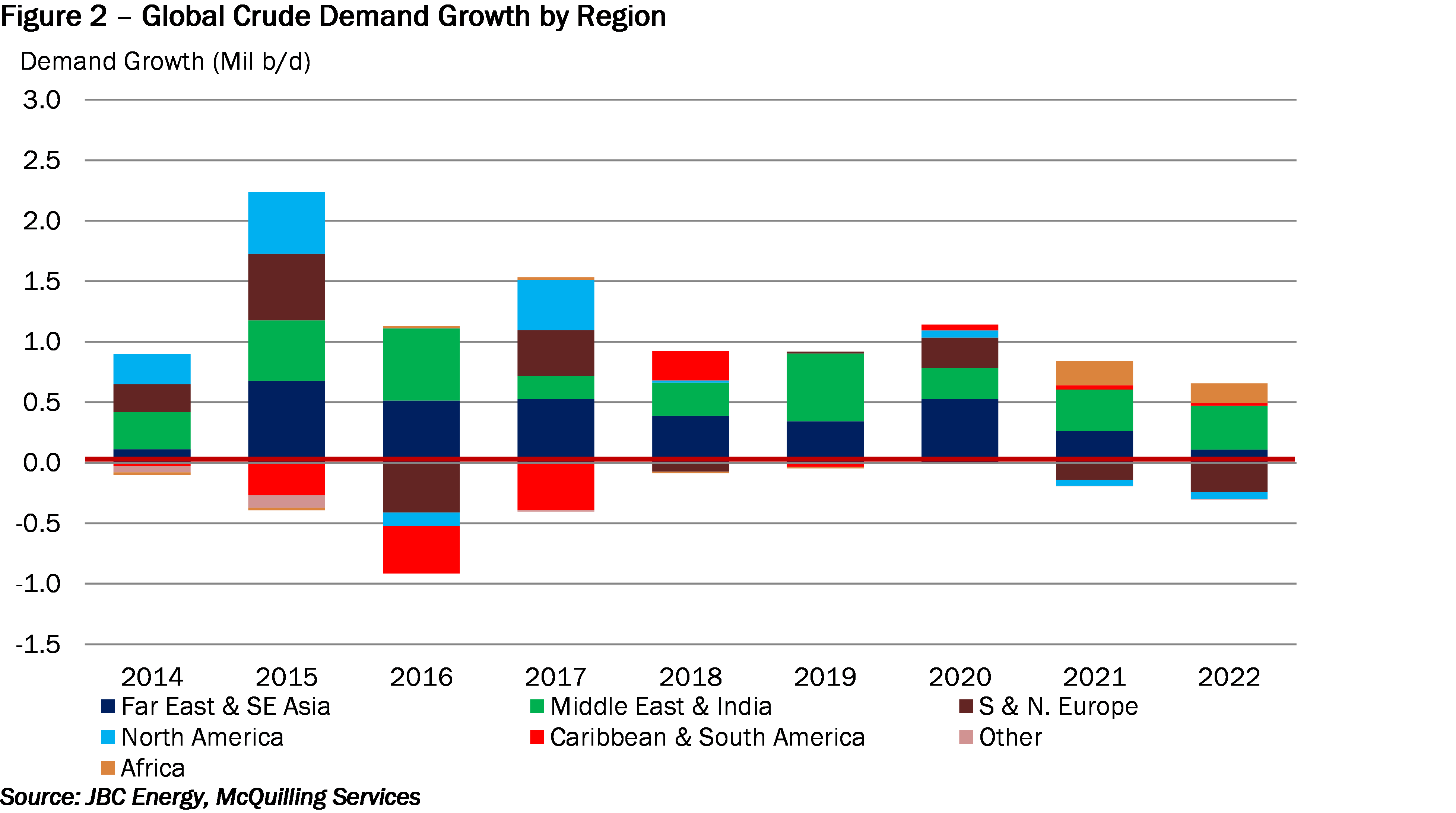

Looking back on 2017, global oil product demand rose by approximately 1.5 million b/d amid a combined 884,000 b/d of additional gasoline and diesel/gasoil demand. Global demand levels are poised to rise 1.3% year-on-year in 2018 amid higher requirements for all refined products excluding fuel oil which is expected to experience demand declines of 0.7% year-on-year, according to JBC Energy (Figure 1). The highest amount of growth expected this year is within the jet fuel/kerosene sector with 2.1% growth year-on-year, while demand for diesel/gasoil and gasoline is on track to rise by 1.3%. Through 2022, we expect annualized demand growth of 2.1% for naphtha, 1.2% for gasoline, 2.3% for jet fuel/kerosene, 1.0% for diesel/ gasoil and 0.6% for fuel oil. From a volume standpoint, diesel/gasoil is the big winner as 363,000 additional barrels will be demanded in 2018.

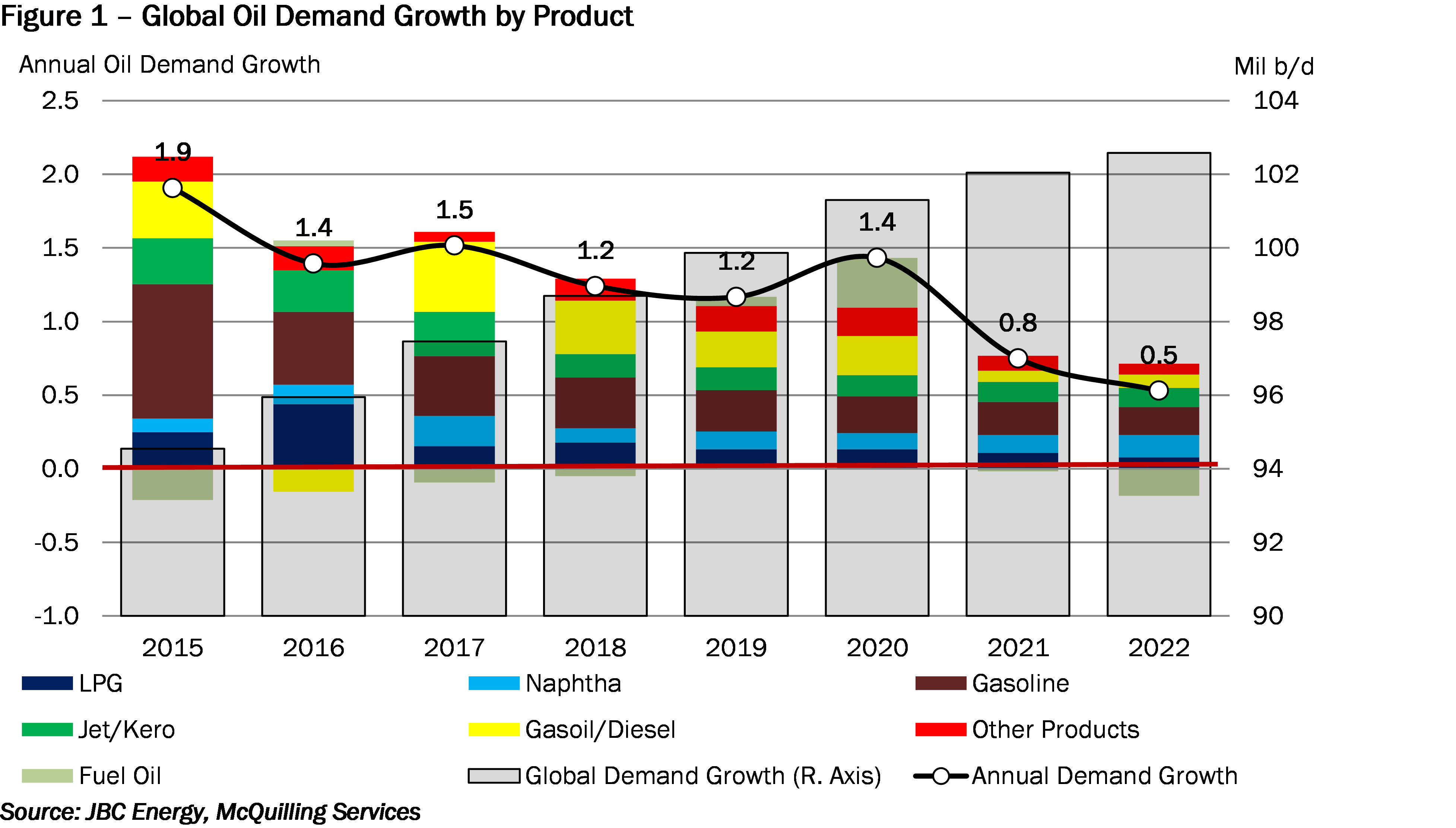

Global crude demand growth is expected to rise by 840,000 b/d in 2018 amid significant growth in the East on the back of expanding refinery capacity. India will require over 210,000 b/d of additional crude in 2018, while over the 2018-2022 period, demand is expected to increase by 1.9% per annum. South East Asia and the Far East are also projected to demand a considerable amount of crude next year as growth is on track to rise 10.8% and 6.1%, respectively. Crude demand growth in the Middle East is expected to increase at a greater rate than the East over the long-term, as Saudi Arabia and various other nations seek to diversify away from traditional upstream revenues, growing their refined product sectors. Middle Eastern crude demand is on track to rise by 3.0% per annum over our forecast period with the expectation that the majority, if not all demand, will be met by regional supply (Figure 2).