The US Crude Export Market Emerges

Jan. 2, 2018

The main driver behind the interest in US crude has been pricing incentives as considerable pressure has been placed on WTI in comparison to other benchmarks. US crude production rose 4% year-on-year to an average of about 9.2 million b/d in 2017, while Canadian output is also up around 4-5% in 2017. As a result, the North American crude balance is on track to expand by 4.7% in 2017 to 14.2 million b/d putting significant pressure on WTI relative to Brent. The wide differential between these benchmarks and the upward pricing pressure on Dubai due to OPEC production cuts has given refiners (especially in the East) ample incentive to source US crude. The differential has been particularly wide since September, bolstered by Hurricane Harvey, which correlates with a significant rise in US crude export volumes.

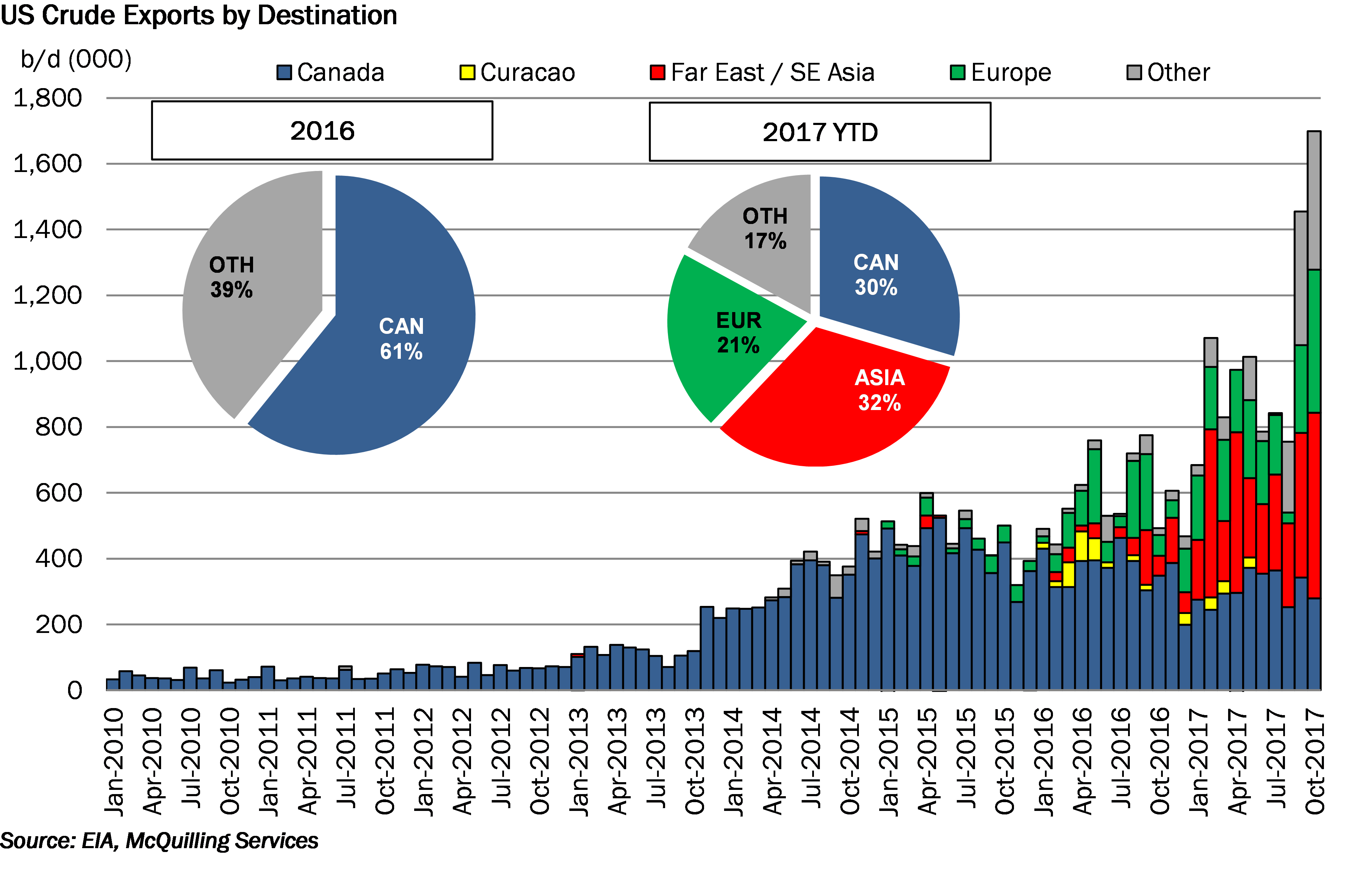

In 2016, 61% of US crude headed for Canada; however, this level has since shrunk to 30% or 307,000 b/d through the first 10 months of 2017. The Far East and South East Asia have gained a lot of interest for US crude in 2017, importing about 336,000 b/d per month on average through the first 10 months. China has become a major importer, taking around 448,000 b/d in October 2017 alone, while we have also seen increase flows into Korea, Singapore and India for the first time ever. Europe has also taken its fair share of US shale oil in 2017 with volumes up 90% year-on-year through October 2017. Volumes into the Netherlands and UK have averaged 77,000 b/d and 80,000 b/d, respectively. We expand on this topic further and discuss future expectations in our latest Tanker Market Outlook.